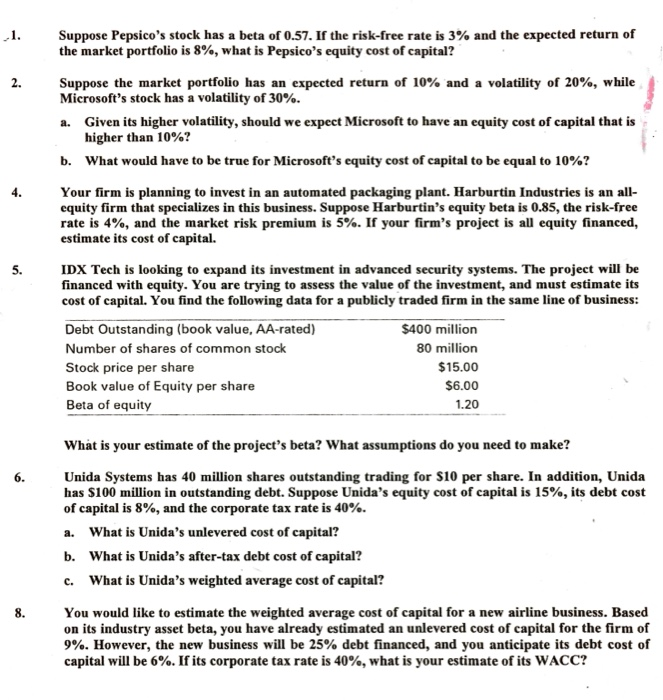

Suppose Pepsico's stock has a beta of 0.57. If the risk-free rate is 3% and the expected return of the market portfolio is 8%, what is Pepsico's equity cost of capital? 2. Suppose the market portfolio has an expected return of 10% and a volatility of 20%, while Microsoft's stock has a volatility of 30%. a. Given its higher volatility, should we expect Microsoft to have an equity cost of capital that is higher than 10%? what would have to be true for Microsoft's equity cost of capital to be equal to 10%? b. 4.Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an l equity firm that specializes in this business. Suppose Harburtin's equity beta is 0.85, the risk-free rate is 4%, and the market risk premium is 5%. If your firm's project is all equity financed, estimate its cost of capital. IDX Tech is looking to expand its investment in advanced security systems. The project will be financed with equity. You are trying to assess the value of the investment, and must estimate its cost of capital. You find the following data for a publicly traded firm in the same line of business: 5. Debt Outstanding (book value, AA-rated) Number of shares of common stock Stock price per share Book value of Equity per share Beta of equity $400 million 80 million $15.00 6.00 1.20 What is your estimate of the project's beta? What assumptions do you need to make? Unida Systems has 40 million shares outstanding trading for S10 per share. In addition, Unida has $100 million in outstanding debt. Suppose Unida's equity cost of capital is 15%, its debt cost of capital is 8%, and the corporate tax rate is 40%. 6. a. b. c. What is Unida's unlevered cost of capital? What is Unida's after-tax debt cost of capital? What is Unida's weighted average cost of capital? 8.You would like to estimate the weighted average cost of capital for a new airline business. Based on its industry asset beta, you have already estimated an unlevered cost of capital for the firm of 9%. However, the new business will be 25% debt financed, and you anticipate its debt cost of capital will be 6%. If its corporate tax rate is 40%, what is your estimate of its WACC