Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Quantitative Question Suppose in an interest rate swap the notional principal is $10,000,000 with a swap period of 2 years. Two companies agree

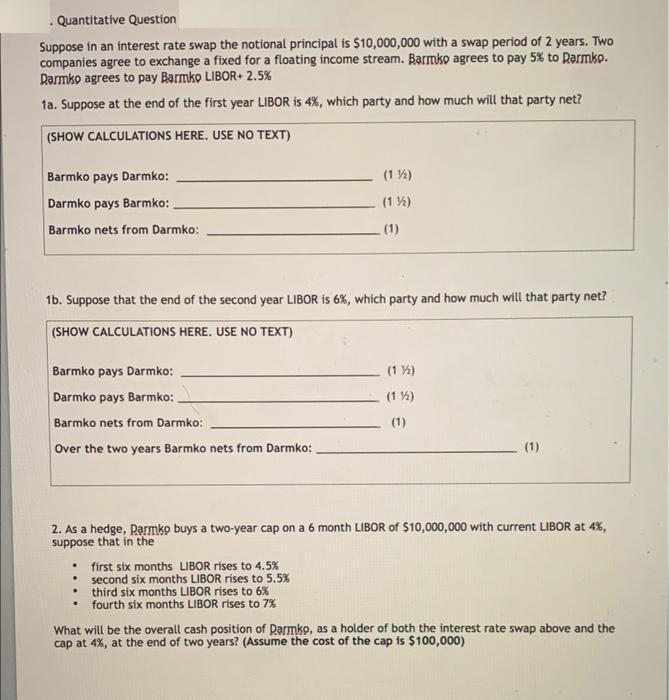

. Quantitative Question Suppose in an interest rate swap the notional principal is $10,000,000 with a swap period of 2 years. Two companies agree to exchange a fixed for a floating income stream. Barmko agrees to pay 5% to Darmko. Darmko agrees to pay Barmko LIBOR+ 2.5% 1a. Suppose at the end of the first year LIBOR is 4%, which party and how much will that party net? (SHOW CALCULATIONS HERE. USE NO TEXT) Barmko pays Darmko: Darmko pays Barmko:. Barmko nets from Darmko: 1b. Suppose that the end of the second year LIBOR is 6%, which party and how much will that party net? (SHOW CALCULATIONS HERE. USE NO TEXT) Barmko pays Darmko: Darmko pays Barmko: Barmko nets from Darmko: Over the two years Barmko nets from Darmko: (1) (1) (1) first six months LIBOR rises to 4.5% second six months LIBOR rises to 5.5% third six months LIBOR rises to 6% fourth six months LIBOR rises to 7% . (1) (1) (1) 2. As a hedge, Darmko buys a two-year cap on a 6 month LIBOR of $10,000,000 with current LIBOR at 4%, suppose that in the (1) What will be the overall cash position of Darmko, as a holder of both the interest rate swap above and the cap at 4%, at the end of two years? (Assume the cost of the cap is $100,000)

Step by Step Solution

★★★★★

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Barmko pays Darmro barmico puys Barmco Barmlco Net from Darmkc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started