Answered step by step

Verified Expert Solution

Question

1 Approved Answer

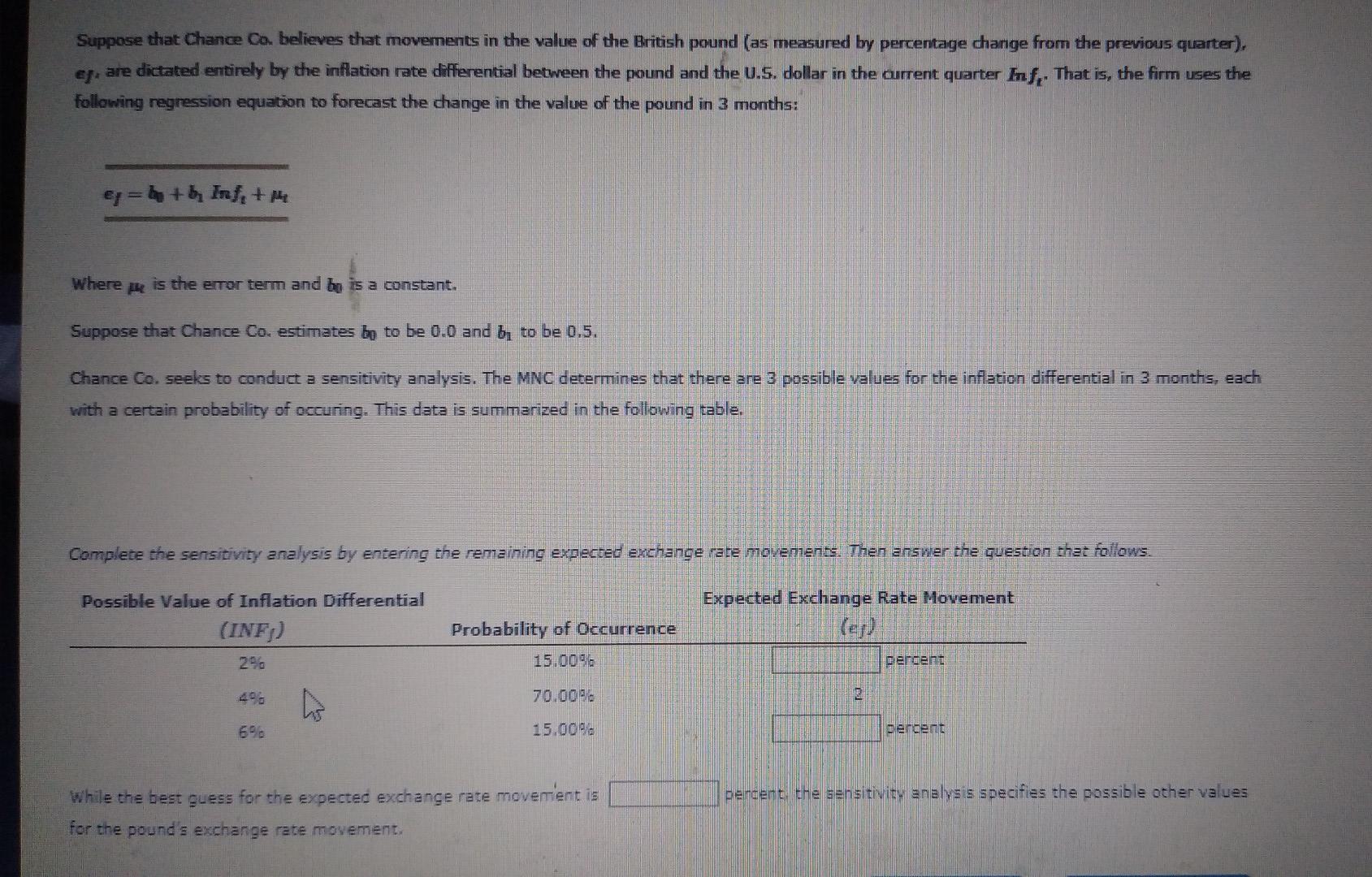

Suppose that Chance Co believes that movements in the value of the British pound (as measured by percentage change from the previous quarter). es are

Suppose that Chance Co believes that movements in the value of the British pound (as measured by percentage change from the previous quarter). es are dictated entirely by the inflation rate differential between the pound and the U.S. dollar in the current quarter Inf. That is, the firm uses the following regression equation to forecast the change in the value of the pound in 3 months: ey=+b, Inf, + Mix Where is the error term and bo is a constant. Suppose that Chance Co. estimates bo to be 0.0 and b to be 0.5. Chance Co. seeks to conduct a sensitivity analysis. The MNC determines that there are 3 possible values for the inflation differential in 3 months, each with a certain probability of occuring. This data is summarized in the following table. Complete the sensitivity analysis by entering the remaining expected exchange rate movements. Then answer the question that follows. Expected Exchange Rate Movement Possible Value of Inflation Differential (INF) Probability of Occurrence 15.0096 perdens 496 70.000 15.000 berpent pendent the sensitivity analysis specifies the possible other values While the best guess for the expected exchange rate movement is for the pound's exchange rate movement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started