Question

Suppose that Dave expects to work for 40 years. in his first 20 years he expects to earn $600,000, while in his second 20 years

Suppose that Dave expects to work for 40 years. in his first 20 years he expects to earn $600,000, while in his second 20 years he expects to earn $900,000. suppose that the interest rate earned on saving is 50% and the interest rate paid on loans is 50%.

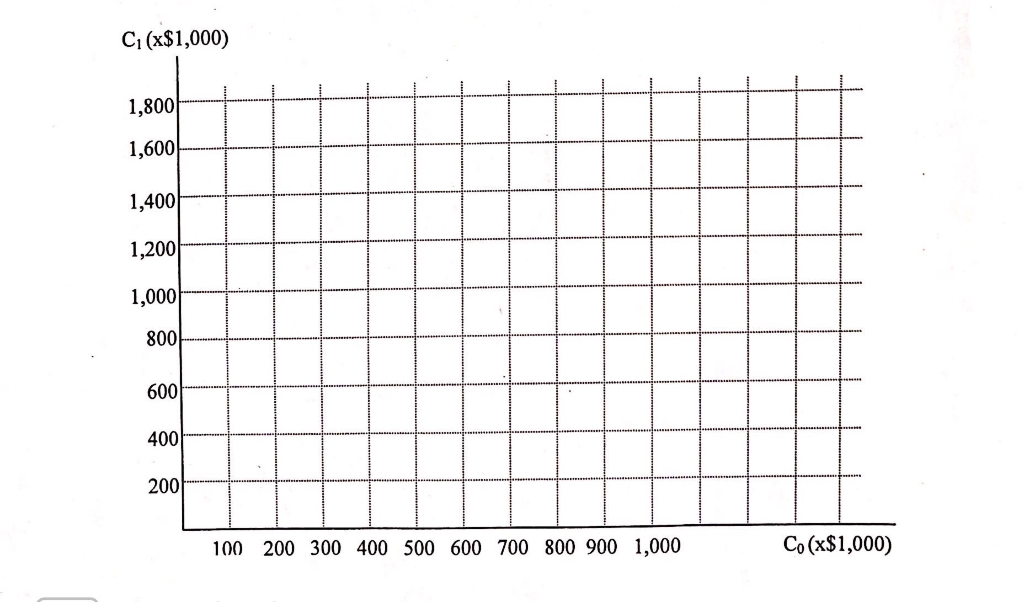

a. Show dave's income when young and old (M0, M1) on the diagram below.

b. Draw dave's budget line on the diagram below. Assume that he can save and borrow at i=50%.

c. Draw an indifference curve consistent with dave taking out 100,000 mortgage loan when he is under 40 years old. Identify his consumption choice as C0* and C1* on the diagram below.

d. Show how a comprehensive flat personal income tax at t=33.3% alters Dave's budget line if Mortgage interest is not deductible from taxable income.

e. Show how a comprehensive flat personal income tax at t=33.3% alters Dave's budget line if mortgage interest is deductible from taxable income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started