Answered step by step

Verified Expert Solution

Question

1 Approved Answer

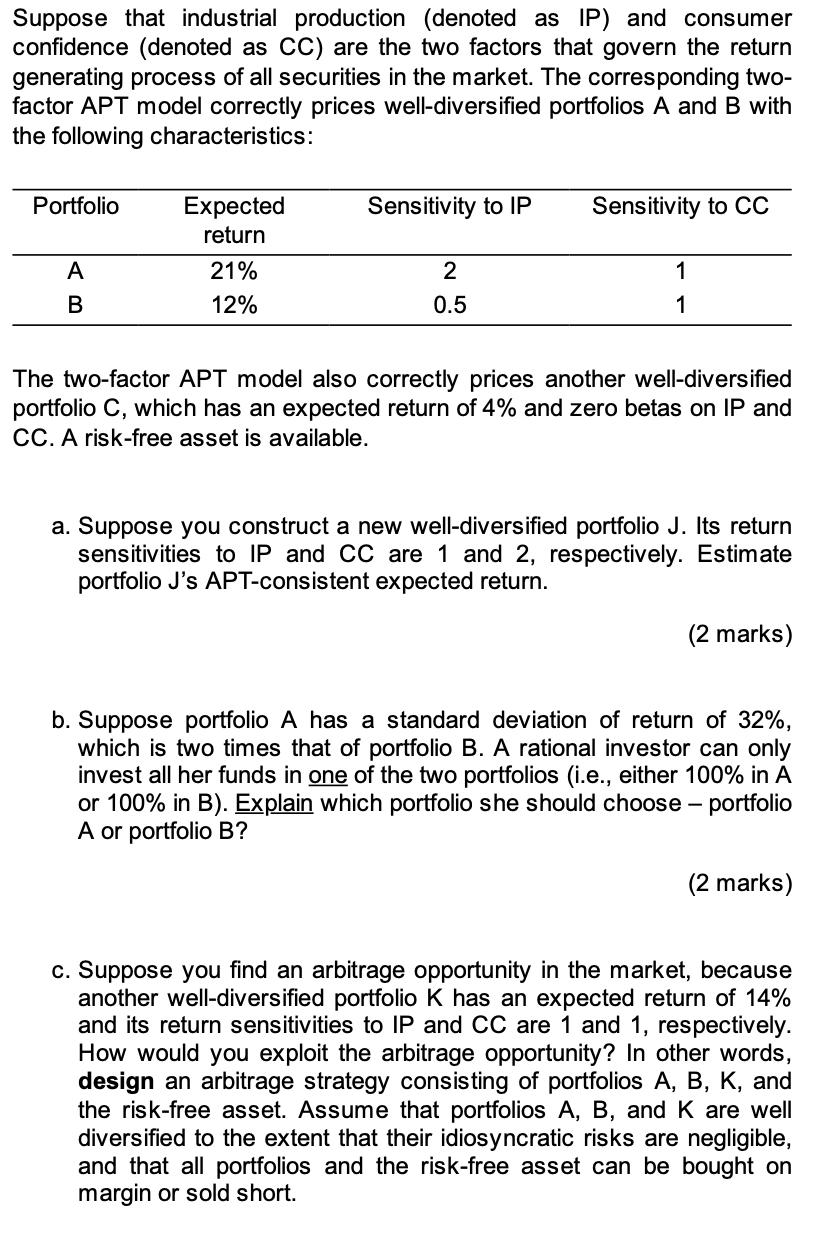

Suppose that industrial production (denoted as IP) and consumer confidence (denoted as CC) are the two factors that govern the return generating process of

Suppose that industrial production (denoted as IP) and consumer confidence (denoted as CC) are the two factors that govern the return generating process of all securities in the market. The corresponding two- factor APT model correctly prices well-diversified portfolios A and B with the following characteristics: Portfolio Expected Sensitivity to IP Sensitivity to CC return A 21% 2 1 B 12% 0.5 1 The two-factor APT model also correctly prices another well-diversified portfolio C, which has an expected return of 4% and zero betas on IP and CC. A risk-free asset is available. a. Suppose you construct a new well-diversified portfolio J. Its return sensitivities to IP and CC are 1 and 2, respectively. Estimate portfolio J's APT-consistent expected return. (2 marks) b. Suppose portfolio A has a standard deviation of return of 32%, which is two times that of portfolio B. A rational investor can only invest all her funds in one of the two portfolios (i.e., either 100% in A or 100% in B). Explain which portfolio she should choose - portfolio A or portfolio B? (2 marks) c. Suppose you find an arbitrage opportunity in the market, because another well-diversified portfolio K has an expected return of 14% and its return sensitivities to IP and CC are 1 and 1, respectively. How would you exploit the arbitrage opportunity? In other words, design an arbitrage strategy consisting of portfolios A, B, K, and the risk-free asset. Assume that portfolios A, B, and K are well diversified to the extent that their idiosyncratic risks are negligible, and that all portfolios and the risk-free asset can be bought on margin or sold short.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started