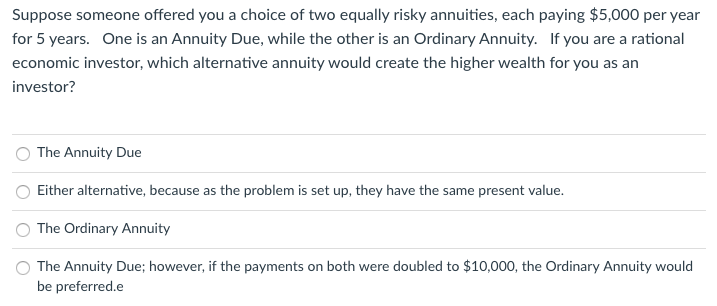

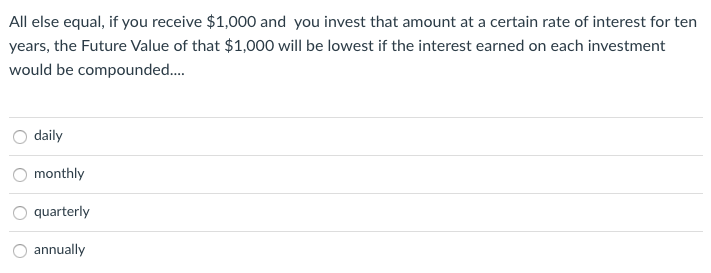

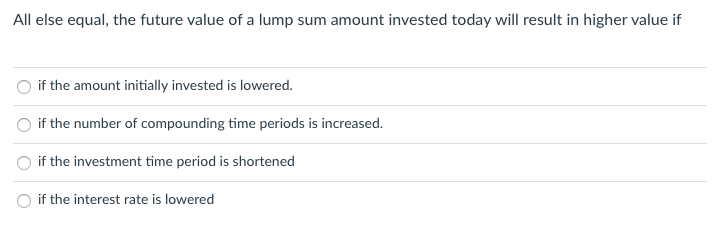

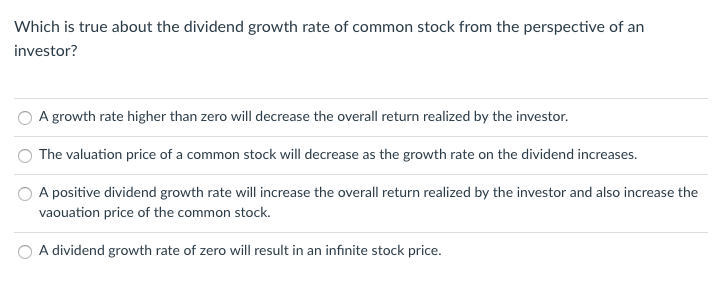

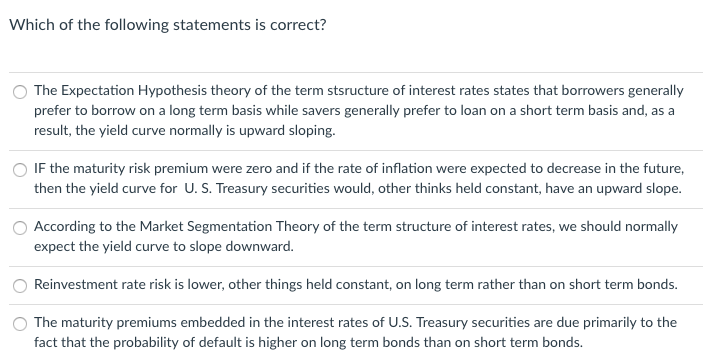

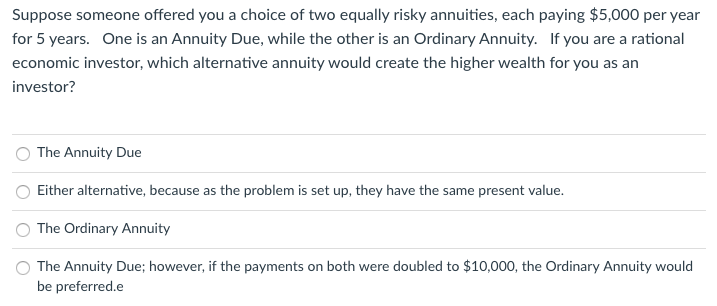

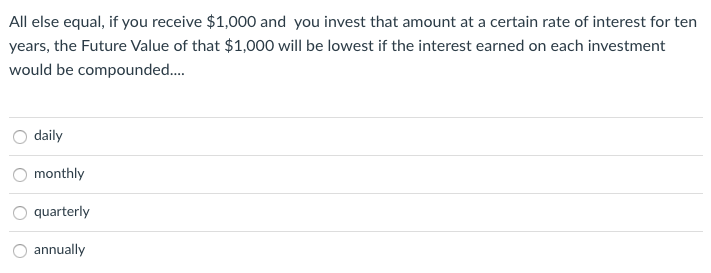

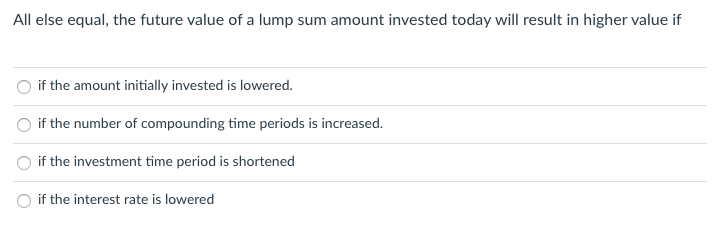

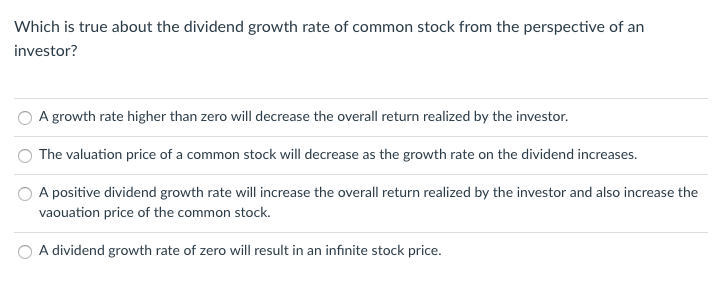

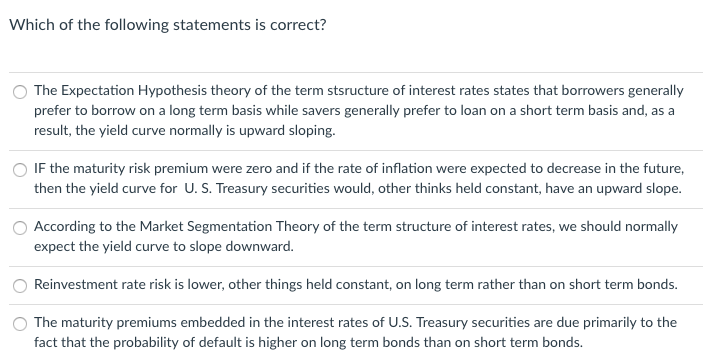

Suppose someone offered you a choice of two equally risky annuities, each paying $5,000 per year for 5 years. One is an Annuity Due, while the other is an Ordinary Annuity. If you are a rational economic investor, which alternative annuity would create the higher wealth for you as an investor? The Annuity Due Either alternative, because as the problem is set up, they have the same present value. The Ordinary Annuity The Annuity Due; however, if the payments on both were doubled to $10,000, the Ordinary Annuity would be preferred.e All else equal, if you receive $1,000 and you invest that amount at a certain rate of interest for ten years, the Future Value of that $1,000 will be lowest if the interest earned on each investment would be compounded.... daily monthly quarterly annually All else equal, the future value of a lump sum amount invested today will result in higher value if if the amount initially invested is lowered. if the number of compounding time periods is increased. if the investment time period is shortened if the interest rate is lowered Which is true about the dividend growth rate of common stock from the perspective of an investor? A growth rate higher than zero will decrease the overall return realized by the investor. The valuation price of a common stock will decrease as the growth rate on the dividend increases. A positive dividend growth rate will increase the overall return realized by the investor and also increase the vaouation price of the common stock. A dividend growth rate of zero will result in an infinite stock price. Which of the following statements is correct? The Expectation Hypothesis theory of the term stsructure of interest rates states that borrowers generally prefer to borrow on a long term basis while savers generally prefer to loan on a short term basis and, as a result, the yield curve normally is upward sloping. IF the maturity risk premium were zero and if the rate of inflation were expected to decrease in the future, then the yield curve for U. S. Treasury securities would, other thinks held constant, have an upward slope. According to the Market Segmentation Theory of the term structure of interest rates, we should normally expect the yield curve to slope downward. Reinvestment rate risk is lower, other things held constant, on long term rather than on short term bonds. The maturity premiums embedded in the interest rates of U.S. Treasury securities are due primarily to the fact that the probability of default is higher on long term bonds than on short term bonds