Question

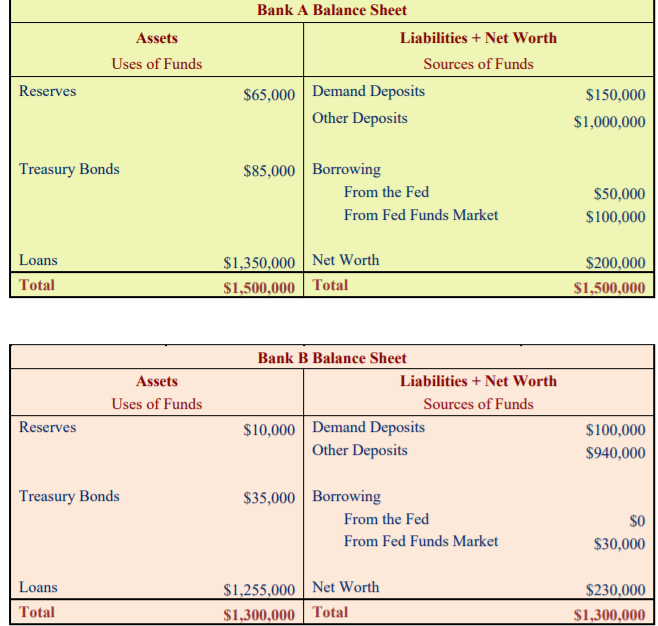

Suppose that in a country, there are only two banks, Bank A and Bank B. The file HW4 Bank Balance Sheets shows their balance sheets.

Suppose that in a country, there are only two banks, Bank A and Bank B. The file HW4 Bank Balance Sheets shows their balance sheets. Here are some simplifying assumptions to make our lives a bit more bearable:

- The country uses dollars as its unit of accounts.

- There are no travelers' checks.

- There are no fancy accounts in this country like money market mutual funds deposits.

- Other deposits consist of saving deposits by households as well small denomination (less than $100,000) time deposits.

- The amount of currency held by the non-bank public is $25,000.

- All the reserves are held at the central bank. They also call their central bank "the Fed".

- The required reserve ratio is 10 percent.

We concluded that excess reserves held by Bank A = 50000 and by B = 0.

Also, M1=275000 and M2=2215000.

1. If Bank A lends $50,000 to Anna through crediting her checking account (same as demand deposit) by $50,000. After this loan is made and before Anna spends it, what are M1 and M2 money supply equals to?

2. If Anna uses that $50,000 to buy herself a nice little piece of land in the countryside. Anna pays for this land by writing a check on her checking account at Bank A and giving it to the seller of the land. The seller deposits the check-in his savings account at Bank B. After this transaction, the M1 and M2 money supply equal to?

3. After Anna pays for the land and after the inter-bank transactions are completed, what are the amount of Bank A and B reserves at the Fed equal to?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started