Answered step by step

Verified Expert Solution

Question

1 Approved Answer

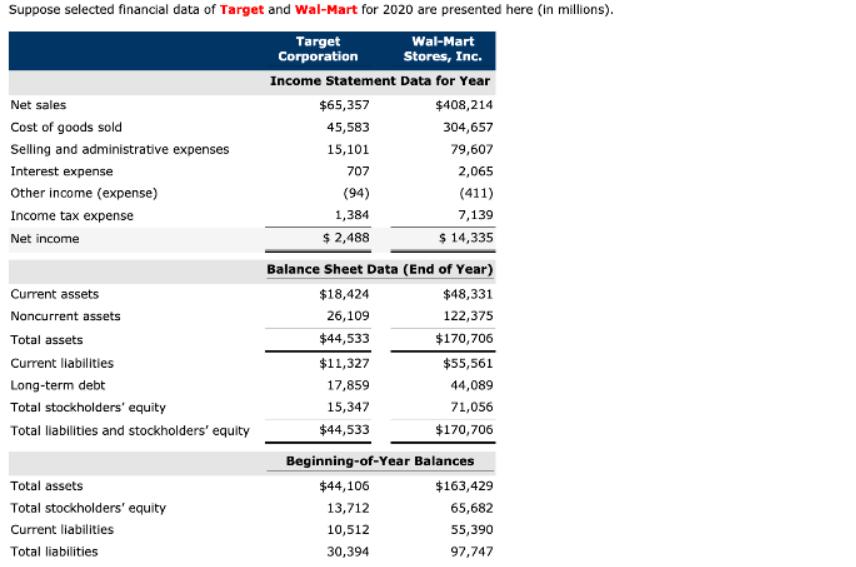

Suppose selected financial data of Target and Wal-Mart for 2020 are presented here (in millions). Net sales Cost of goods sold Selling and administrative

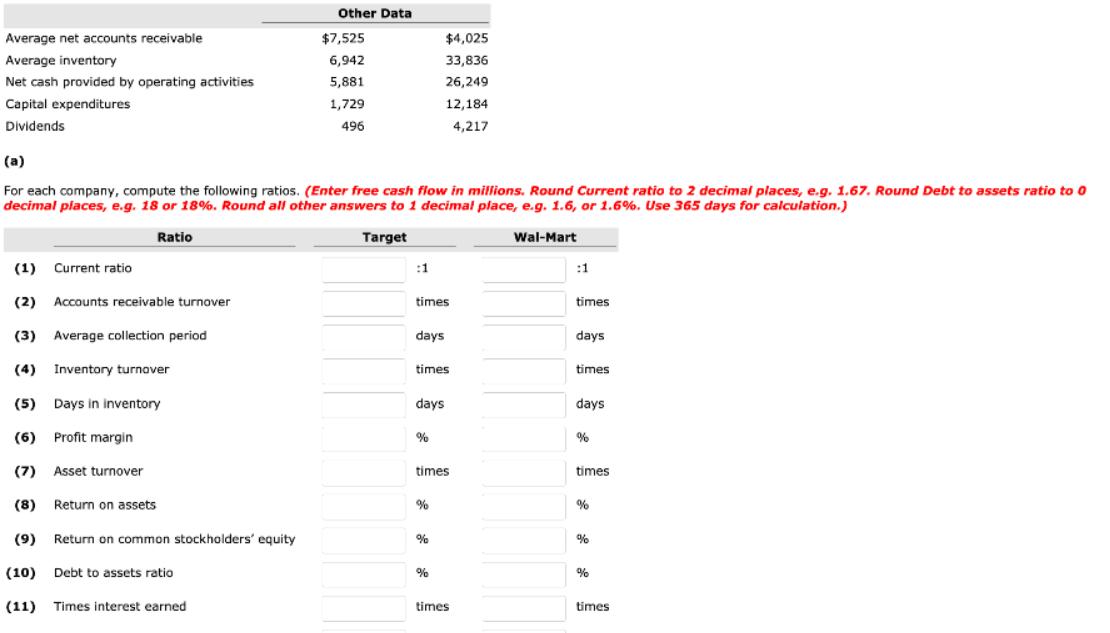

Suppose selected financial data of Target and Wal-Mart for 2020 are presented here (in millions). Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Target Corporation Income Statement Data for Year $65,357 45,583 Wal-Mart Stores, Inc. $408,214 304,657 15,101 79,607 707 2,065 (94) (411) 1,384 7,139 $ 2,488 $14,335 Balance Sheet Data (End of Year) Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity $18,424 $48,331 26,109 122,375 $44,533 $170,706 $11,327 $55,561 17,859 44,089 15,347 71,056 Total liabilities and stockholders' equity $44,533 $170,706 Beginning-of-Year Balances Total assets Total stockholders' equity $44,106 $163,429 13,712 65,682 Current liabilities Total liabilities 10,512 55,390 30,394 97,747 Other Data Average net accounts receivable $7,525 $4,025 Average inventory 6,942 33,836 Net cash provided by operating activities 5,881 26,249 Capital expenditures Dividends 1,729 12,184 496 4,217 (a) For each company, compute the following ratios. (Enter free cash flow in millions. Round Current ratio to 2 decimal places, e.g. 1.67. Round Debt to assets ratio to 0 decimal places, e.g. 18 or 18%. Round all other answers to 1 decimal place, e.g. 1.6, or 1.6%. Use 365 days for calculation.) Ratio (1) Current ratio Target Wal-Mart :1 :1 (2) Accounts receivable turnover (3) Average collection period (4) Inventory turnover (5) Days in inventory (6) Profit margin times times days days times times days days % % (7) Asset turnover (8) Return on assets times % times % (9) Return on common stockholders' equity % % (10) Debt to assets ratio % % (11) Times interest earned times times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started