Question

Suppose that Mr. Dubinski has obtained from Blaine's banker the quotes below for default spreads over 10-year Treasury bonds (note that these differ from the

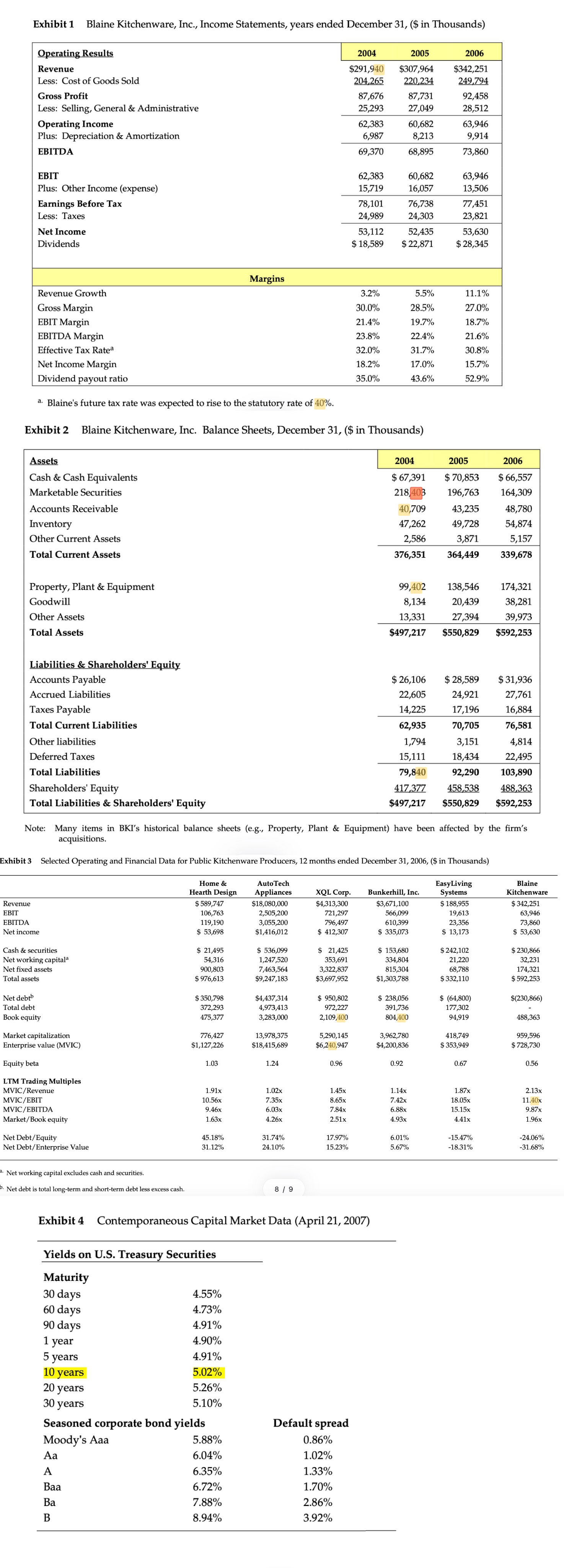

Suppose that Mr. Dubinski has obtained from Blaine's banker the quotes below for default spreads over 10-year Treasury bonds (note that these differ from the more general corporate bonds yields in case Exhibit 4) What do these quotes imply about BKI's cost of debt at the various debt levels and credit ratings? You can construct a debt waterfall for BKI and each different cost of debt from the different rated credit instruments.

Compute your own assessment of BKI's weighted average cost of capital at each of the indicated debt levels. What do your calculations imply about Blaine's optimal capital structure? (the case gives you Blaines equity Betas YOY, and the cost of debt. The Exhibit on page 3 of the Case can give you a partial basis for estimating required return of the market)

Based on these calculations, how many shares should Blaine purchase and at what price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started