Answered step by step

Verified Expert Solution

Question

1 Approved Answer

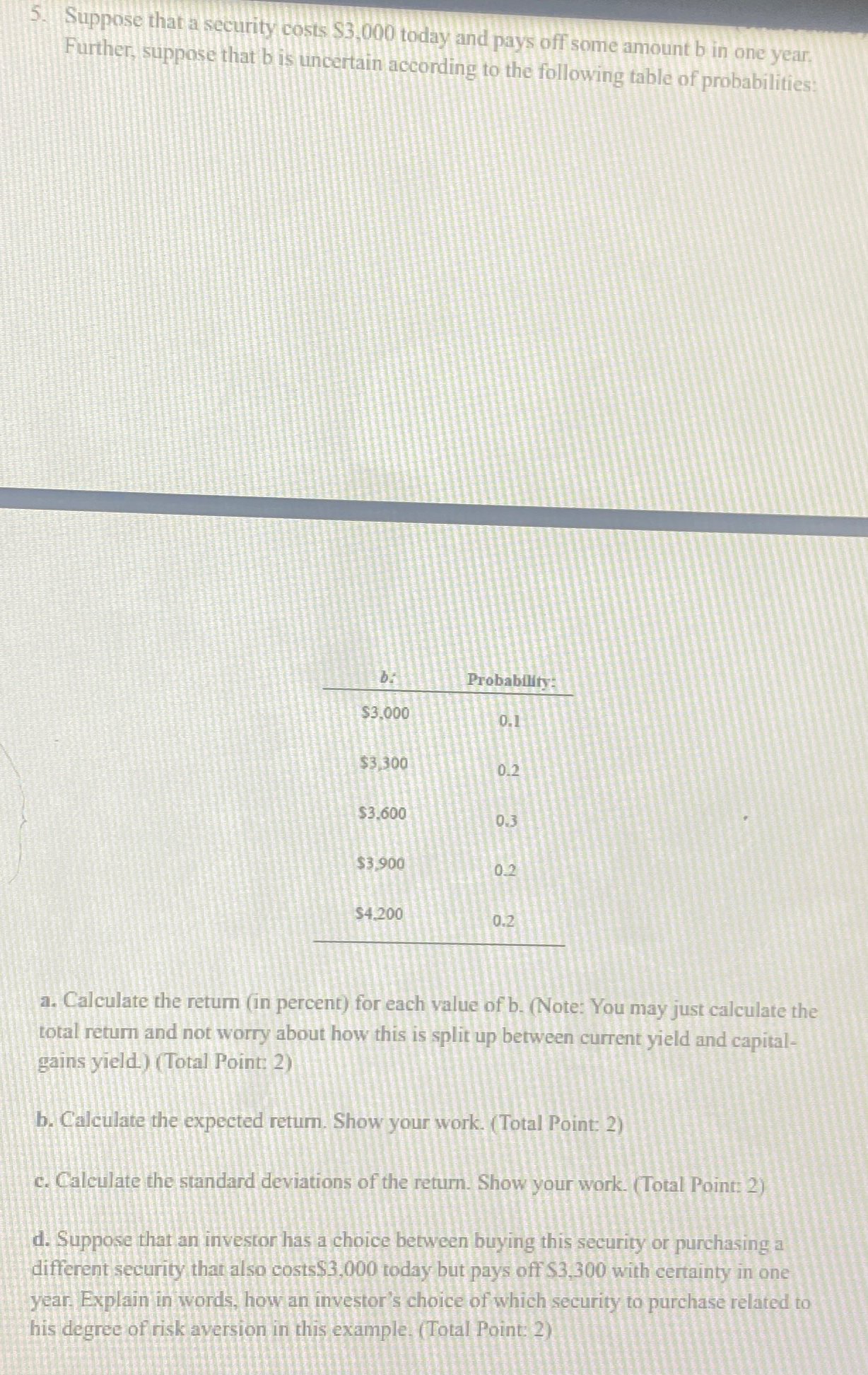

Suppose that a security costs $ 3 , 0 0 0 today and pays off some amount b in one year. Further, suppose that b

Suppose that a security costs $ today and pays off some amount in one year. Further, suppose that is uncertain according to the following table of probabilities:

tableProbability:$$$$$

a Calculate the retum in percent for each value of bNote: You may just calculate the total retum and not worry about how this is split up between current yield and capitalgains yield

b Calculate the expected retum.Show your work.

c Calculate the standard deviations of the return. Show your work. Pls solve this one

d Suppose that an investor has a choice between buying this security or purchasing a different security that also costs $ today but pays off $ with certainty in one year. Explain in words, how an investor's choice of which security to purchase related to his degree of risk aversion in this example.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started