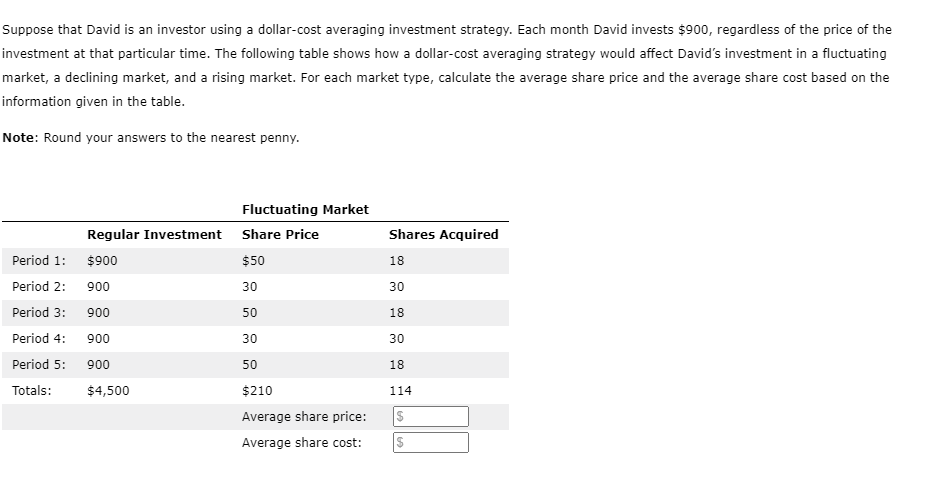

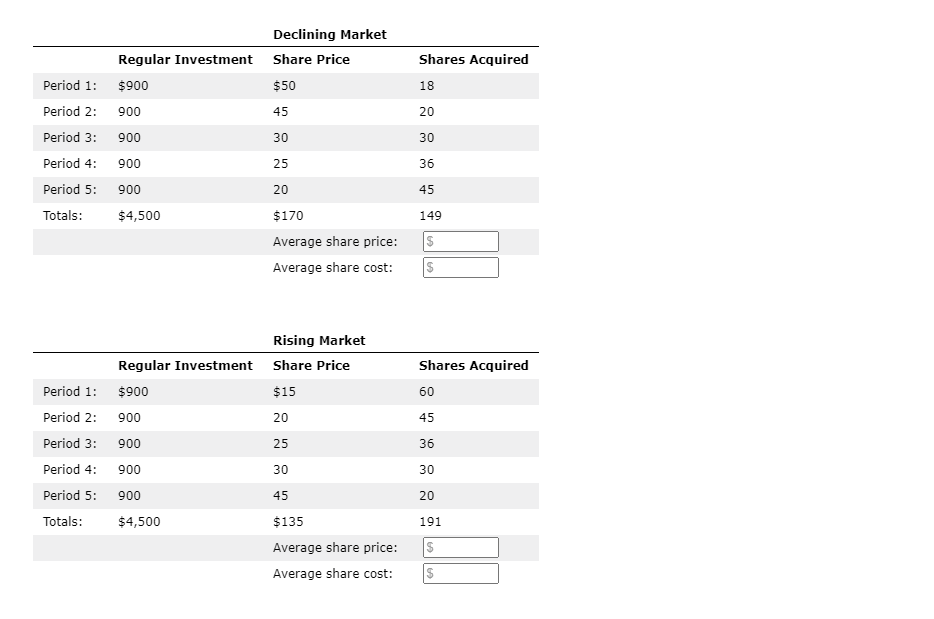

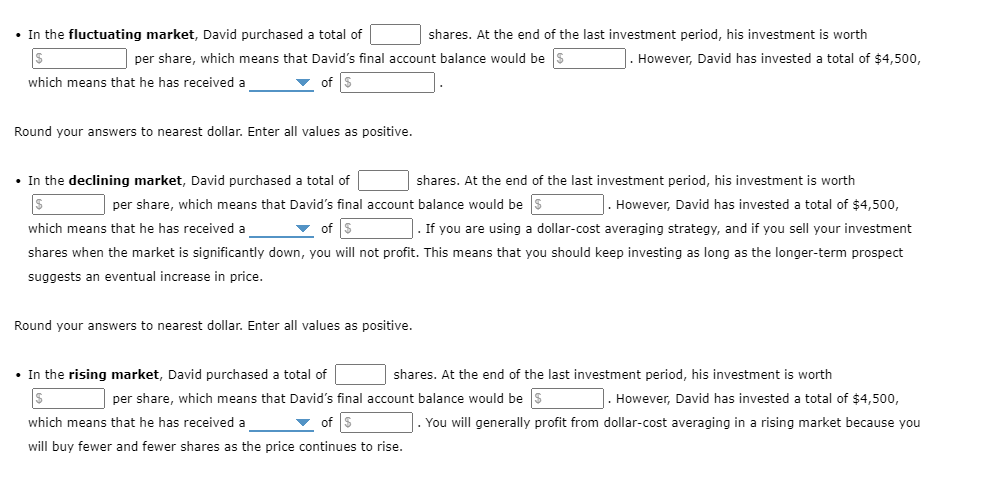

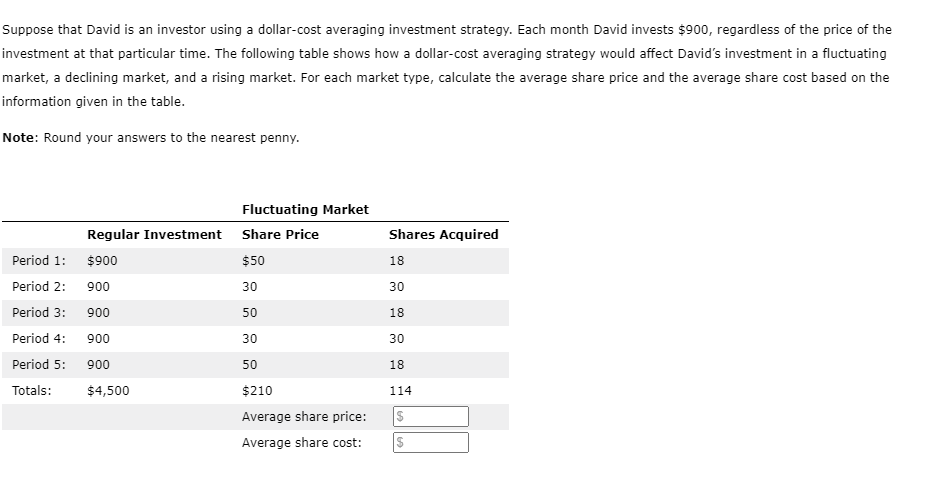

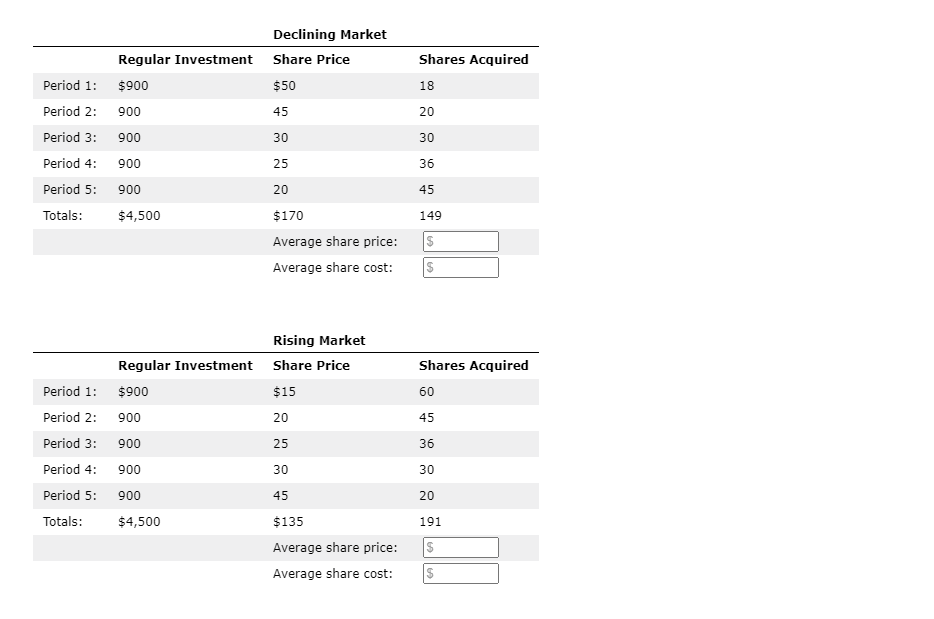

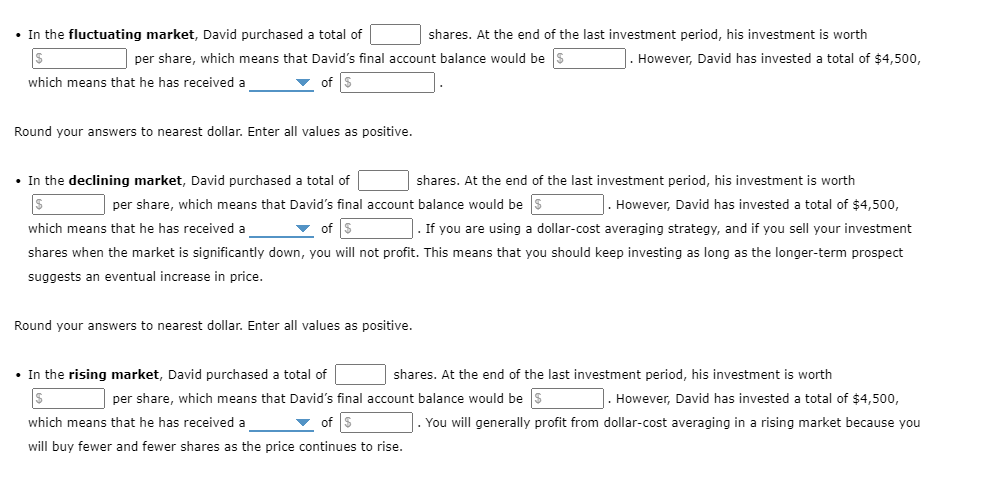

Suppose that David is an investor using a dollar-cost averaging investment strategy. Each month David invests $900, regardless of the price of the investment at that particular time. The following table shows how a dollar-cost averaging strategy would affect David's investment in a fluctuating market, a declining market, and a rising market. For each market type, calculate the average share price and the average share cost based on the information given in the table. Note: Round your answers to the nearest penny. Shares Acquired 18 30 18 Fluctuating Market Regular Investment Share Price Period 1: $900 $50 Period 2: 900 30 Period 3: 900 50 Period 4: 900 30 Period 5: 900 50 Totals: $4,500 $210 Average share price: Average share cost: 30 18 114 $ Shares Acquired 18 20 30 Declining Market Regular Investment Share Price Period 1: $900 $50 Period 2: 900 45 Period 3: 900 30 Period 4: 900 25 Period 5: 900 20 Totals: $4,500 $170 Average share price: Average share cost: 36 45 149 $ $ Shares Acquired 60 45 36 Rising Market Regular Investment Share Price Period 1: $900 $15 Period 2: 900 20 Period 3: 900 25 Period 4: 900 30 Period 5: 900 45 Totals: $4,500 $135 Average share price: Average share cost: 30 20 191 $ $ In the fluctuating market, David purchased a total of shares. At the end of the last investment period, his investment is worth S per share, which means that David's final account balance would be $ However, David has invested a total of $4,500, which means that he has received a of $ Round your answers to nearest dollar. Enter all values as positive. In the declining market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of S If you are using a dollar-cost averaging strategy, and if you sell your investment shares when the market is significantly down, you will not profit. This means that you should keep investing as long as the longer-term prospect suggests an eventual increase in price. Round your answers to nearest dollar. Enter all values as positive. In the rising market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of $ . You will generally profit from dollar-cost averaging in a rising market because you will buy fewer and fewer shares as the price continues to rise