Answered step by step

Verified Expert Solution

Question

1 Approved Answer

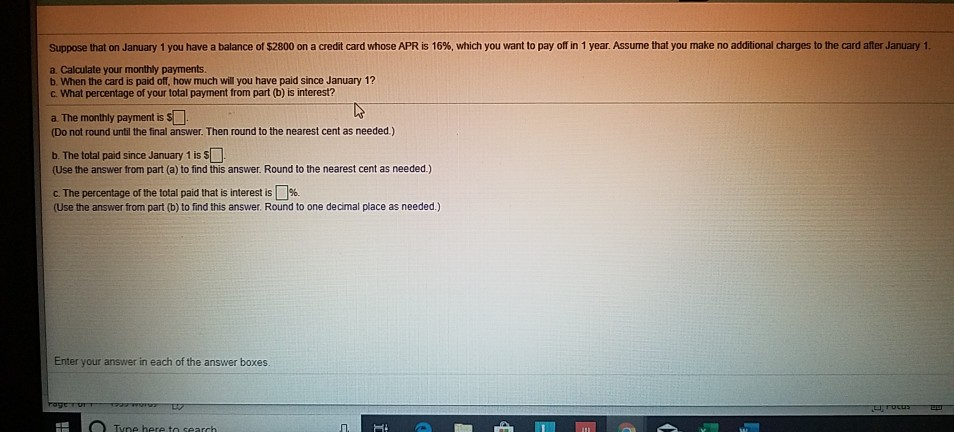

Suppose that on January 1 you have a balance of $2800 on a credit card whose APR is 16%, which you want to pay off

Suppose that on January 1 you have a balance of $2800 on a credit card whose APR is 16%, which you want to pay off in 1 year. Assume that you make no additional charges to the card after January 1 a Calculate your monthly payments. b. When the card is paid off, how much will you have paid since January 1? c. What percentage of your total payment from part(b) is interest? a. The monthly payment is (Do not round until the final answer. Then round to the nearest cent as needed.) b. The total paid since January 1 is (Use the answer from part (a) to find this answer. Round to the nearest cent as needed.) c. The percentage of the total paid that is interest is %. (Use the answer from part (b) to find this answer. Round to one decimal place as needed.) Enter your answer in each of the answer boxes Tune here to cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started