Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a 20-year 100-par-value bond with a coupon rate of 12 percent is selling at par, and that current date is coupon payment

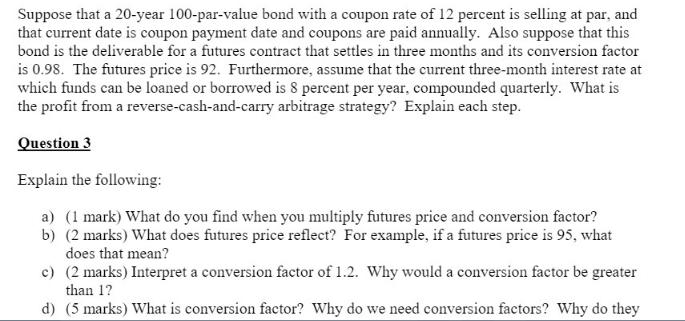

Suppose that a 20-year 100-par-value bond with a coupon rate of 12 percent is selling at par, and that current date is coupon payment date and coupons are paid annually. Also suppose that this bond is the deliverable for a futures contract that settles in three months and its conversion factor is 0.98. The futures price is 92. Furthermore, assume that the current three-month interest rate at which funds can be loaned or borrowed is 8 percent per year, compounded quarterly. What is the profit from a reverse-cash-and-carry arbitrage strategy? Explain each step. Question 3 Explain the following: a) (1 mark) What do you find when you multiply futures price and conversion factor? b) (2 marks) What does futures price reflect? For example, if a futures price is 95, what does that mean? c) (2 marks) Interpret a conversion factor of 1.2. Why would a conversion factor be greater than 1? d) (5 marks) What is conversion factor? Why do we need conversion factors? Why do they

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a When you multiply the futures price and the conversion factor you get the invoice price The invoic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started