Question

Suppose that Mr. Amirul, a 26-year old investor from Jeddah, Saudi Arabia, would like to make a long-term investment in Malaysia. He has approached you,

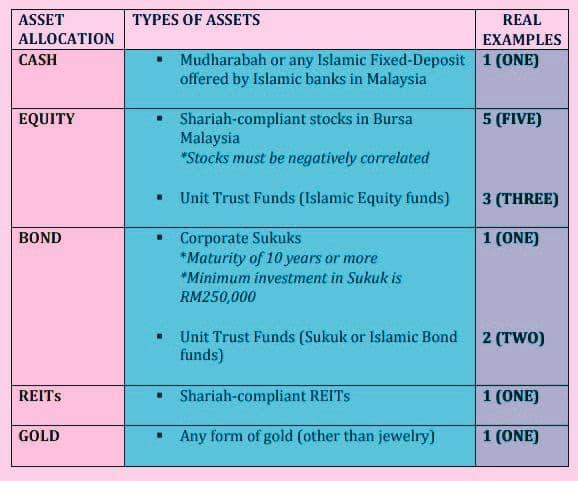

Suppose that Mr. Amirul, a 26-year old investor from Jeddah, Saudi Arabia, would like to make a long-term investment in Malaysia. He has approached you, a licensed investment consultant, to advise him on a Shariah-compliant portfolio of RM10 million. Mr. Amirul is married and he has a 4-year old daughter and a 1-year old son. He is willing to take high risks in anticipation of high returns. His investment horizon is 15 years.

a.) Provide the EXAMPLES OF REAL ASSETS OR SECURITIES for each type of investment and provide JUSTIFICATION of why you choose each asset or instrument.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started