Answered step by step

Verified Expert Solution

Question

1 Approved Answer

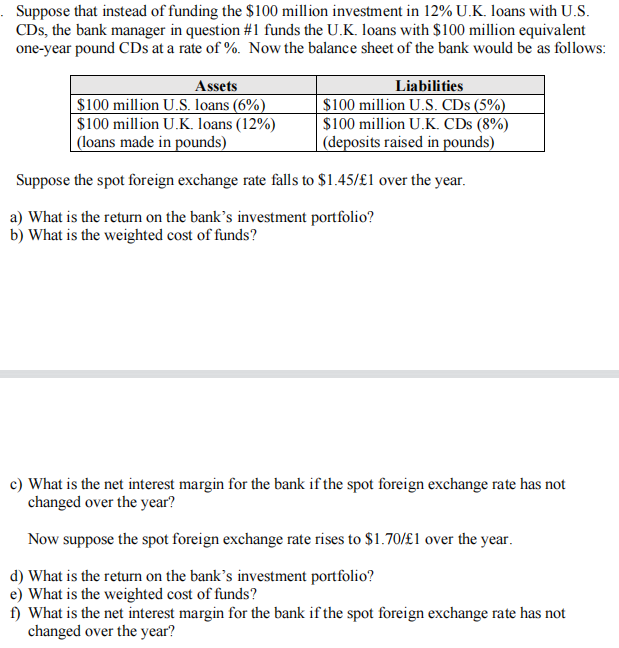

Suppose that instead of funding the $100 million investment in 12% U.K. loans with U.S. CDs, the bank manager in question #1 funds the U.K.

Suppose that instead of funding the $100 million investment in 12% U.K. loans with U.S. CDs, the bank manager in question \#1 funds the U.K. loans with $100 million equivalent one-year pound CDs at a rate of %. Now the balance sheet of the bank would be as follows: } Suppose the spot foreign exchange rate falls to $1.45/1 over the year. a) What is the return on the bank's investment portfolio? b) What is the weighted cost of funds? c) What is the net interest margin for the bank if the spot foreign exchange rate has not changed over the year? Now suppose the spot foreign exchange rate rises to $1.70/1 over the year. d) What is the return on the bank's investment portfolio? e) What is the weighted cost of funds? f) What is the net interest margin for the bank if the spot foreign exchange rate has not changed over the year

Suppose that instead of funding the $100 million investment in 12% U.K. loans with U.S. CDs, the bank manager in question \#1 funds the U.K. loans with $100 million equivalent one-year pound CDs at a rate of %. Now the balance sheet of the bank would be as follows: } Suppose the spot foreign exchange rate falls to $1.45/1 over the year. a) What is the return on the bank's investment portfolio? b) What is the weighted cost of funds? c) What is the net interest margin for the bank if the spot foreign exchange rate has not changed over the year? Now suppose the spot foreign exchange rate rises to $1.70/1 over the year. d) What is the return on the bank's investment portfolio? e) What is the weighted cost of funds? f) What is the net interest margin for the bank if the spot foreign exchange rate has not changed over the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started