Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can

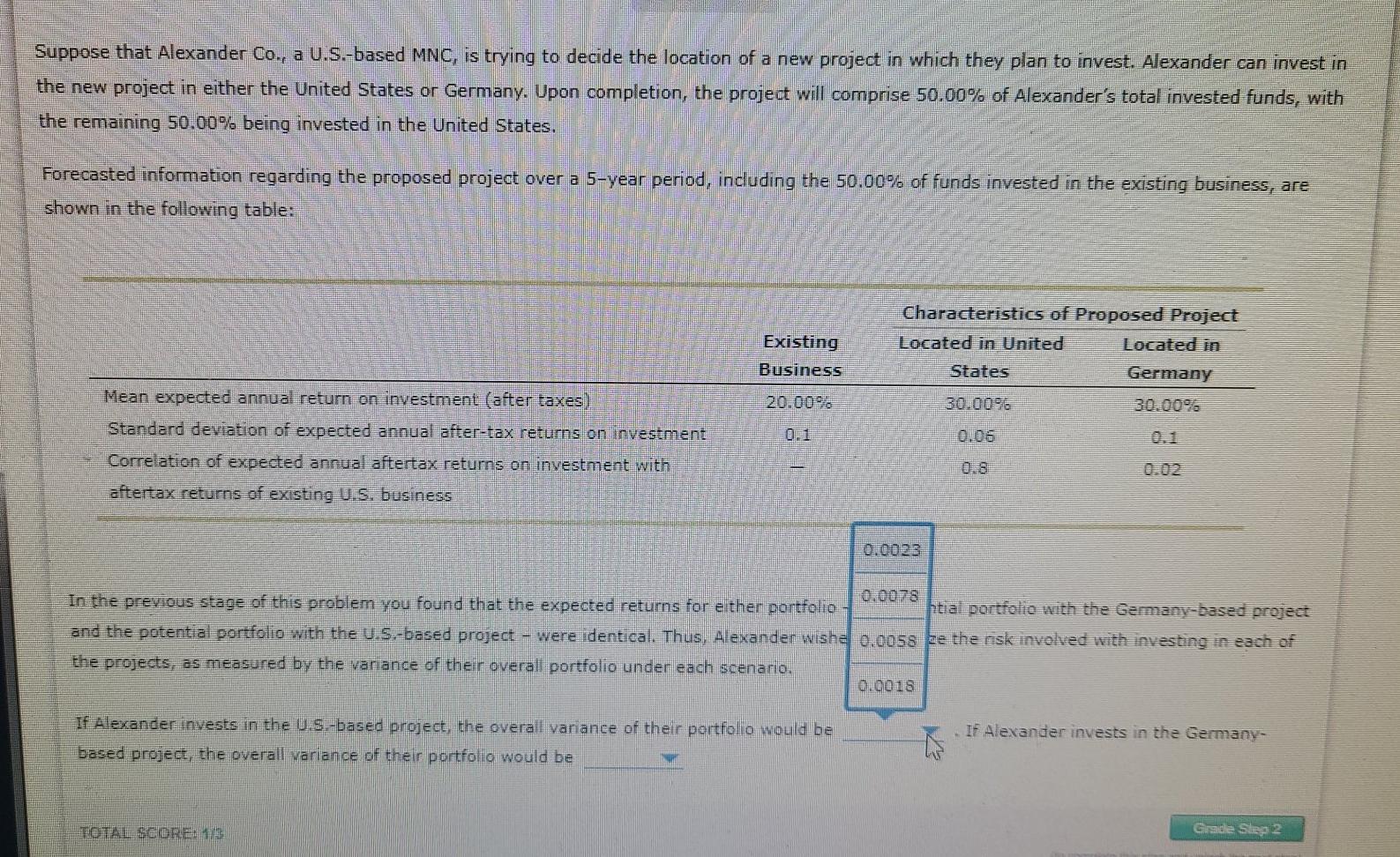

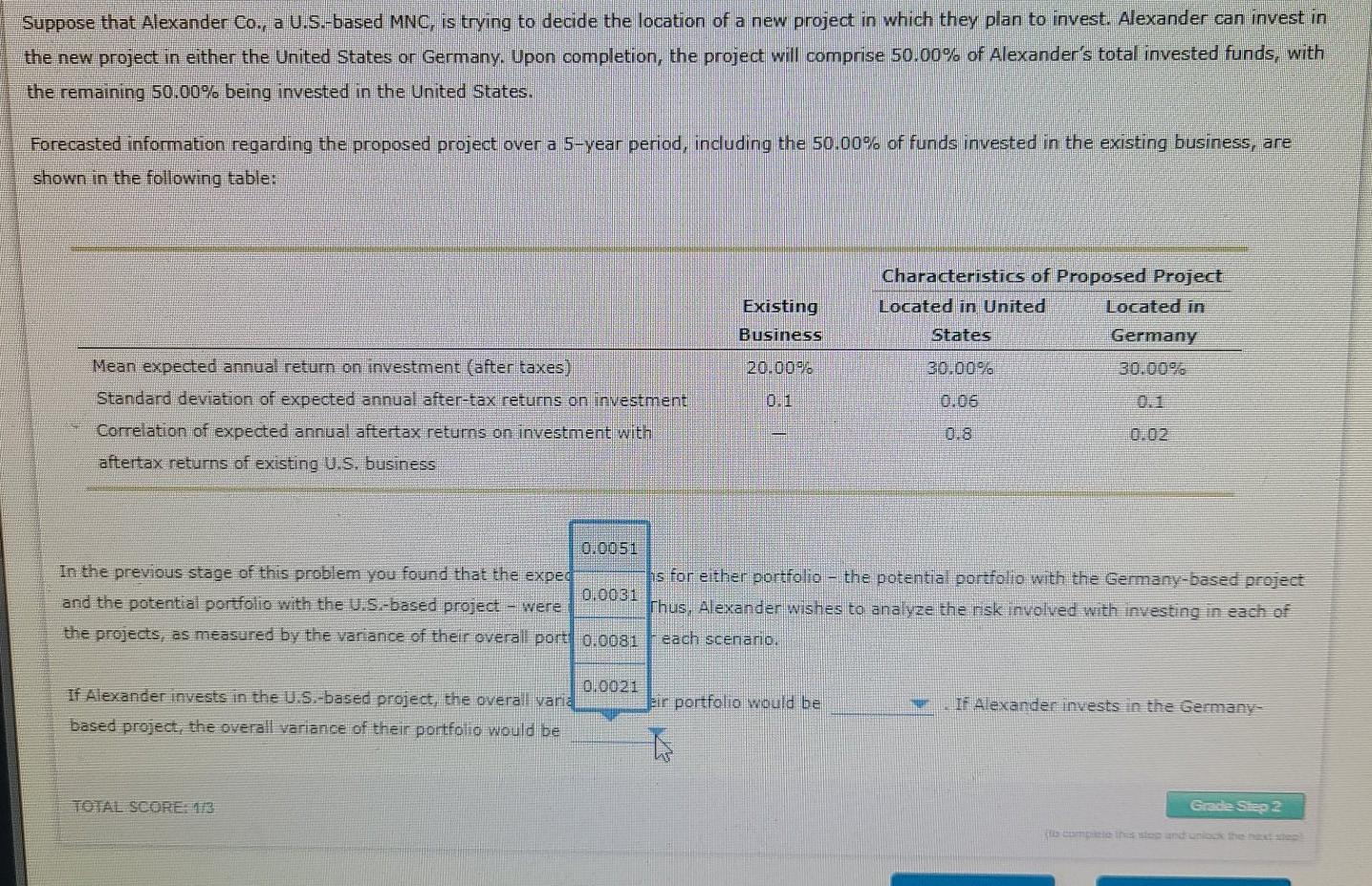

Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 50.00% of Alexander's total invested funds, with the remaining 50.00% being invested in the United States. Forecasted information regarding the proposed project over a 5-year period, including the 50.00% of funds invested in the existing business, are shown in the following table: Existing Business Characteristics of Proposed Project Located in United Located in States Germany 20.00% 30.0096 0.06 Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 0.0023 0.0078 In the previous stage of this problem you found that the expected returns for either portfolio htial portfolio with the Germany-based project and the potential portfolio with the U.S.-based project - were identical. Thus, Alexander wishe 0.0058 ze the risk involved with investing in each of the projects, as measured by the variance of their overall portfolio under each scenario. 0.0018 If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be based project, the overall variance of their portfolio would be If Alexander invests in the Germany TOTAL SCORE113 Grade Step 2 Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 50.00% of Alexander's total invested funds, with the remaining 50.00% being invested in the United States. Forecasted information regarding the proposed project over a 5-year period, including the 50.00% of funds invested in the existing business, are shown in the following table: Existing Business Characteristics of Proposed Project Located in United Located in States Germany 30.00% 30.00% 20.00% 0.06 Mean expected annual return on investment (after taxes) Standard deviation of expected annual after-tax returns on investment Correlation of expected annual aftertax returns on investment with aftertax returns of existing U.S. business 0.8 0.02 010051 In the previous stage of this problem you found that the exped is for either portfolio - the potential portfolio with the Germany-based project 0.0031 and the potential portfolio with the U.S.-based project - were Thus, Alexander wishes to analyze the nsk involved with investing in each of the projects, as measured by the variance of their overall port 0.0081 each scenario. 0.0021 If Alexander invests in the U.S.-based project, the overall varia eir portfolio would be based project, the overall variance of their portfolio would be If Alexander invests in the Germany TOTAL SCORES 1/3 Grade Sizp2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started