Answered step by step

Verified Expert Solution

Question

1 Approved Answer

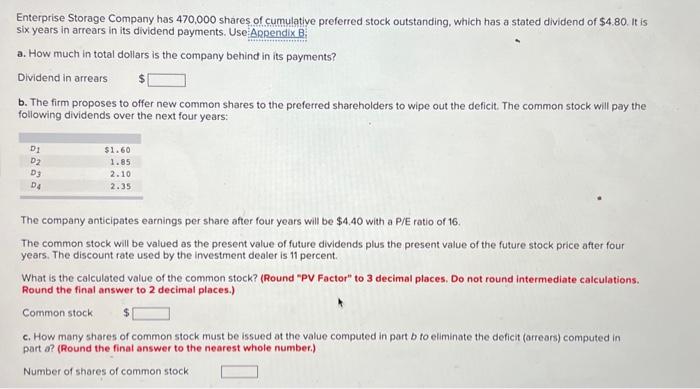

Enterprise Storage Company has 470,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $4.80. It is six years in arrears

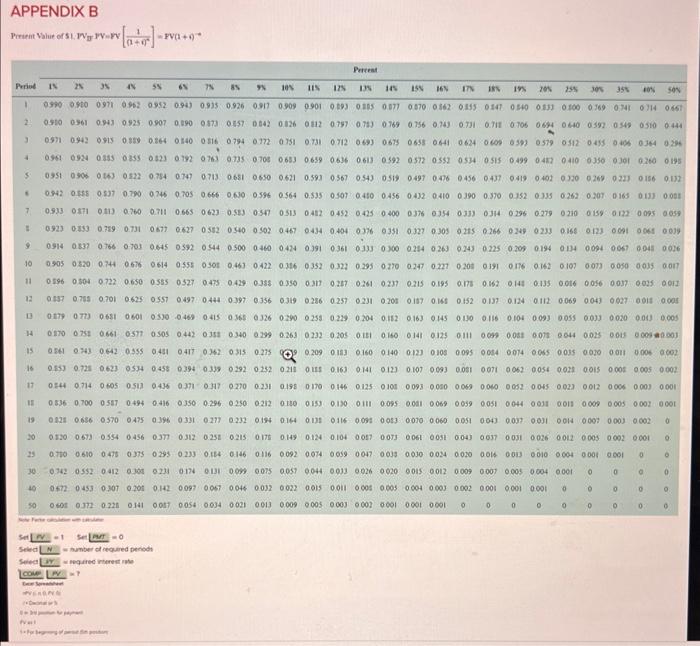

Enterprise Storage Company has 470,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $4.80. It is six years in arrears in its dividend payments. Use Appendix B. a. How much in total dollars is the company behind in its payments? Dividend in arrears b. The firm proposes to offer new common shares to the preferred shareholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D1 D2 D3 DA $1.60 1.85 2.10 2.35 The company anticipates earnings per share after four years will be $4.40 with a P/E ratio of 16. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment dealer is 11 percent. What is the calculated value of the common stock? (Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Common stock c. How many shares of common stock must be issued at the value computed in part b to eliminate the deficit (arrears) computed in part a? (Round the final answer to the nearest whole number.) Number of shares of common stock APPENDIX B Present Value of $1. PVg PV=FV Period IN 2% 3% I 6% 7% 8% 9% 10% 11% 16% 17% 12% 0990 0.910 0971 0962 0952 0943 0.935 0.926 0917 0.909 0.901 0.093 0305 0.877 0.870 0362 0855 0147 0540 0333 0100 0769 0.741 0714 0.667 2 0900 0961 0.943 0925 0907 0,890 0373 0.557 0042 0.826 0812 0.797 0.753 0769 0.756 0.743 0.731 0.71 0.706 0694 0640 0592 0549 0510 0444 3 4 $ " L 1 9 10 RFING 13 M 15 ST [(2+0) A - PV(1+0) NF NS +290 +90 8590 SL90 (690 ZILO ICLO ISLO ZELO 620 9120 000 1980 6880 160 2160 1660 ESSO ZL50 2650 (190 990 6590 1290 SOLO SELO ENLO 26LO CEO SSEO SEO 1260 1960 . Percent 16 0553 0.725 0.623 0534 0458 0394 0.339 0292 0252 0.215 0.15 0.163 0141 0.123 NCT NOT SH 11 0.596 0.504 0.722 0.650 0.585 0527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0237 0.215 0.195 0.178 0.162 0.14 0.135 0.06 0.056 0.037 0.025 0.013 0.857 0.785 0.701 0.625 0557 0497 0444 0.397 0.356 0319 0.286 0.257 0.231 0.20 0.187 0.165 0.152 0.137 0.124 0.112 0.069 0.043 0027 0.01 0.000 Set PV-1 Set PMT-0 Select NAS COMPLPVMT De Spree VERING SAMKONDA 0951 0906 0.043 0822 0.754 0747 0713 0681 0.650 0.621 0.593 0567 0.543 0519 0497 0476 0456 0.437 0419 0402 0.330 0269 0223 0156 0.132 0.942 0555 0537 0.790 0.746 0.705 0666 0.630 0.596 0.564 0.535 0.507 0.450 0.456 0432 0.410 0.390 0.370 0.352 0.335 0262 0207 0163 0.133 0.008 30 40 0672 0453 0.307 0.200 0.142 0.097 50 060 0.372 0.228 0341 0057 0054 0034 0021 0013 0.009 0005 0.003 0.002 0.001 0.001 0.001 number of required periods SISO PESO CISO ISO CSO CISO LISO CSO 290 5990 1120 090 6500 5600 CZ10 4510 DITO SLTO 96TO HEO CECO CO CO 00PO STO SMO ZONO 4000 3900 1600 1210 0910 2009920 SETO SOCO ECO ISCO CO TOPO PEPO 2+0 2050 0150 2850 2290 LEWO ICLO 630 CEED (760 9000 1100 1900 1600 HTO H610 6020 sto co 90 0 000 ero 1900 1600 FCO 0940 0050 +50 2650 $90 TOLO 9940 LERO +60 LIDO STOD 0500 C200 2010 2910 910 1610 8020 Co to acto seco tzco Esco 90 2090 3050 3550 +190 990 H20 0220 5060 1010 10 60 1900 200 300 5410 SITO ESTO ZICO LLCO 950 1550 90 00 100 000 200 000 000 Lt00 6500 200 2600 910 910 310 ECTO SETO SLED SLO 0190 0820 6000 6000 2100 5100 000 9200 00 00 L500 S200 6400 IETO TO IEZO SOCO ZINO ESSO CO 541 ZISO 6L50 (650 6090 OIFO CIPO 660 5000 100 0000 ccoo 5500 600 1010 9110 OCTO SMO C910 210 1020 6220 850 0620 9200 90 50 690 OC50 1090 1890 (220 6400 1000 6000 $100 5000 100 100 100 6600 1110 SZEO IPEO O910 1310 5020 20 1920 660 OFCO CO CO SOS0 LLS0 1990 ESCO OLEO 2000 9000 1100 0000 5000 5900 +100 P500 5600 2010 EZIO OFTO 0910 ESTO 6020 SO SEZO SICO CO LINO ISO SS50 2190 THCO 1950 35F SOC 557 Not 17 0244 0.714 0605 0.513 0436 0.371 0317 0270 0.231 0198 0170 0146 0.125 010 0093 0.000 0.069 0.060 0052 0045 0.023 0012 0006 0.003 0.001 11 0536 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0212 0180 0153 0.130 0111 0.095 0.001 0.069 0059 0051 0044 0031 0011 0009 0005 0.002 0001 19 0225 0.656 0.570 0475 0.396 0331 0277 0232 0194 0164 013 0116 0.09 0.003 0.070 0.060 0.051 0043 0.037 0.031 0.014 0.007 0.003 0.002 0 20 3051 0043 0037 0031 0026 0.012 0005 0.002 0.001 0. 0 0 0 0 0.107 0.093 0.081 0071 0062 0054 0.023 0015 000 0 M60 PCO 900 SSPO OSCO 0920 1000 5610 0067 0044 0.032 0022 0.015 0011 0005 0.005 0004 0.003 0.002 0.001 0.001 0.001 0 0 0 0 1000 1000 1000 0100 100 5000 1000 1000 0 NOP 0 0 50% 0 0 0 0 0005 0.002 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started