Answered step by step

Verified Expert Solution

Question

1 Approved Answer

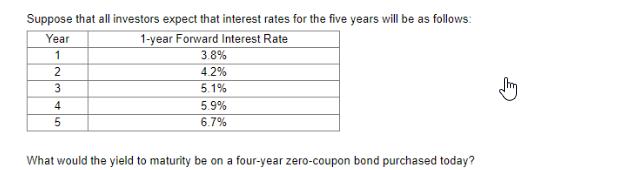

Suppose that all investors expect that interest rates for the five years will be as follows: 1-year Forward Interest Rate Year 1 2 3

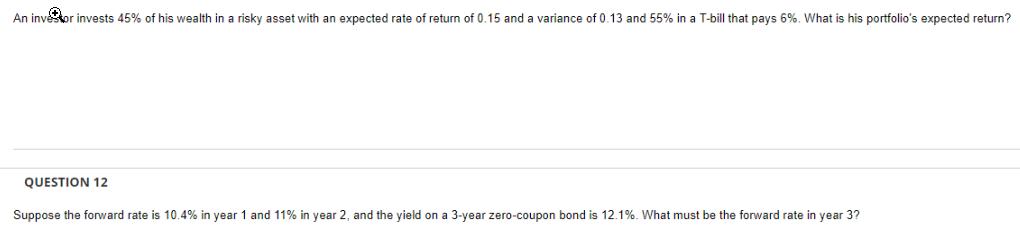

Suppose that all investors expect that interest rates for the five years will be as follows: 1-year Forward Interest Rate Year 1 2 3 4 5 3.8% 4.2% 5.1% 5.9% 6.7% What would the yield to maturity be on a four-year zero-coupon bond purchased today? An investor invests 45% of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.13 and 55% in a T-bill that pays 6%. What is his portfolio's expected return? QUESTION 12 Suppose the forward rate is 10.4% in year 1 and 11% in year 2, and the yield on a 3-year zero-coupon bond is 12.1%. What must be the forward rate in year 3?

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To find the yield to maturity YTM on a fouryear zerocoupon bond purchased today you can us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started