Question

Suppose one of GP Manufacturings executives typically uses the payback as a primary capital budgeting decision tool and wants some payback information. a. What is

Suppose one of GP Manufacturing’s executives typically uses the payback as a primary capital budgeting decision tool and wants some payback information.

a. What is the project’s payback period?

b. What is the rationale behind the use of payback as a project evaluation tool?

c. What deficiencies does payback have as a capital budgeting decision method?

d. Does payback provide any useful information regarding capital budgeting decisions?

e. Chino Material Systems Inc. has a number of different types of products: some that are relatively expensive, some that are inexpensive, some that have very long lives, and some with short lives. Strictly as a sales tool, without regard to the validity of the analysis, would the payback be of more help to the sales staff for some types of equipment than for others? Explain.

f. People occasionally use the payback’s reciprocal as an estimate of the project’s rate of return. Would thisprocedure be more appropriate for projects with very long or short lives? Explain.

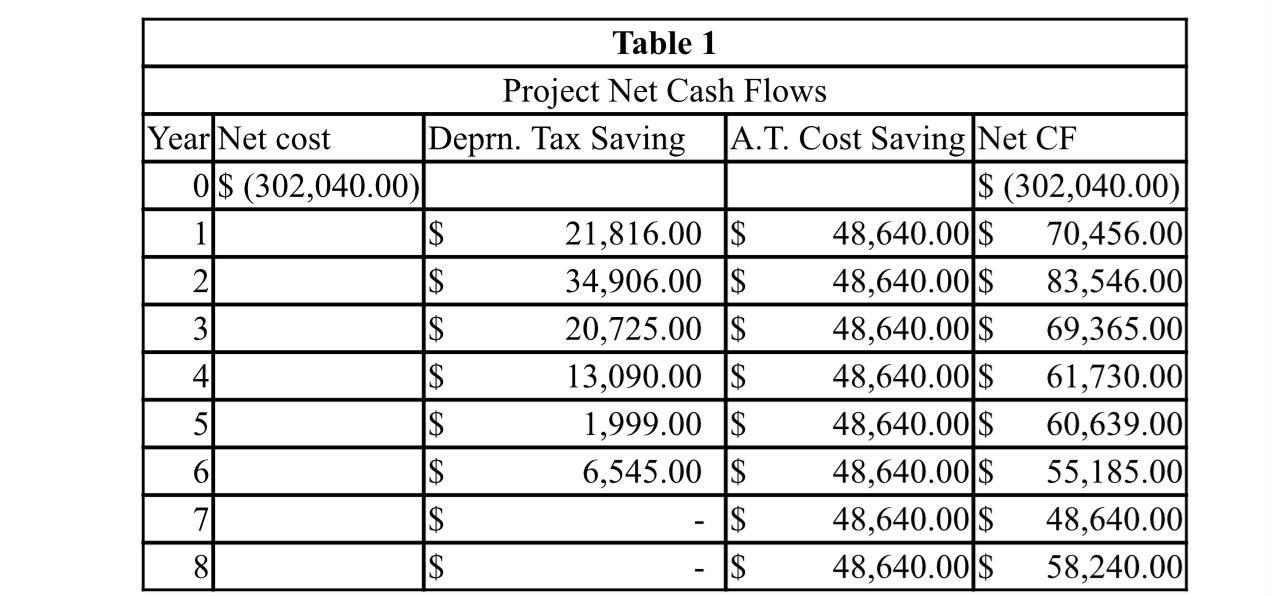

Year Net cost 0$ (302,040.00) 1 2 3 5 6 7 8 Table 1 Project Net Cash Flows Deprn. Tax Saving A.T. Cost Saving Net CF $ $ $ $ $ $ $ $ 21,816.00 $ 34,906.00 $ 20,725.00 $ 13,090.00 $ 1,999.00 $ 6,545.00 $ $ $ $ (302,040.00)| 70,456.00 83,546.00 69,365.00 61,730.00 60,639.00 55,185.00 48,640.00 58,240.00 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The payback period of a project is the amount of time it takes for the projects net cash flows to equal the initial investment Using the info...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started