Question

Suppose Tetra Works Inc. is the only qualified institutional investor in a private equity fund managed by Punch Capital, a private equity company. Tetra Works

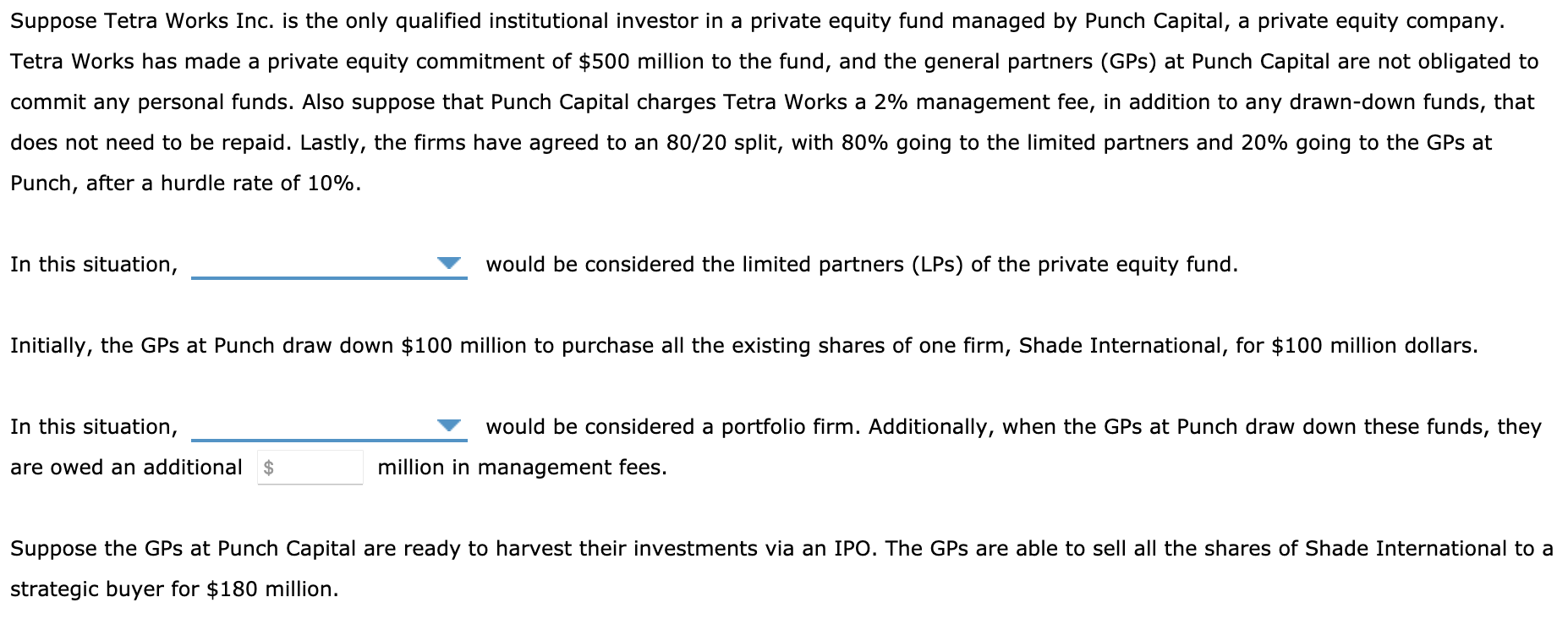

Suppose Tetra Works Inc. is the only qualified institutional investor in a private equity fund managed by Punch Capital, a private equity company. Tetra Works has made a private equity commitment of $500 million to the fund, and the general partners (GPs) at Punch Capital are not obligated to commit any personal funds. Also suppose that Punch Capital charges Tetra Works a 2% management fee, in addition to any drawn-down funds, that does not need to be repaid. Lastly, the firms have agreed to an 80/20 split, with 80% going to the limited partners and 20% going to the GPs at Punch, after a hurdle rate of 10%.

In this situation, ______ would be considered the limited partners (LPs) of the private equity fund. (Punch Capital, Tetra Works, Shade International)

Initially, the GPs at Punch draw down $100 million to purchase all the existing shares of one firm, Shade International, for $100 million dollars.

In this situation, ______ would be considered a portfolio firm. (Punch Capital, Tetra Works, Shade International)

Additionally, when the GPs at Punch draw down these funds, they are owed an additional $_____ million in management fees. Suppose Punch Capital draws down another $100 million to purchase the shares of another company, but when Punch attempts to harvest these shares via an IPO the shares turn out to be worthless ($0).

Use the following table to enter the payments that occur during the waterfall.

This situation would likely result in a _____ of the early profits resulting from the harvesting of the Shade International shares. (clawback, giveback, take-back)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started