Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Company X knows that in six months it has to sell 20,000 ounces of silver in order to fulfill an order. The

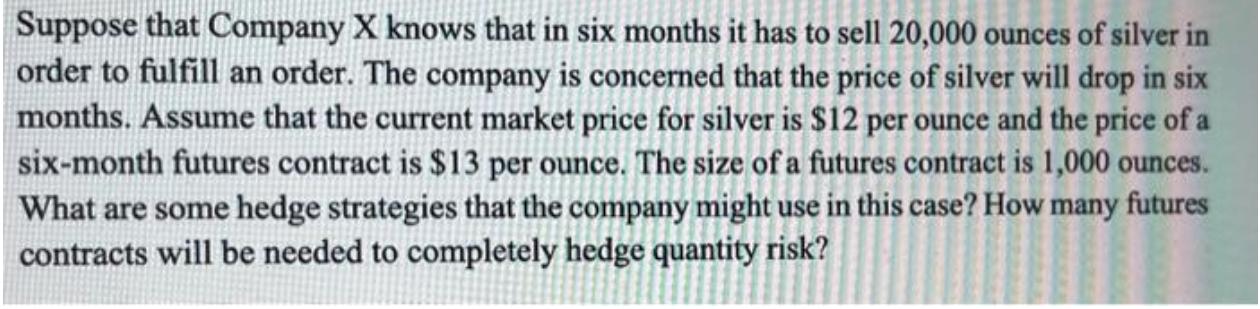

Suppose that Company X knows that in six months it has to sell 20,000 ounces of silver in order to fulfill an order. The company is concerned that the price of silver will drop in six months. Assume that the current market price for silver is $12 per ounce and the price of a six-month futures contract is $13 per ounce. The size of a futures contract is 1,000 ounces. What are some hedge strategies that the company might use in this case? How many futures contracts will be needed to completely hedge quantity risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Hedging Strategies for Company X Company X is concerned about a potential drop in silver prices and needs to fulfill a future order Here are some hedg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started