Question

Suppose that Caroline is a single parent who would like to save some money for her daughters college education. Her daughter is currently 10 years

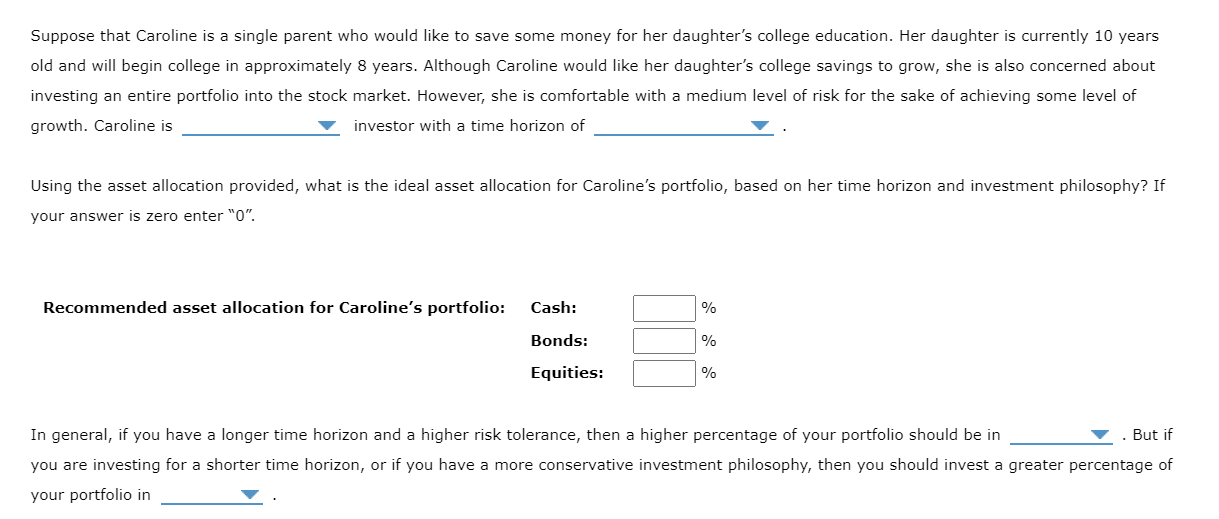

Suppose that Caroline is a single parent who would like to save some money for her daughters college education. Her daughter is currently 10 years old and will begin college in approximately 8 years. Although Caroline would like her daughters college savings to grow, she is also concerned about investing an entire portfolio into the stock market. However, she is comfortable with a medium level of risk for the sake of achieving some level of growth. Caroline is an aggressive, a moderate, a conservative investor with a time horizon of 6 to 10 years, 11 or more years, 0 to 5 years.

Suppose that Caroline is a single parent who would like to save some money for her daughters college education. Her daughter is currently 10 years old and will begin college in approximately 8 years. Although Caroline would like her daughters college savings to grow, she is also concerned about investing an entire portfolio into the stock market. However, she is comfortable with a medium level of risk for the sake of achieving some level of growth. Caroline is an aggressive, a moderate, a conservative investor with a time horizon of 6 to 10 years, 11 or more years, 0 to 5 years.

In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in equities or bonds But if you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in equities or bonds.

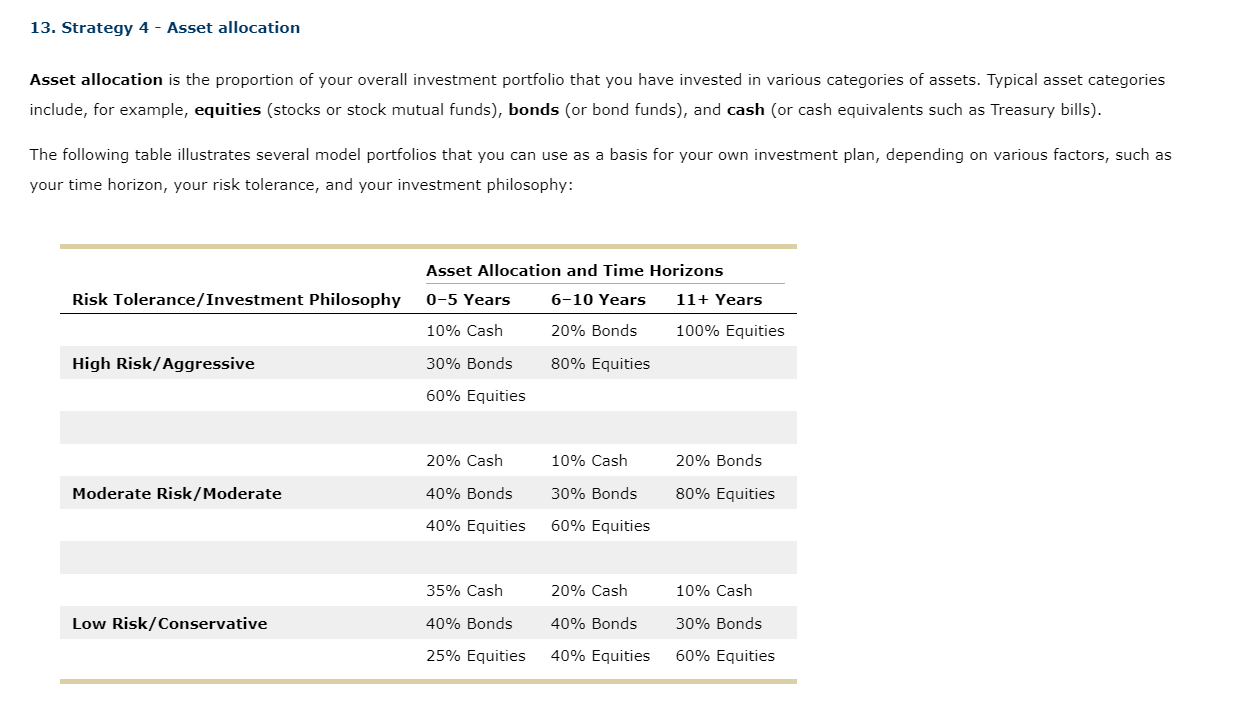

13. Strategy 4 - Asset allocation Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets. Typical asset categories include, for example, equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or cash equivalents such as Treasury bills). The following table illustrates several model portfolios that you can use as a basis for your own investment plan, depending on various factors, such as your time horizon, your risk tolerance, and your investment philosophy: Suppose that Caroline is a single parent who would like to save some money for her daughter's college education. Her daughter is currently 10 years old and will begin college in approximately 8 years. Although Caroline would like her daughter's college savings to grow, she is also concerned about investing an entire portfolio into the stock market. However, she is comfortable with a medium level of risk for the sake of achieving some level of growth. Caroline is investor with a time horizon of Using the asset allocation provided, what is the ideal asset allocation for Caroline's portfolio, based on her time horizon and investment philosophy? If your answer is zero enter " 0 ". In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in . But if you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in 13. Strategy 4 - Asset allocation Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets. Typical asset categories include, for example, equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or cash equivalents such as Treasury bills). The following table illustrates several model portfolios that you can use as a basis for your own investment plan, depending on various factors, such as your time horizon, your risk tolerance, and your investment philosophy: Suppose that Caroline is a single parent who would like to save some money for her daughter's college education. Her daughter is currently 10 years old and will begin college in approximately 8 years. Although Caroline would like her daughter's college savings to grow, she is also concerned about investing an entire portfolio into the stock market. However, she is comfortable with a medium level of risk for the sake of achieving some level of growth. Caroline is investor with a time horizon of Using the asset allocation provided, what is the ideal asset allocation for Caroline's portfolio, based on her time horizon and investment philosophy? If your answer is zero enter " 0 ". In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in . But if you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started