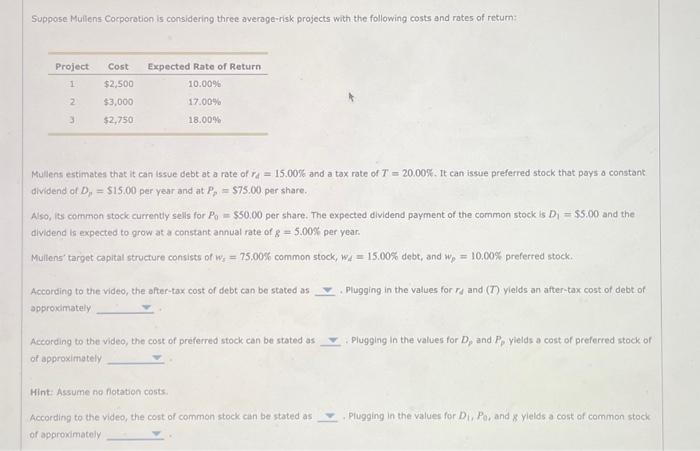

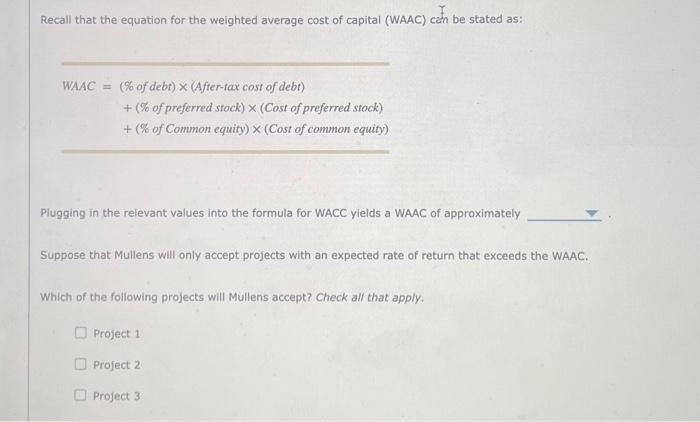

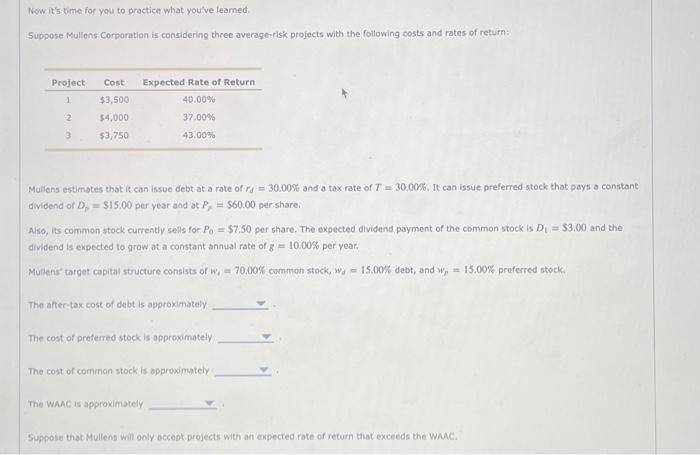

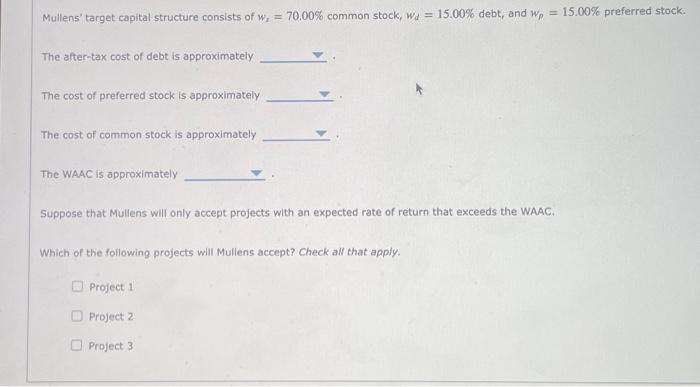

Suppose Mulfens Cocporotion is considering three averoge-risk projects with the following costs and rates of retum: Mullens estimates that it can issue debt at a rate of rd=15.00% and a tax rate of T=20.00%. It can issue preferred stock that pays o constank dividend of Dn=$15.00 per year and at Pp=$75.00 per share. Also, its common stock currently sells for P0=$50.00 per share. The expected dividend payment of the common stock is D1=$5.00 and the dividend if expected to grow at a constant annual rate of g=5.00% per year. Muilens' target capital structure consists of ws=75.00% common stock, wA=15.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for rd and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for Dp and Pp yields a cost of preferred stock of of approximately Hint: Assume ho fotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D1,P0, and z yleids a cost of common stock of approximately Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC=(%ofdebt)(After-taxcostofdebt)+(%ofpreferredstock)(Costofpreferredstock)+(%ofCommonequity)(Costofcommonequity) Plugging in the relevant values into the formula for WACC yields a WAAC of approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3 Now it's time for you to practice what you've leamed. Suppose Mullens Corporation is considering three average-risk projects with the following costs and rates of return: Muliens estmates that it can issue debt at a rate of rd=30.00% and a tax rate of T=30.00%. It can issue preferred stock that pays a constant dividend of Dp=$15.00 per year and at PF=$60.00 per share. Akso, its common stock currently sells for P0=$7.50 per share. The expected dividend payment of the common stock is D1=$3.00 and the dividend is expected to grow at a constant annual rate of g=10.00% per year. Muliens target capital structure consists of wi=70.00% common stock, wd=15.00% debt, and wp=15.00%. preferred stocki The after-tax cost of debt is approximately The cost of proferred stock is approximately The cost of common stock is approximstely The Wanc is approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WMAC. Mullens' target capital structure consists of wx=70.00% common stock, wd=15.00% debt, and wp=15.00% preferred stock. The after-tax cost of debt is approximately The cost of preferred stock is approximately The cost of common stock is approximately The WAAC is approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3