Question

Suppose that during the most recent 10 year period, the average annual total rate of return on the aggregate market portfolio, namely the All

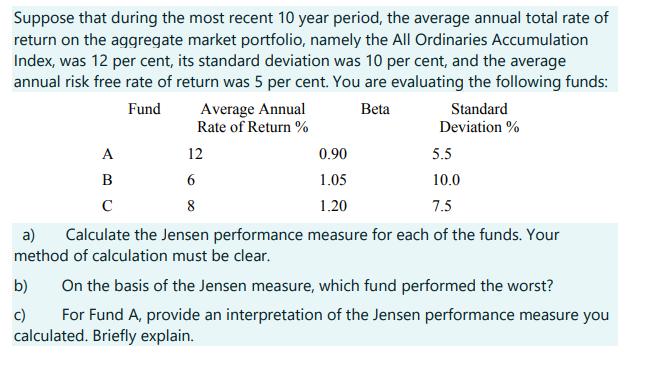

Suppose that during the most recent 10 year period, the average annual total rate of return on the aggregate market portfolio, namely the All Ordinaries Accumulation Index, was 12 per cent, its standard deviation was 10 per cent, and the average annual risk free rate of return was 5 per cent. You are evaluating the following funds: Fund Beta A B Average Annual Rate of Return% b) c) 12 6 8 0.90 1.05 1.20 Standard Deviation % 5.5 10.0 7.5 a) Calculate the Jensen performance measure for each of the funds. Your method of calculation must be clear. On the basis of the Jensen measure, which fund performed the worst? For Fund A, provide an interpretation of the Jensen performance measure you calculated. Briefly explain.

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Discrete Mathematics and Its Applications

Authors: Kenneth H. Rosen

7th edition

0073383090, 978-0073383095

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App