Answered step by step

Verified Expert Solution

Question

1 Approved Answer

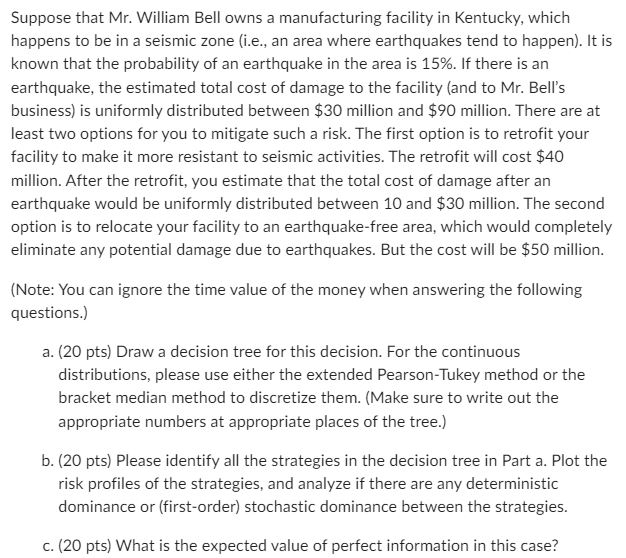

Suppose that Mr . William Bell owns a manufacturing facility in Kentucky, which happens to be in a seismic zone ( i . e .

Suppose that Mr William Bell owns a manufacturing facility in Kentucky, which

happens to be in a seismic zone ie an area where earthquakes tend to happen It is

known that the probability of an earthquake in the area is If there is an

earthquake, the estimated total cost of damage to the facility and to Mr Bell's

business is uniformly distributed between $ million and $ million. There are at

least two options for you to mitigate such a risk. The first option is to retrofit your

facility to make it more resistant to seismic activities. The retrofit will cost $

million. After the retrofit, you estimate that the total cost of damage after an

earthquake would be uniformly distributed between and $ million. The second

option is to relocate your facility to an earthquakefree area, which would completely

eliminate any potential damage due to earthquakes. But the cost will be $ million.

Note: You can ignore the time value of the money when answering the following

questions.

a pts Draw a decision tree for this decision. For the continuous

distributions, please use either the extended PearsonTukey method or the

bracket median method to discretize them. Make sure to write out the

appropriate numbers at appropriate places of the tree.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started