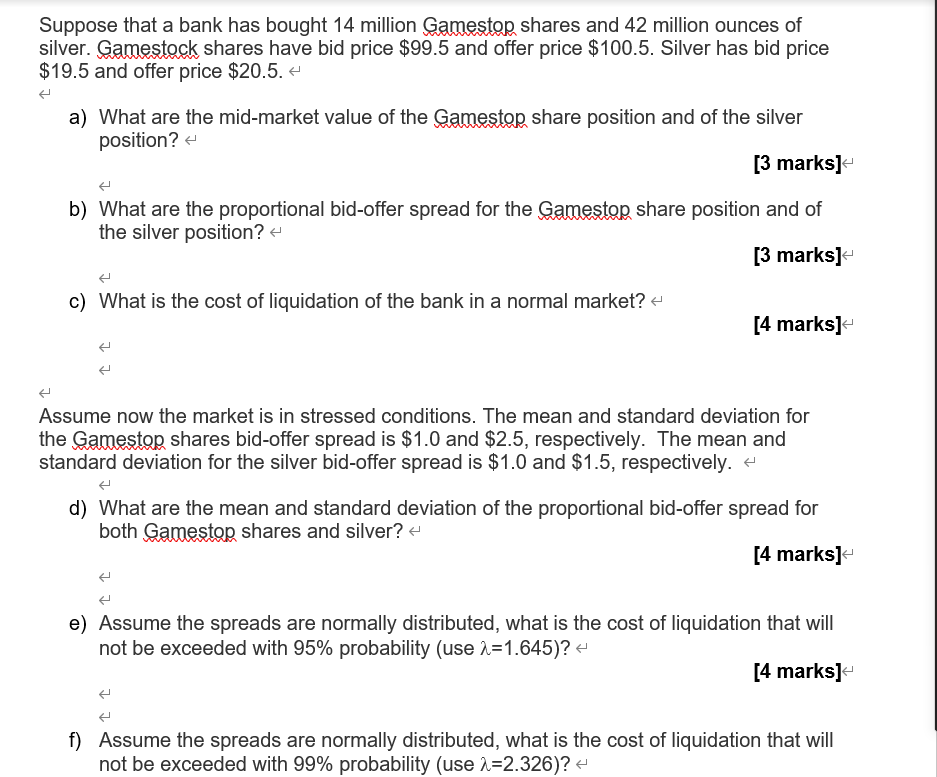

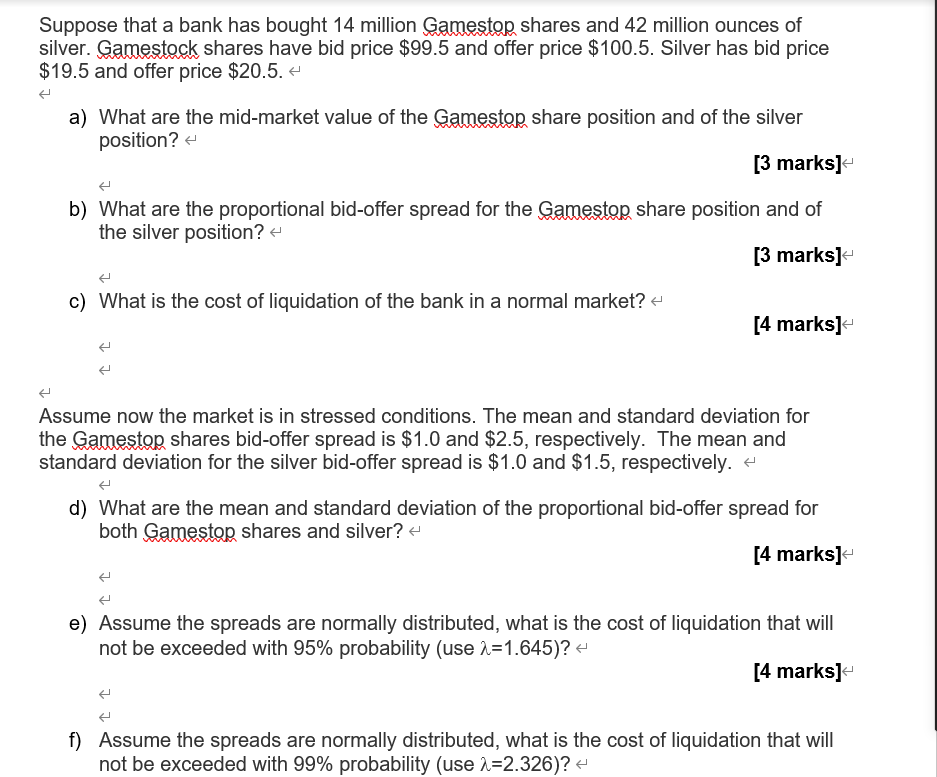

Suppose that a bank has bought 14 million Gamestop shares and 42 million ounces of silver. Gamestock shares have bid price $99.5 and offer price $100.5. Silver has bid price $19.5 and offer price $20.5.4 a) What are the mid-market value of the Gamestop share position and of the silver position? [3 marks] b) What are the proportional bid-offer spread for the Gamestop share position and of the silver position? [3 marks] c) What is the cost of liquidation of the bank in a normal market? [4 marks] Assume now the market is in stressed conditions. The mean and standard deviation for the Gamestop shares bid-offer spread is $1.0 and $2.5, respectively. The mean and standard deviation for the silver bid-offer spread is $1.0 and $1.5, respectively. + d) What are the mean and standard deviation of the proportional bid-offer spread for both Gamestop shares and silver? 4 [4 marks] e) Assume the spreads are normally distributed, what is the cost of liquidation that will not be exceeded with 95% probability (use 2 =1.645)? [4 marks] f) Assume the spreads are normally distributed, what is the cost of liquidation that will not be exceeded with 99% probability (use 2=2.326)? + Suppose that a bank has bought 14 million Gamestop shares and 42 million ounces of silver. Gamestock shares have bid price $99.5 and offer price $100.5. Silver has bid price $19.5 and offer price $20.5.4 a) What are the mid-market value of the Gamestop share position and of the silver position? [3 marks] b) What are the proportional bid-offer spread for the Gamestop share position and of the silver position? [3 marks] c) What is the cost of liquidation of the bank in a normal market? [4 marks] Assume now the market is in stressed conditions. The mean and standard deviation for the Gamestop shares bid-offer spread is $1.0 and $2.5, respectively. The mean and standard deviation for the silver bid-offer spread is $1.0 and $1.5, respectively. + d) What are the mean and standard deviation of the proportional bid-offer spread for both Gamestop shares and silver? 4 [4 marks] e) Assume the spreads are normally distributed, what is the cost of liquidation that will not be exceeded with 95% probability (use 2 =1.645)? [4 marks] f) Assume the spreads are normally distributed, what is the cost of liquidation that will not be exceeded with 99% probability (use 2=2.326)? +