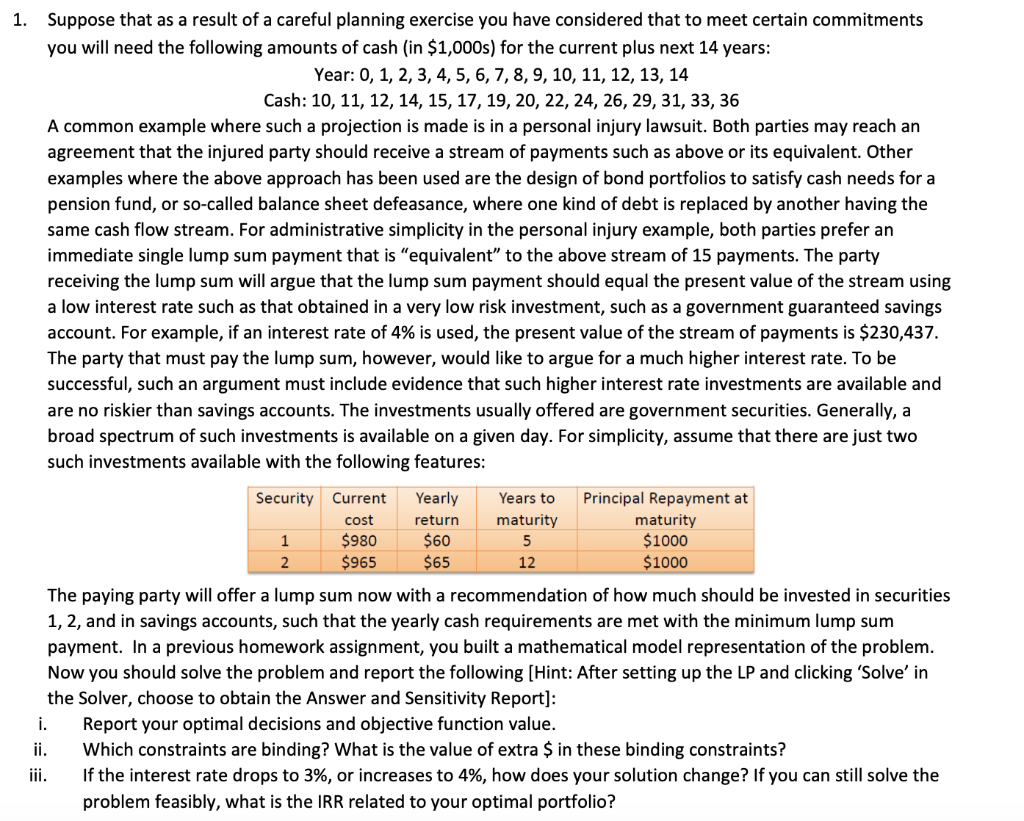

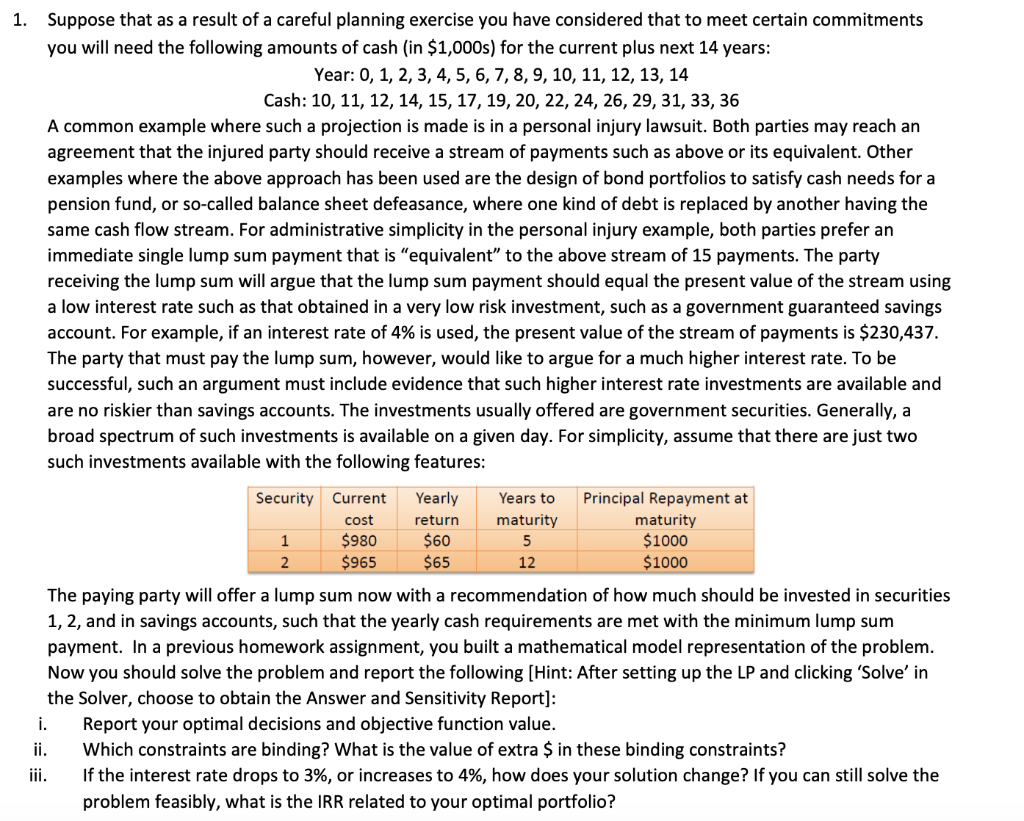

Suppose that as a result of a careful planning exercise you have considered that to meet certain commitments you will need the following amounts of cash (in $1,000s ) for the current plus next 14 years: Year:0,1,2,3,4,5,6,7,8,9,10,11,12,13,14Cash:10,11,12,14,15,17,19,20,22,24,26,29,31,33,36 A common example where such a projection is made is in a personal injury lawsuit. Both parties may reach an agreement that the injured party should receive a stream of payments such as above or its equivalent. Other examples where the above approach has been used are the design of bond portfolios to satisfy cash needs for a pension fund, or so-called balance sheet defeasance, where one kind of debt is replaced by another having the same cash flow stream. For administrative simplicity in the personal injury example, both parties prefer an immediate single lump sum payment that is "equivalent" to the above stream of 15 payments. The party receiving the lump sum will argue that the lump sum payment should equal the present value of the stream using a low interest rate such as that obtained in a very low risk investment, such as a government guaranteed savings account. For example, if an interest rate of 4% is used, the present value of the stream of payments is $230,437. The party that must pay the lump sum, however, would like to argue for a much higher interest rate. To be successful, such an argument must include evidence that such higher interest rate investments are available and are no riskier than savings accounts. The investments usually offered are government securities. Generally, a broad spectrum of such investments is available on a given day. For simplicity, assume that there are just two such investments available with the following features: The paying party will offer a lump sum now with a recommendation of how much should be invested in securities 1,2 , and in savings accounts, such that the yearly cash requirements are met with the minimum lump sum payment. In a previous homework assignment, you built a mathematical model representation of the problem. Now you should solve the problem and report the following [Hint: After setting up the LP and clicking 'Solve' in the Solver, choose to obtain the Answer and Sensitivity Report]: i. Report your optimal decisions and objective function value. ii. Which constraints are binding? What is the value of extra $ in these binding constraints? iii. If the interest rate drops to 3%, or increases to 4%, how does your solution change? If you can still solve the problem feasibly, what is the IRR related to your optimal portfolio? Suppose that as a result of a careful planning exercise you have considered that to meet certain commitments you will need the following amounts of cash (in $1,000s ) for the current plus next 14 years: Year:0,1,2,3,4,5,6,7,8,9,10,11,12,13,14Cash:10,11,12,14,15,17,19,20,22,24,26,29,31,33,36 A common example where such a projection is made is in a personal injury lawsuit. Both parties may reach an agreement that the injured party should receive a stream of payments such as above or its equivalent. Other examples where the above approach has been used are the design of bond portfolios to satisfy cash needs for a pension fund, or so-called balance sheet defeasance, where one kind of debt is replaced by another having the same cash flow stream. For administrative simplicity in the personal injury example, both parties prefer an immediate single lump sum payment that is "equivalent" to the above stream of 15 payments. The party receiving the lump sum will argue that the lump sum payment should equal the present value of the stream using a low interest rate such as that obtained in a very low risk investment, such as a government guaranteed savings account. For example, if an interest rate of 4% is used, the present value of the stream of payments is $230,437. The party that must pay the lump sum, however, would like to argue for a much higher interest rate. To be successful, such an argument must include evidence that such higher interest rate investments are available and are no riskier than savings accounts. The investments usually offered are government securities. Generally, a broad spectrum of such investments is available on a given day. For simplicity, assume that there are just two such investments available with the following features: The paying party will offer a lump sum now with a recommendation of how much should be invested in securities 1,2 , and in savings accounts, such that the yearly cash requirements are met with the minimum lump sum payment. In a previous homework assignment, you built a mathematical model representation of the problem. Now you should solve the problem and report the following [Hint: After setting up the LP and clicking 'Solve' in the Solver, choose to obtain the Answer and Sensitivity Report]: i. Report your optimal decisions and objective function value. ii. Which constraints are binding? What is the value of extra $ in these binding constraints? iii. If the interest rate drops to 3%, or increases to 4%, how does your solution change? If you can still solve the problem feasibly, what is the IRR related to your optimal portfolio