Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that discount bond prices are as follows: a. A customer of your bank wants a forward contract to borrow $20M in three years from

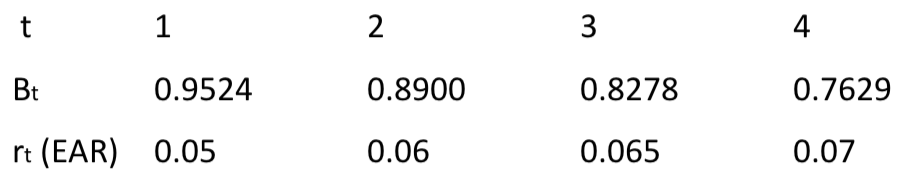

Suppose that discount bond prices are as follows:

a. A customer of your bank wants a forward contract to borrow $20M in three years from now for one year. What would be your quote to the customer?

b. How would you confirm the rate?

c. If customer accepts your offer, how would you lock-in the cash flows. Is there an arbitrage opportunity available? Show the entire cashflows chart.

t 1 2 3 4 Bt 0.9524 0.8900 0.8278 0.7629 rt (EAR) 0.05 0.06 0.065 0.07Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started