suppose that 10 years ago you boight a home for $130,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years.

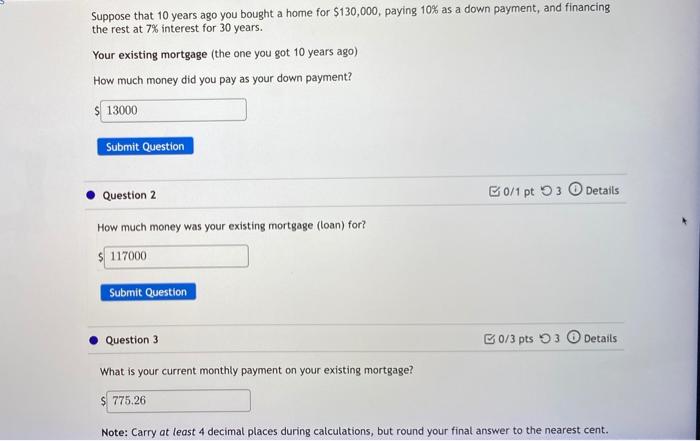

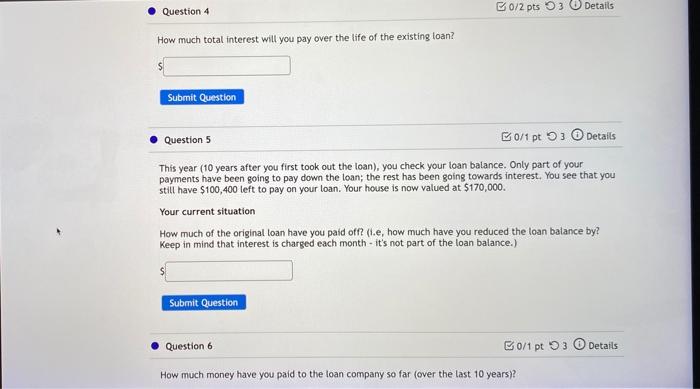

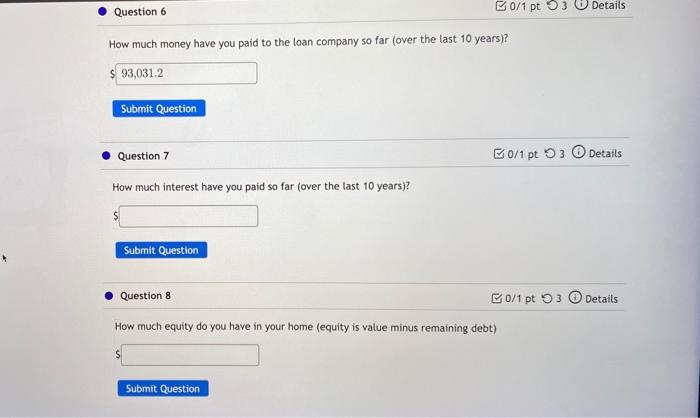

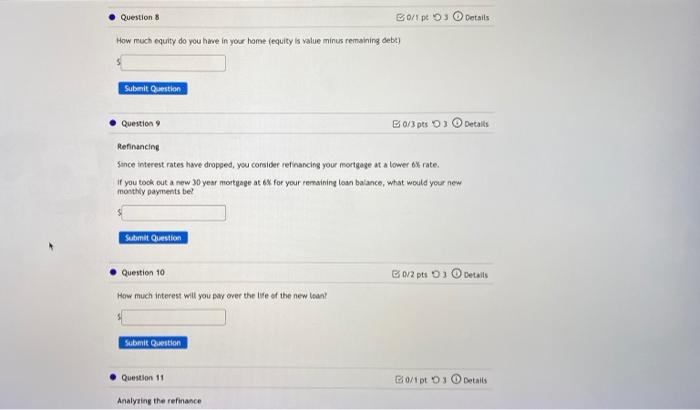

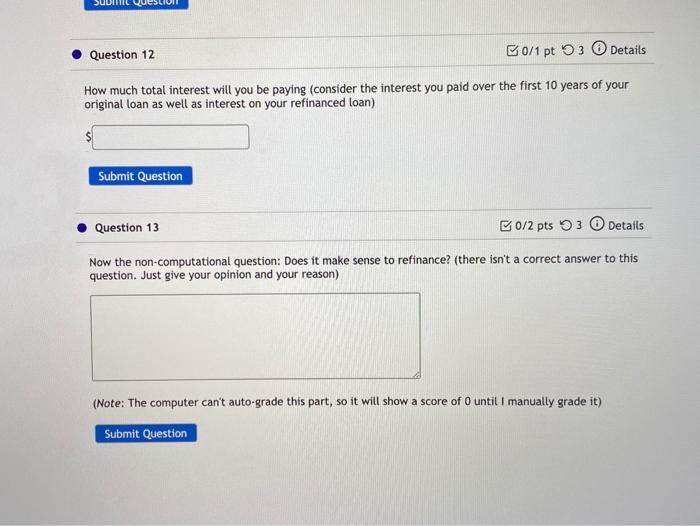

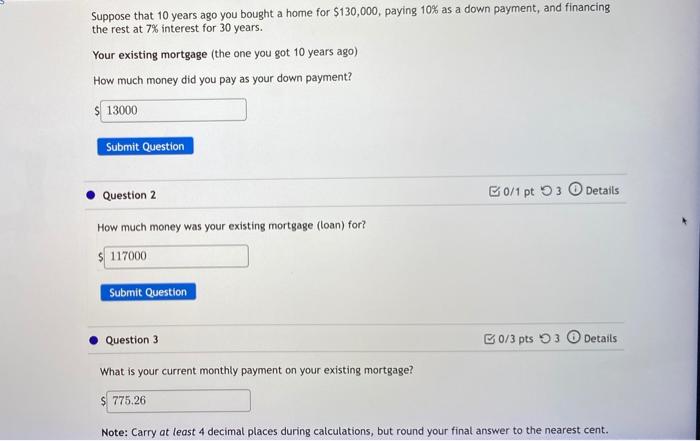

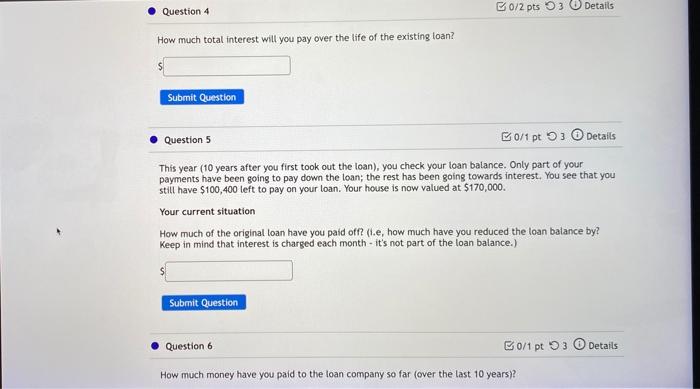

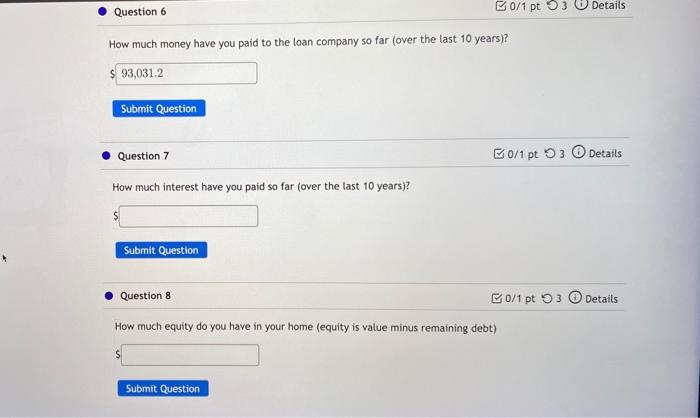

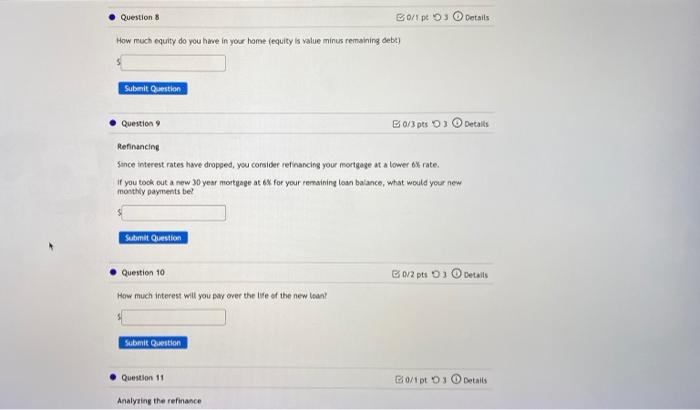

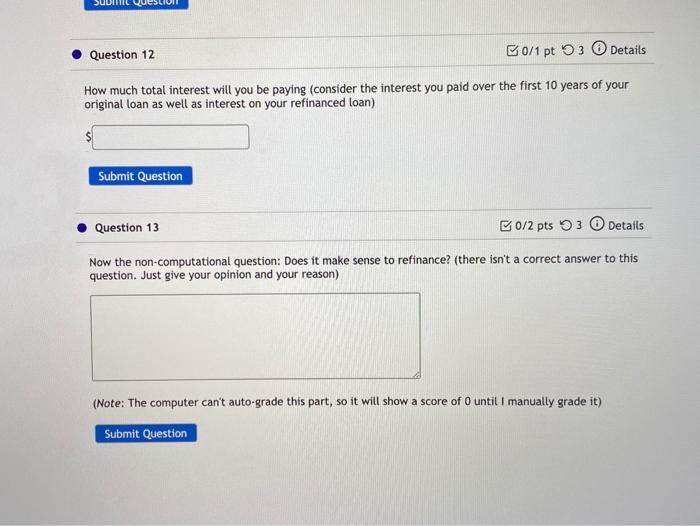

Suppose that 10 years ago you bought a home for $130,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. Your existing mortgage (the one you got 10 years ago) How much money did you pay as your down payment? $ 13000 Submit Question Question 2 B0/1 pt 3 Details How much money was your existing mortgage (loan) for? 117000 Submit Question Question 3 0/3 pts 3 Details What is your current monthly payment on your existing mortgage? $ 775.26 Note: Carry at least 4 decimal places during calculations, but round your final answer to the nearest cent. Question 4 C0/2 pts 3 Details How much total interest will you pay over the life of the existing loan? Submit Question Question 5 B0/1 pto 3 Details This year (10 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $100,400 left to pay on your loan. Your house is now valued at $170,000. Your current situation How much of the original loan have you paid off (le, how much have you reduced the loan balance by? Keep in mind that interest is charged each month - it's not part of the loan balance.) Submit Question Question 6 E0/1 pt 3 Details How much money have you paid to the loan company so far (over the last 10 years)? Question 6 B0/1 pt 53 Details How much money have you paid to the loan company so far (over the last 10 years)? $ 93,031.2 Submit Question Question 7 B0/1 pt 93 Details How much interest have you paid so far (over the last 10 years)? Submit Question Question 8 0/1 pt 93 Details How much equity do you have in your home (equity is value minus remaining debt) Submit Question Question 8 Bon pt 3 Details How much equity do you have in your home equity is value minus remaining debt) Submit Question Question 0/3 pts On Details Refinancing Since interest rates have dropped, you consider refinancing your mortgage at lower ox rate. if you took out a new year mortgage at o% for your remaining loan balanco, what would your new monthly payments be! Submit Question Question 10 B0/2 pti 1 Details How much interest will you pay over the life of the new loan? Submit Question Question 11 Boto Details Analyzing the refinance ESLON Question 12 0/1 pt 3 Details How much total interest will you be paying (consider the interest you paid over the first 10 years of your original loan as well as interest on your refinanced loan) Submit Question Question 13 0/2 pts 3 Details Now the non-computational question: Does it make sense to refinance? (there isn't a correct answer to this question. Just give your opinion and your reason) (Note: The computer can't auto-grade this part, so it will show a score of O until I manually grade it) Submit