Suppose that immediately after the bonds were issued, $290 mm of principal was received on the mortgages. What would be the balance of the bonds? Show balances for each class of bonds issued in the transaction. What is the effect of prepayments on credit risk?

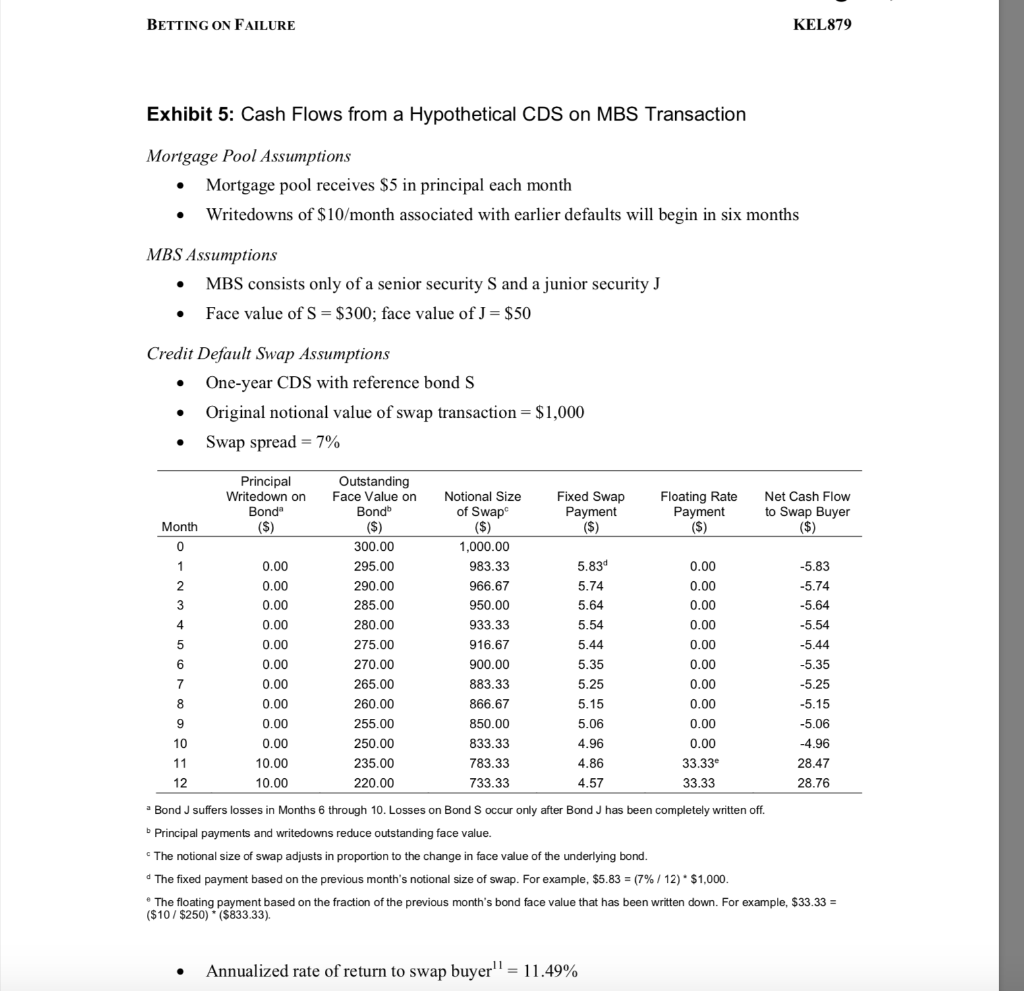

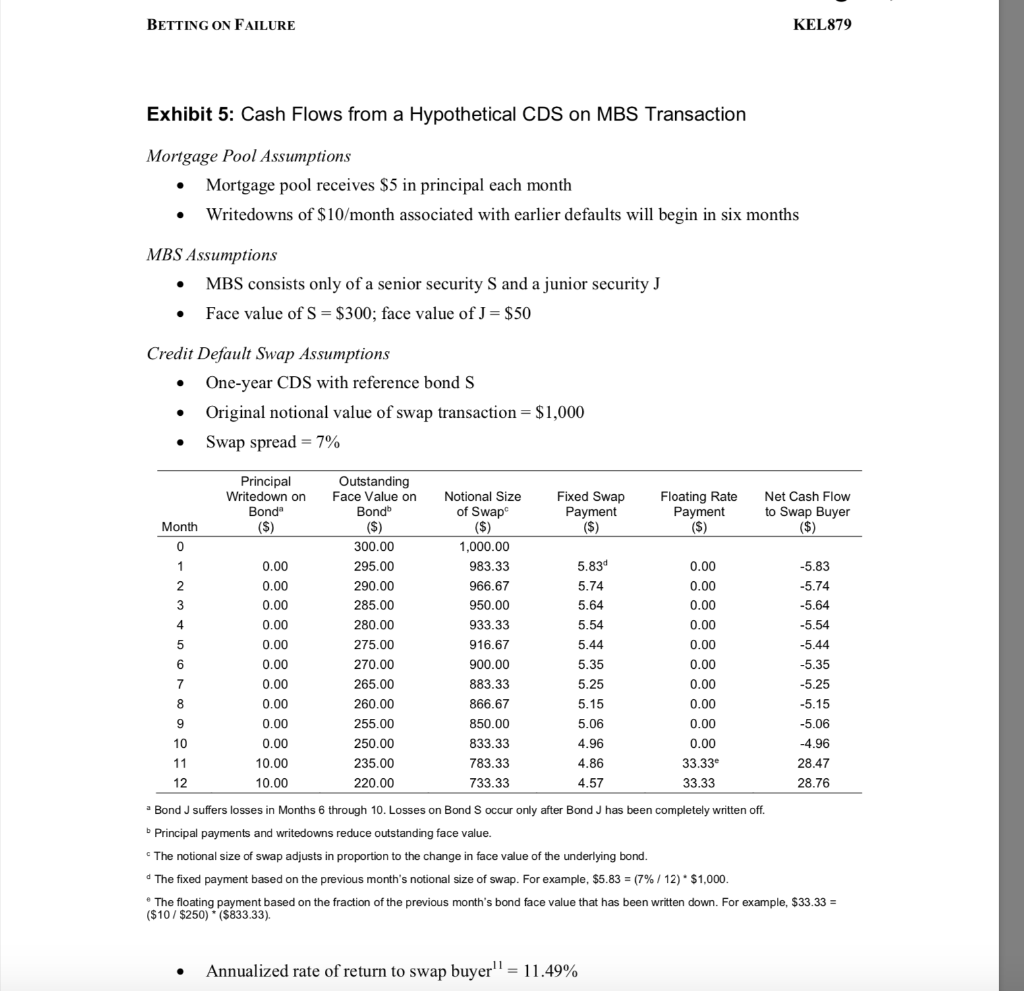

BETTING ON FAILURE KEL879 Exhibit 5: Cash Flows from a Hypothetical CDS on MBS Transaction Mortgage Pool Assumptions Mortgage pool receives $5 in principal each month Writedowns of $10/month associated with earlier defaults will begin in six months MBS Assumptions MBS consists only of a senior security S and a junior security J Face value of S = $300; face value of J = $50 . Credit Default Swap Assumptions One-year CDS with reference bond S Original notional value of swap transaction = $1,000 Swap spread = 7% . . Principal Writedown on Bond" ($) ) Fixed Swap Payment ($) Floating Rate Payment ) ($) Net Cash Flow to Swap Buyer ($) Month 0 1 2 3 -5.83 -5.74 -5.64 -5.54 4 Outstanding Face Value on Bondo ($) S 300.00 295.00 290.00 285.00 280.00 275.00 270.00 265.00 260.00 255.00 250.00 235.00 220.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10.00 10.00 5 6 7 8 9 10 11 12 Notional Size of Swap ($) 1,000.00 983.33 966.67 950.00 933.33 916.67 900.00 883.33 866.67 850.00 833.33 783.33 733.33 5.834 5.74 5.64 5.54 5.44 5.35 5.25 5.15 5.06 4.96 4.86 4.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 33.33 33.33 -5.44 -5.35 -5.25 -5.15 -5.06 -4.96 28.47 28.76 Bond J suffers losses in Months 6 through 10. Losses on Bond S occur only after Bond J has been completely written off. Principal payments and writedowns reduce outstanding face value. The notional size of swap adjusts in proportion to the change in face value of the underlying bond. The fixed payment based on the previous month's notional size of swap. For example, $5.83 = (7%/12) * $1,000. The floating payment based on the fraction of the previous month's bond face value that has been written down. For example, $33.33 = ($10 / $250) * ($833.33). $$ . Annualized rate of return to swap buyer" = 11.49% BETTING ON FAILURE KEL879 Exhibit 5: Cash Flows from a Hypothetical CDS on MBS Transaction Mortgage Pool Assumptions Mortgage pool receives $5 in principal each month Writedowns of $10/month associated with earlier defaults will begin in six months MBS Assumptions MBS consists only of a senior security S and a junior security J Face value of S = $300; face value of J = $50 . Credit Default Swap Assumptions One-year CDS with reference bond S Original notional value of swap transaction = $1,000 Swap spread = 7% . . Principal Writedown on Bond" ($) ) Fixed Swap Payment ($) Floating Rate Payment ) ($) Net Cash Flow to Swap Buyer ($) Month 0 1 2 3 -5.83 -5.74 -5.64 -5.54 4 Outstanding Face Value on Bondo ($) S 300.00 295.00 290.00 285.00 280.00 275.00 270.00 265.00 260.00 255.00 250.00 235.00 220.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10.00 10.00 5 6 7 8 9 10 11 12 Notional Size of Swap ($) 1,000.00 983.33 966.67 950.00 933.33 916.67 900.00 883.33 866.67 850.00 833.33 783.33 733.33 5.834 5.74 5.64 5.54 5.44 5.35 5.25 5.15 5.06 4.96 4.86 4.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 33.33 33.33 -5.44 -5.35 -5.25 -5.15 -5.06 -4.96 28.47 28.76 Bond J suffers losses in Months 6 through 10. Losses on Bond S occur only after Bond J has been completely written off. Principal payments and writedowns reduce outstanding face value. The notional size of swap adjusts in proportion to the change in face value of the underlying bond. The fixed payment based on the previous month's notional size of swap. For example, $5.83 = (7%/12) * $1,000. The floating payment based on the fraction of the previous month's bond face value that has been written down. For example, $33.33 = ($10 / $250) * ($833.33). $$ . Annualized rate of return to swap buyer" = 11.49%