Question

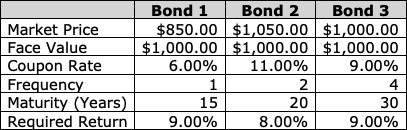

Suppose that investors are considering bond investments using the following bonds: 1) Using the PV function, calculate the price you would be willing to pay

Suppose that investors are considering bond investments using the following bonds:

1) Using the PV function, calculate the price you would be willing to pay for each of these bonds and assess the mispricing of the bonds (undervalued/fairly valued/overvalued).

2) Calculate the yield to maturity on these bonds using the RATE function. Assume that investors purchase these bonds at the given prices shown in the table.

3) Based on 1) and 2), calculate the current yield of each bond.

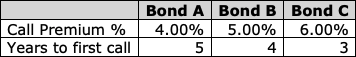

4) Suppose that the above bonds are callable, and the first call dates and premia are as follows:

Calculate the yield to call for each bond.

Market Price Face Value Coupon Rate Frequency Maturity (Years) Required Return Bond 1 Bond 2 Bond 3 $850.00 $1,050.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 6.00% 11.00% 9.00% 1 2 4 15 20 30 9.00% 8.00% 9.00% Call Premium % Years to first call Bond A Bond B Bond C 4.00% 5.00% 6.00% 5 4 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started