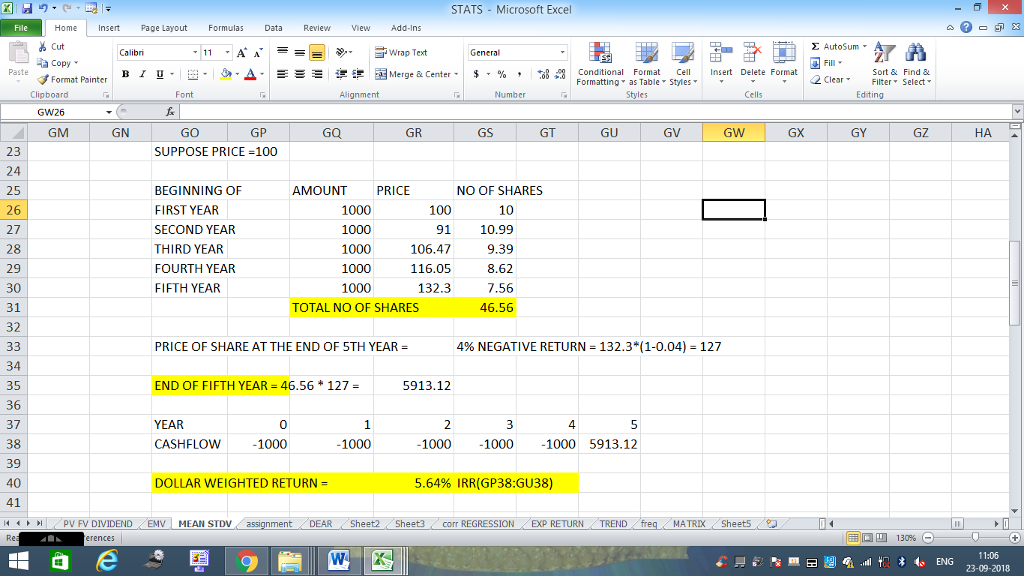

Suppose that an investor opens an account by investing $1,000. At the beginning of each of the next four years, he deposits an additional $1,000 each year, and he then liquidates the account at the end of the total five-year period. Suppose that the yearly returns in this account, beginning in Year 1, are as follows: 9 percent, 17 percent, 9 percent, 14 percent, and 4 percent.

a. Calculate the arithmetic and geometric average returns for this investment. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

So I got the answer to this question but I do not know where some of the figures are coming from. can someone please help me out as to where the prices came from?

File Paste C Home HH = Insert Page Layout Calibri - 11 BIU. 8. Font Cut E Copy Format Painter Clipboard G GW26 - (- GM GN Formulas Data - A A = - A e Review View D Conditional Format Format Cell Formatting as Table Styles Styles x GO GP GS GU GV GW 23 SUPPOSE PRICE =100 24 25 BEGINNING OF NO OF SHARES 26 FIRST YEAR 1000 10 27 SECOND YEAR 1000 10.99 28 THIRD YEAR 1000 9.39 29 FOURTH YEAR 8.62 1000 1000 30 FIFTH YEAR 7.56 31 TOTAL NO OF SHARES 46.56 32 33 PRICE OF SHARE AT THE END OF 5TH YEAR = 4% NEGATIVE RETURN = 132.3*(1-0.04) = 127 34 35 END OF FIFTH YEAR = 46.56 * 127 = 36 37 YEAR 0 1 4 5 2 3 -1000 -1000 38 CASHFLOW -1000 -1000 -1000 5913.12 39 40 DOLLAR WEIGHTED RETURN = 5.64% IRR (GP38:GU38) 41 PV FV DIVIDEND EMV MEAN STDV assignment DEAR Sheet2 Sheet3 corr REGRESSION EXP RETURN TREND freq MATRIX Sheet5 B 10 144 Rea erences [200 FO 33 O W X == Alignment GQ AMOUNT Add-Ins Wrap Text Merge & Center - GR STATS - Microsoft Excel General $ % PRICE 100 91 106.47 116.05 132.3 5913.12 Number C P Insert Delete Format Cells GX GT AutoSum Fill Clear GY Sort & Find & Cal Filter Select GZ Editing q FR E al ta 130% O * ENG 11 HA C 11:06 23-09-2018 x File Paste C Home HH = Insert Page Layout Calibri - 11 BIU. 8. Font Cut E Copy Format Painter Clipboard G GW26 - (- GM GN Formulas Data - A A = - A e Review View D Conditional Format Format Cell Formatting as Table Styles Styles x GO GP GS GU GV GW 23 SUPPOSE PRICE =100 24 25 BEGINNING OF NO OF SHARES 26 FIRST YEAR 1000 10 27 SECOND YEAR 1000 10.99 28 THIRD YEAR 1000 9.39 29 FOURTH YEAR 8.62 1000 1000 30 FIFTH YEAR 7.56 31 TOTAL NO OF SHARES 46.56 32 33 PRICE OF SHARE AT THE END OF 5TH YEAR = 4% NEGATIVE RETURN = 132.3*(1-0.04) = 127 34 35 END OF FIFTH YEAR = 46.56 * 127 = 36 37 YEAR 0 1 4 5 2 3 -1000 -1000 38 CASHFLOW -1000 -1000 -1000 5913.12 39 40 DOLLAR WEIGHTED RETURN = 5.64% IRR (GP38:GU38) 41 PV FV DIVIDEND EMV MEAN STDV assignment DEAR Sheet2 Sheet3 corr REGRESSION EXP RETURN TREND freq MATRIX Sheet5 B 10 144 Rea erences [200 FO 33 O W X == Alignment GQ AMOUNT Add-Ins Wrap Text Merge & Center - GR STATS - Microsoft Excel General $ % PRICE 100 91 106.47 116.05 132.3 5913.12 Number C P Insert Delete Format Cells GX GT AutoSum Fill Clear GY Sort & Find & Cal Filter Select GZ Editing q FR E al ta 130% O * ENG 11 HA C 11:06 23-09-2018 x