Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose such a situation: a bank sets its interest rate on one-year deposits is 10% per annum. Suppose the principal is $1000, and let's

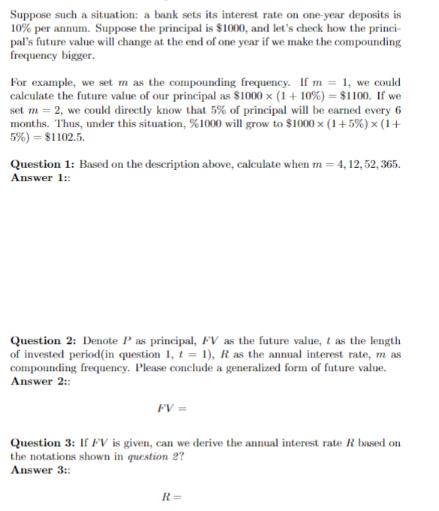

Suppose such a situation: a bank sets its interest rate on one-year deposits is 10% per annum. Suppose the principal is $1000, and let's check how the princi- pal's future value will change at the end of one year if we make the compounding frequency bigger. For example, we set m as the compounding frequency. If m= 1, we could calculate the future value of our principal as $1000 x (1 +10%) = $1100. If we set m = 2, we could directly know that 5% of principal will be earned every 6 months. Thus, under this situation, %1000 will grow to $1000 x (1+5%) x ( 1+ 5%) = $1102.5. Question 1: Based on the description above, calculate when m = 4, 12, 52, 365. Answer 1:: Question 2: Denote P as principal, FV as the future value, t as the length of invested period (in question 1, t = 1), R as the annual interest rate, m as compounding frequency. Please conclude a generalized form of future value. Answer 2:: FV = Question 3: If FV is given, can we derive the annual interest rate R based on the notations shown in question 2? Answer 3:: R=

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 m 4 compounded quarterly FV 1000 1104 4 11062...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started