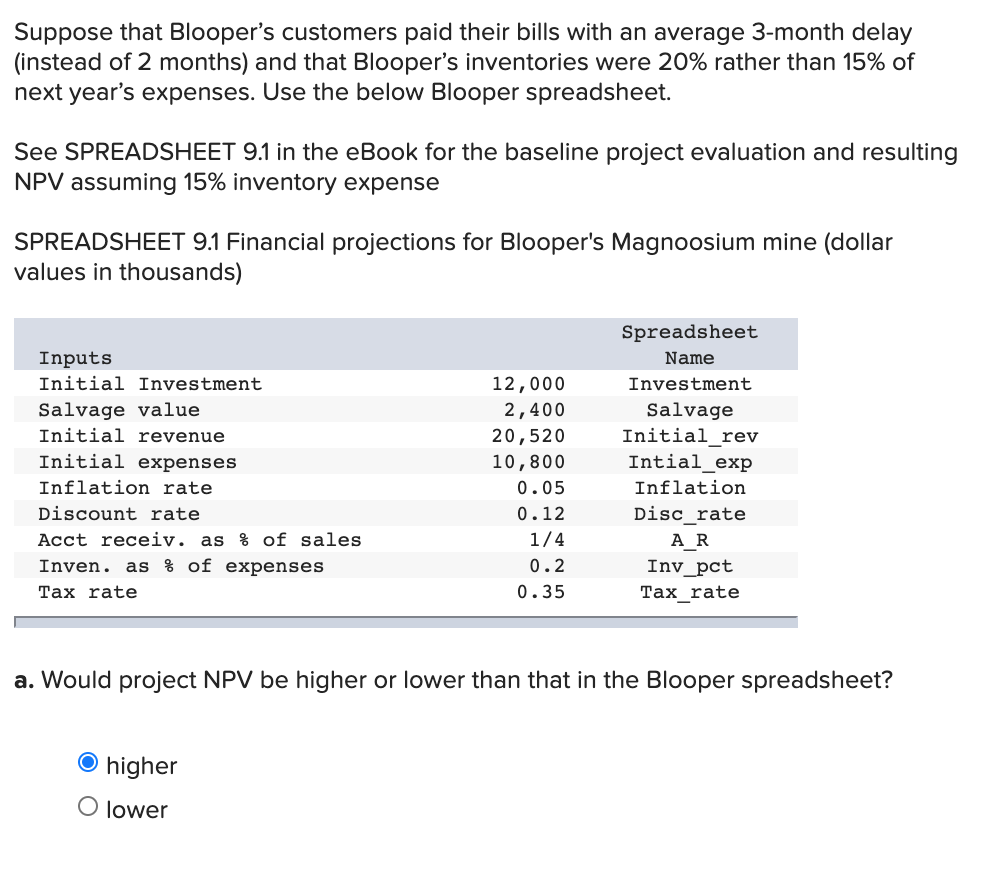

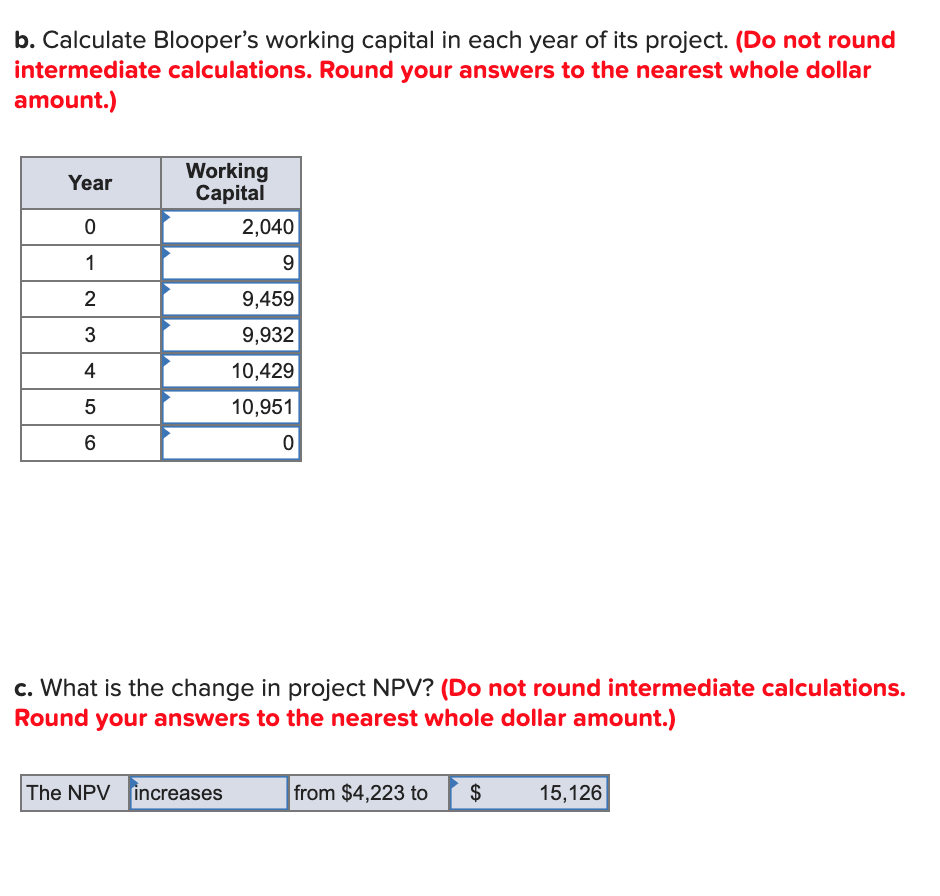

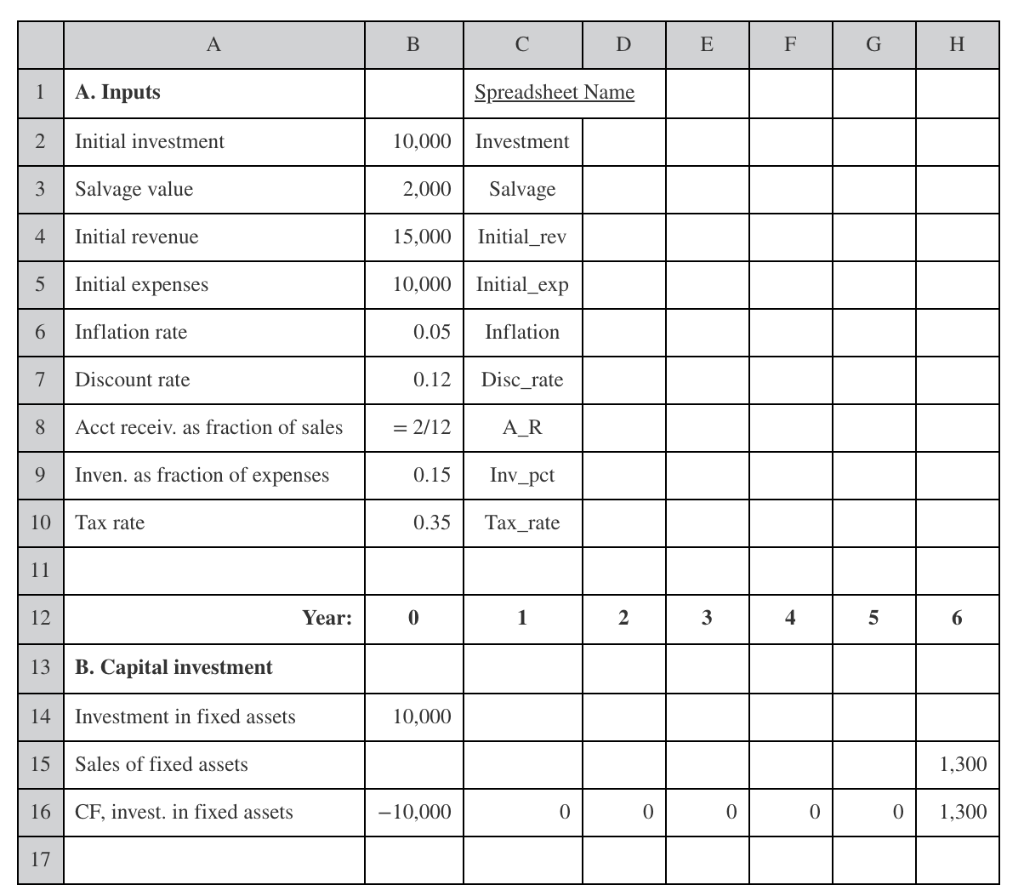

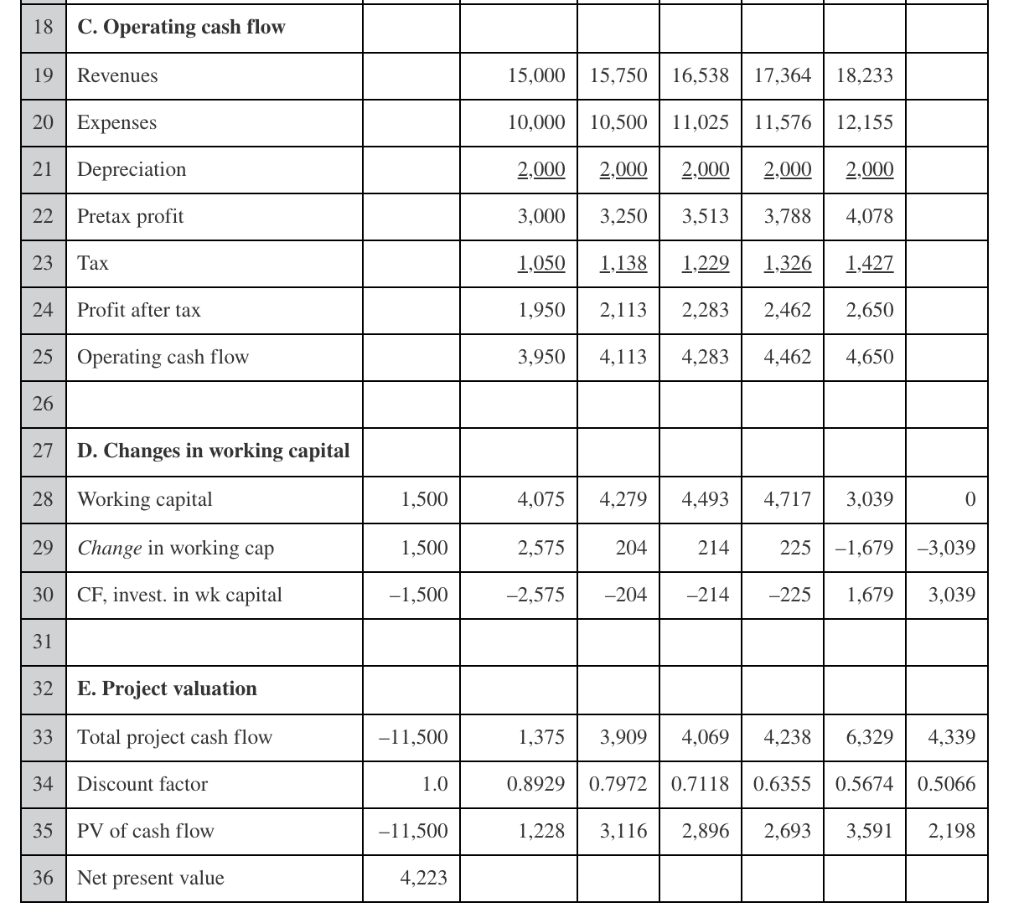

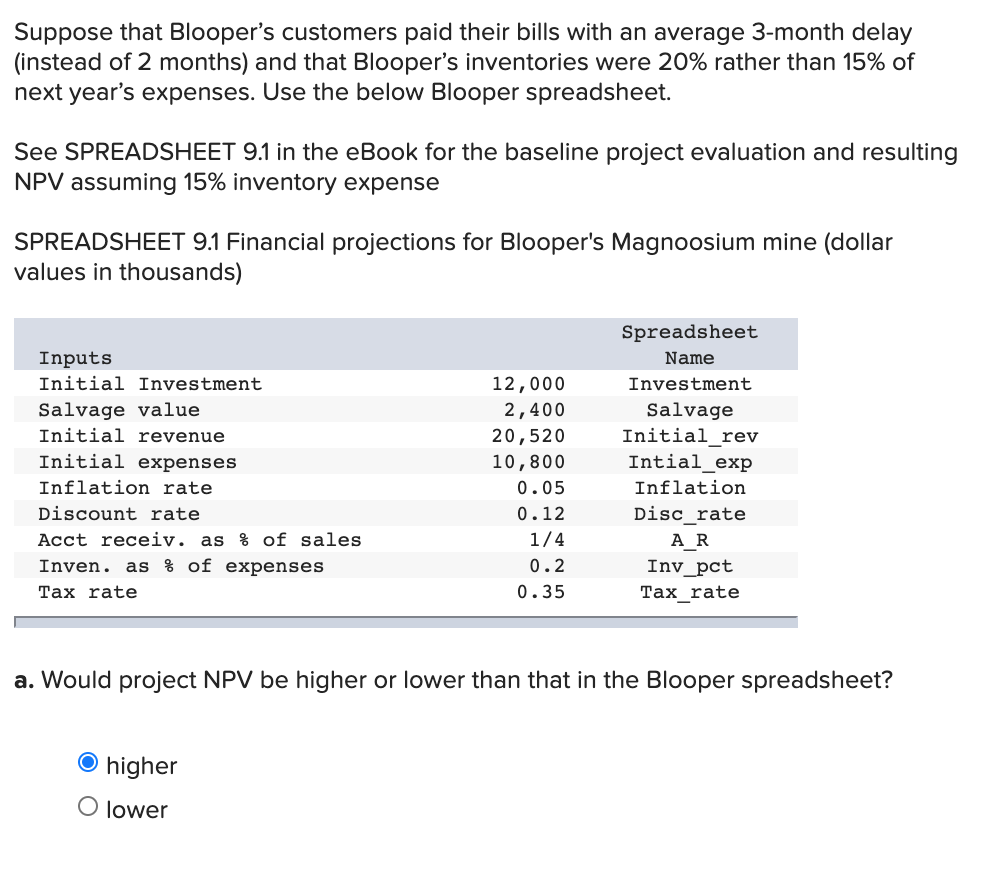

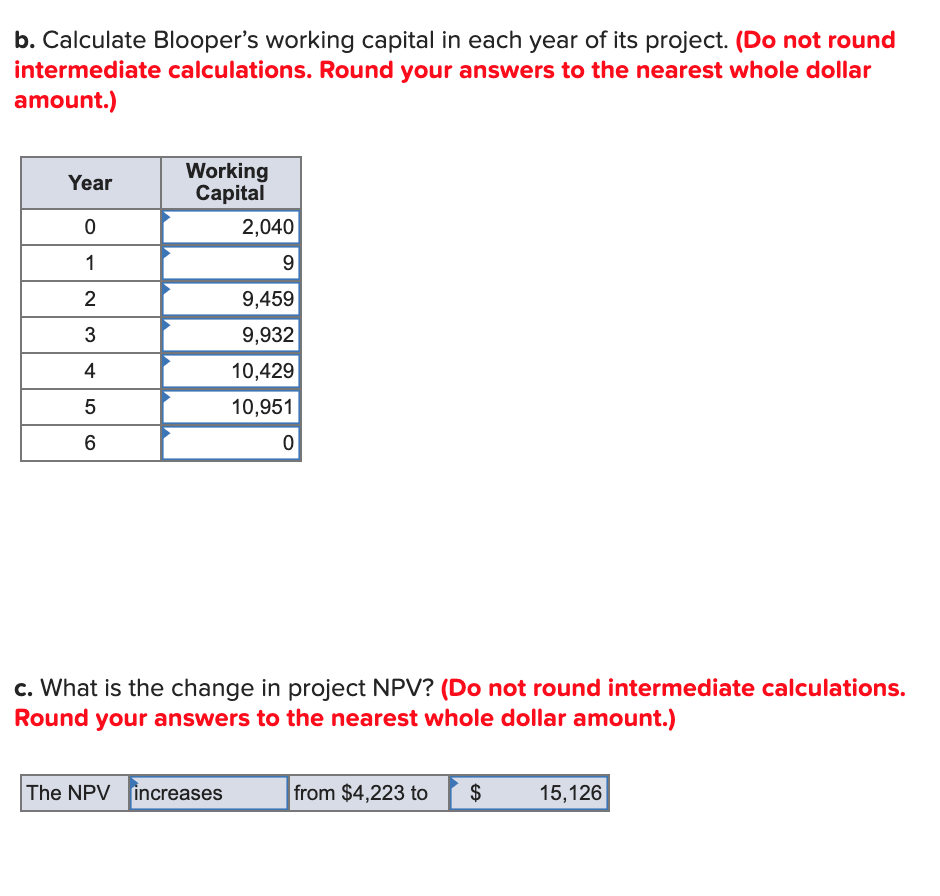

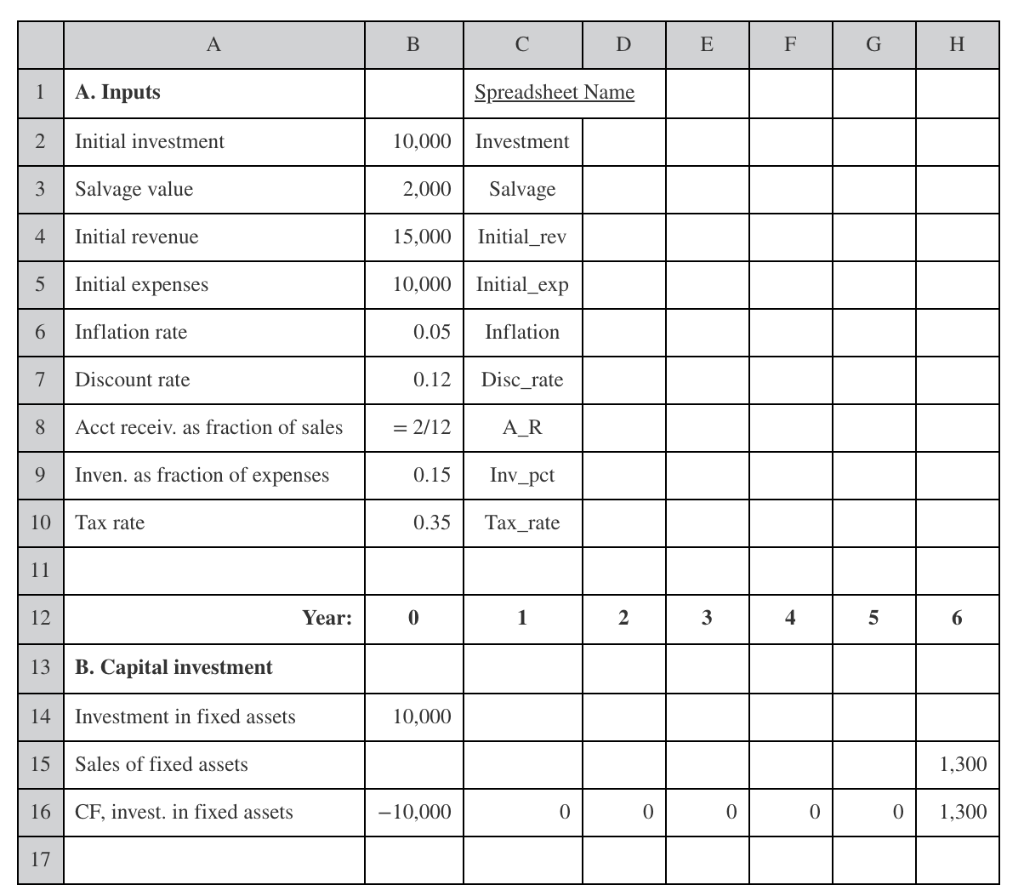

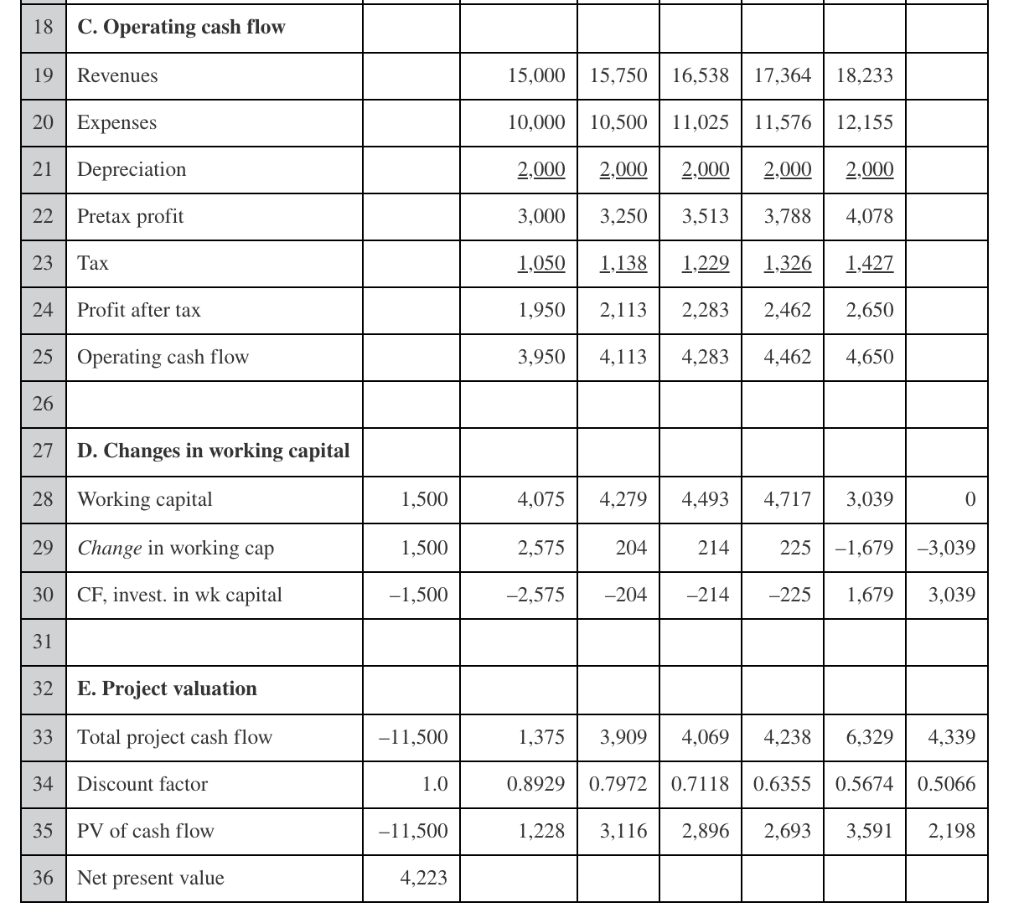

Suppose that Blooper's customers paid their bills with an average 3-month delay (instead of 2 months) and that Blooper's inventories were 20% rather than 15% of next year's expenses. Use the below Blooper spreadsheet. See SPREADSHEET 9.1 in the eBook for the baseline project evaluation and resulting NPV assuming 15% inventory expense SPREADSHEET 9.1 Financial projections for Blooper's Magnoosium mine (dollar values in thousands) Inputs Initial Investment Salvage value Initial revenue Initial expenses Inflation rate Discount rate Acct receiv. as % of sales Inven. as % of expenses Tax rate 12,000 2,400 20,520 10,800 0.05 0.12 1/4 0.2 0.35 Spreadsheet Name Investment Salvage Initial_rev Intial_exp Inflation Disc rate AR Inv_pct Tax_rate a. Would project NPV be higher or lower than that in the Blooper spreadsheet? O higher O lower b. Calculate Blooper's working capital in each year of its project. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Year Working Capital 2,040 9 0 1 2 9,459 9,932 3 4 10,429 5 10,951 6 0 c. What is the change in project NPV? (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) The NPV increases from $4,223 to $ 15, 126 A B D E F H 1 A. Inputs Spreadsheet Name 2 Initial investment 10,000 Investment 3 Salvage value 2,000 Salvage 4 Initial revenue 15,000 Initial_rev Initial expenses 10,000 Initial_exp 6 Inflation rate 0.05 Inflation 7 Discount rate 0.12 Disc_rate 8 Acct receiv. as fraction of sales = 2/12 A_R 9 Inven. as fraction of expenses 0.15 Inv_pct 10 Tax rate 0.35 Tax_rate 11 12 Year: 0 1 2 3 4 5 6 13 B. Capital investment 14 Investment in fixed assets 10,000 15 Sales of fixed assets 1,300 16 CF, invest. in fixed assets - 10,000 0 0 0 0 0 1,300 17 18 C. Operating cash flow 19 Revenues 15,000 15,750 16,538 17,364 18,233 20 Expenses 10,000 10,500 11,025 11,576 12,155 21 Depreciation 2,000 2,000 2,000 2,000 2,000 22 Pretax profit 3,000 3,250 3,513 3,788 4,078 23 Tax 1,050 1,138 1,229 1,326 1,427 24 Profit after tax 1,950 2,113 2,283 2,462 2,650 25 Operating cash flow 3,950 4,113 4,283 4,462 4,650 26 27 D. Changes in working capital 28 Working capital 1,500 4,075 4,279 4,493 4,717 3,039 0 29 Change in working cap 1,500 2,575 204 214 225-1,679 -3,039 30 CF, invest. in wk capital -1,500 -2,575 -204 -214 -225 1,679 3,039 31 32 E. Project valuation 33 Total project cash flow -11,500 1,375 3,909 4,069 4,238 6,329 4,339 34 Discount factor 1.0 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 35 PV of cash flow -11,500 1,228 3,116 2,896 2,693 3,591 2,198 36 Net present value 4,223 Suppose that Blooper's customers paid their bills with an average 3-month delay (instead of 2 months) and that Blooper's inventories were 20% rather than 15% of next year's expenses. Use the below Blooper spreadsheet. See SPREADSHEET 9.1 in the eBook for the baseline project evaluation and resulting NPV assuming 15% inventory expense SPREADSHEET 9.1 Financial projections for Blooper's Magnoosium mine (dollar values in thousands) Inputs Initial Investment Salvage value Initial revenue Initial expenses Inflation rate Discount rate Acct receiv. as % of sales Inven. as % of expenses Tax rate 12,000 2,400 20,520 10,800 0.05 0.12 1/4 0.2 0.35 Spreadsheet Name Investment Salvage Initial_rev Intial_exp Inflation Disc rate AR Inv_pct Tax_rate a. Would project NPV be higher or lower than that in the Blooper spreadsheet? O higher O lower b. Calculate Blooper's working capital in each year of its project. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Year Working Capital 2,040 9 0 1 2 9,459 9,932 3 4 10,429 5 10,951 6 0 c. What is the change in project NPV? (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) The NPV increases from $4,223 to $ 15, 126 A B D E F H 1 A. Inputs Spreadsheet Name 2 Initial investment 10,000 Investment 3 Salvage value 2,000 Salvage 4 Initial revenue 15,000 Initial_rev Initial expenses 10,000 Initial_exp 6 Inflation rate 0.05 Inflation 7 Discount rate 0.12 Disc_rate 8 Acct receiv. as fraction of sales = 2/12 A_R 9 Inven. as fraction of expenses 0.15 Inv_pct 10 Tax rate 0.35 Tax_rate 11 12 Year: 0 1 2 3 4 5 6 13 B. Capital investment 14 Investment in fixed assets 10,000 15 Sales of fixed assets 1,300 16 CF, invest. in fixed assets - 10,000 0 0 0 0 0 1,300 17 18 C. Operating cash flow 19 Revenues 15,000 15,750 16,538 17,364 18,233 20 Expenses 10,000 10,500 11,025 11,576 12,155 21 Depreciation 2,000 2,000 2,000 2,000 2,000 22 Pretax profit 3,000 3,250 3,513 3,788 4,078 23 Tax 1,050 1,138 1,229 1,326 1,427 24 Profit after tax 1,950 2,113 2,283 2,462 2,650 25 Operating cash flow 3,950 4,113 4,283 4,462 4,650 26 27 D. Changes in working capital 28 Working capital 1,500 4,075 4,279 4,493 4,717 3,039 0 29 Change in working cap 1,500 2,575 204 214 225-1,679 -3,039 30 CF, invest. in wk capital -1,500 -2,575 -204 -214 -225 1,679 3,039 31 32 E. Project valuation 33 Total project cash flow -11,500 1,375 3,909 4,069 4,238 6,329 4,339 34 Discount factor 1.0 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 35 PV of cash flow -11,500 1,228 3,116 2,896 2,693 3,591 2,198 36 Net present value 4,223