Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a mutual fund manager has a $15 million portfolio with a beta of 2.2. Also suppose that the risk free rate is 4.5%

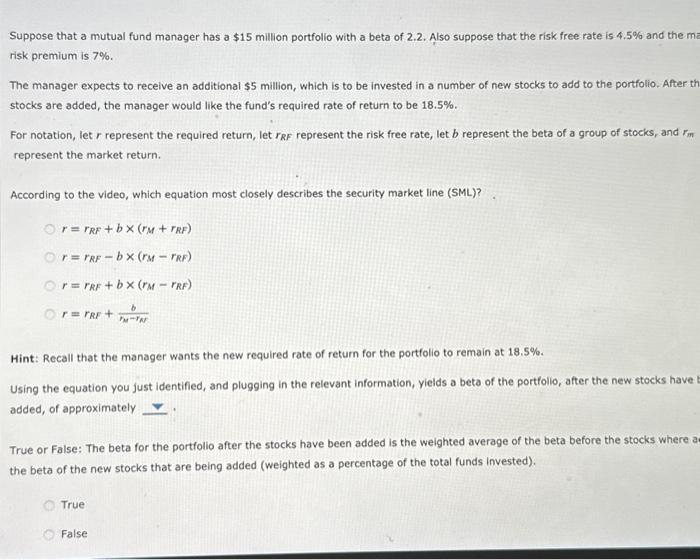

Suppose that a mutual fund manager has a $15 million portfolio with a beta of 2.2. Also suppose that the risk free rate is 4.5% and the ma risk premium is 7%. The manager expects to receive an additional $5 million, which is to be invested in a number of new stocks to add to the portfolio. After th stocks are added, the manager would like the fund's required rate of return to be 18.5%. For notation, let r represent the required return, let TRF represent the risk free rate, let b represent the beta of a group of stocks, and rm represent the market return. According to the video, which equation most closely describes the security market line (SML)? r=rRF + bx (M+ TRF) r = TRF-bx (TM - TRF) r=rRF + bx (rM - TRF) b TM-TRF Or = TRF + Hint: Recall that the manager wants the new required rate of return for the portfolio to remain at 18.5%. Using the equation you just identified, and plugging in the relevant information, yields a beta of the portfolio, after the new stocks have b added, of approximately True or False: The beta for the portfolio after the stocks have been added is the weighted average of the beta before the stocks where a the beta of the new stocks that are being added (weighted as a percentage of the total funds invested). True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started