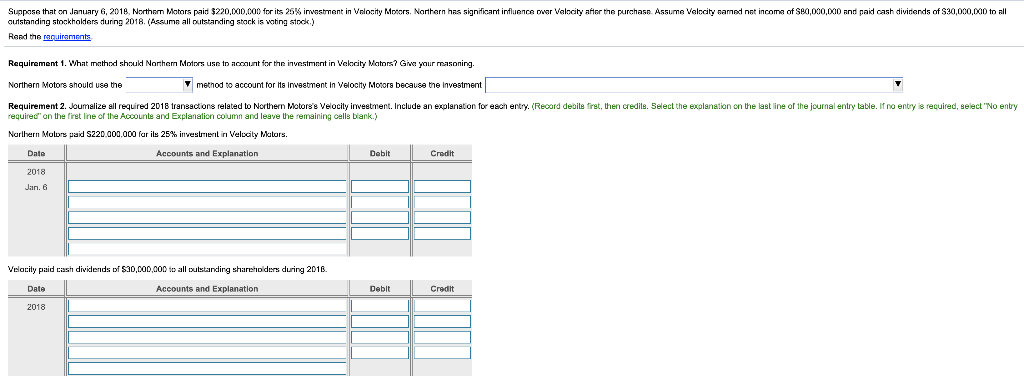

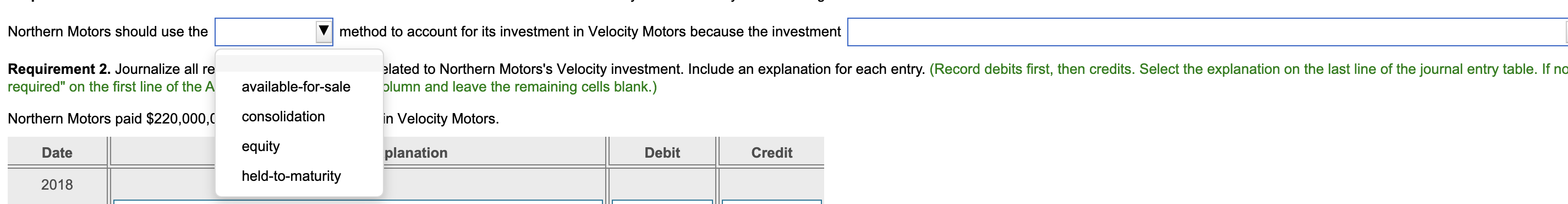

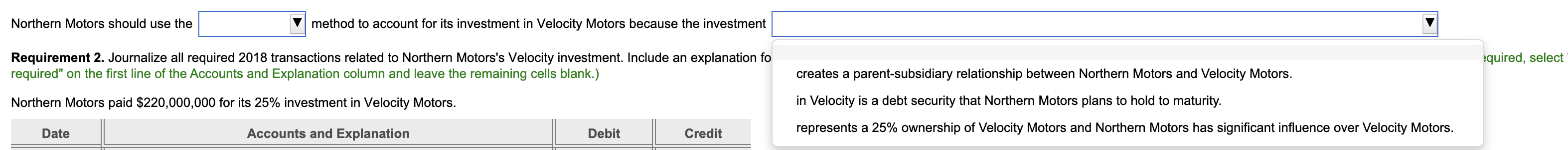

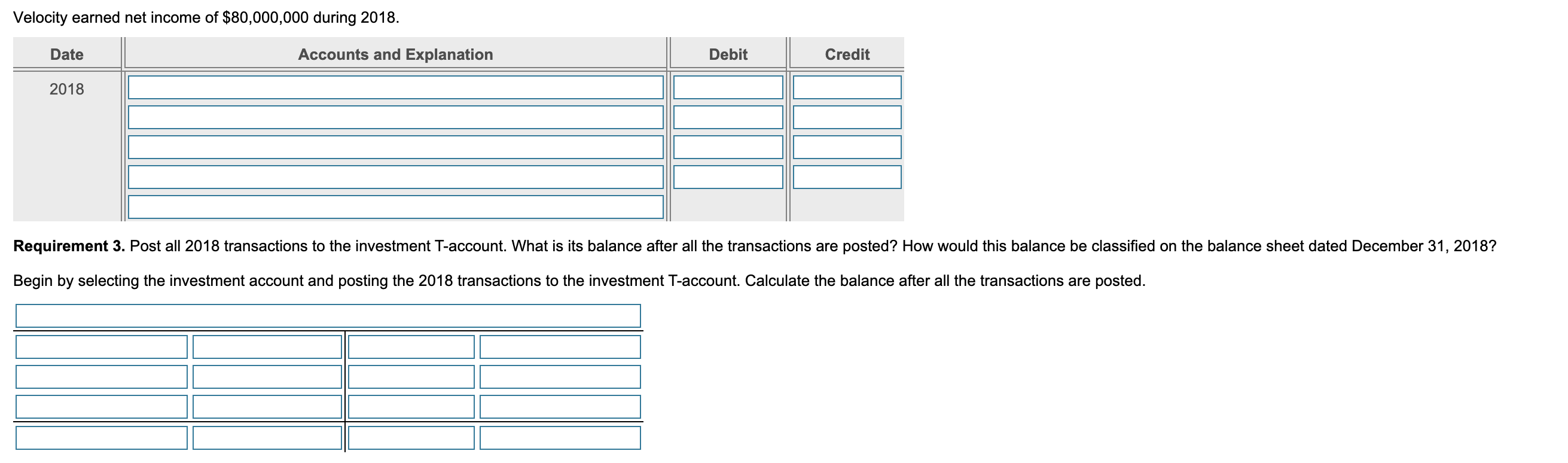

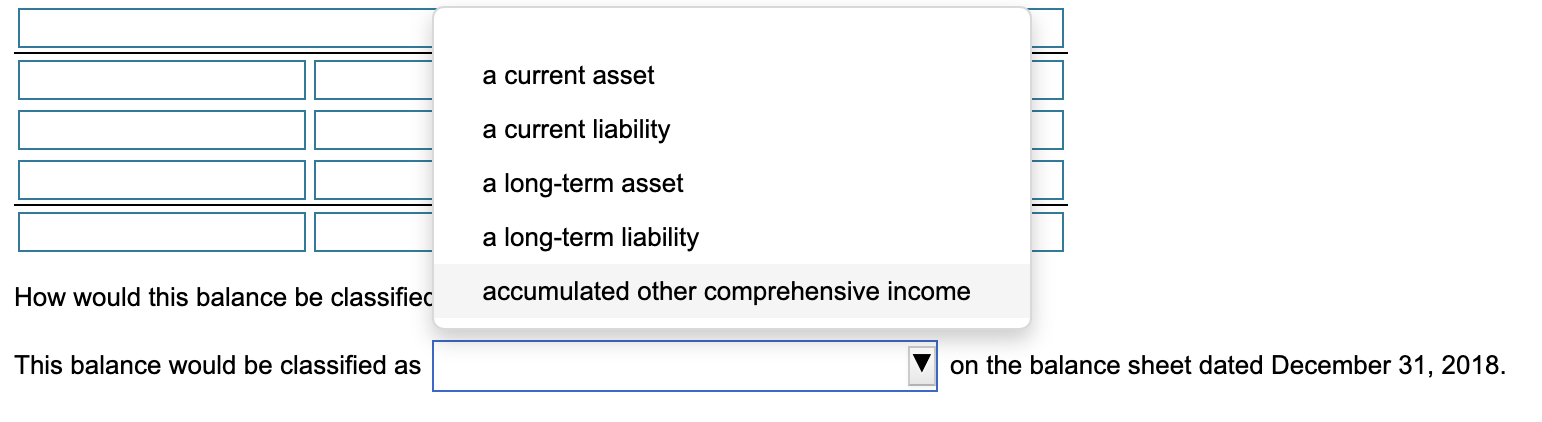

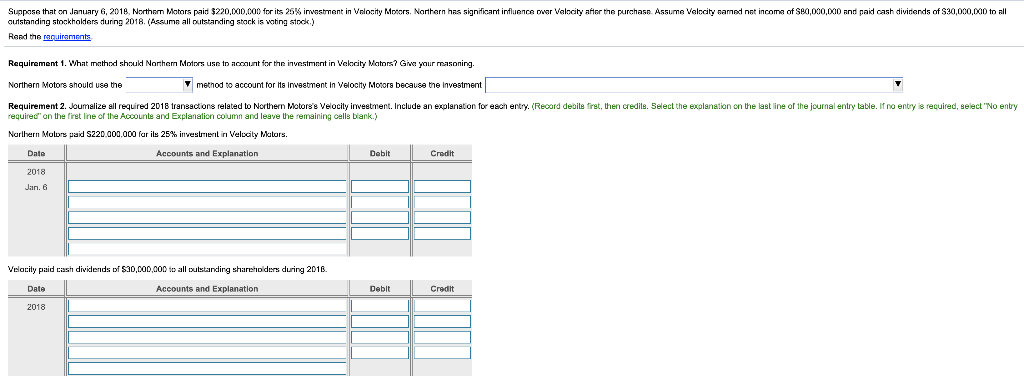

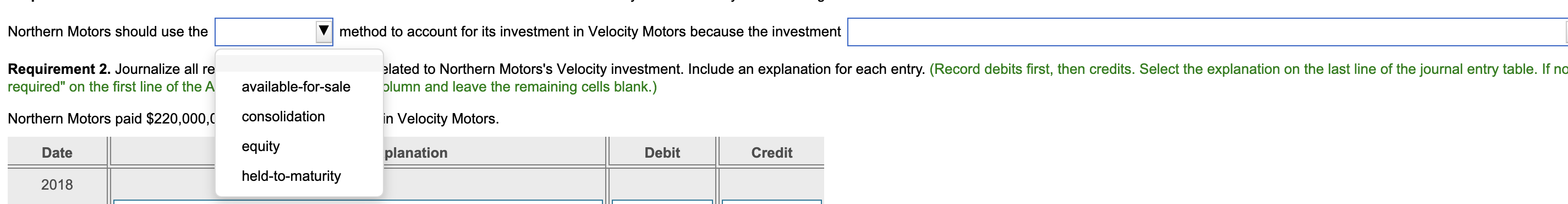

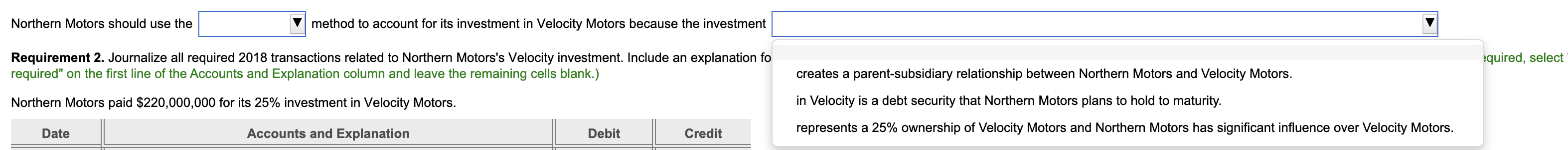

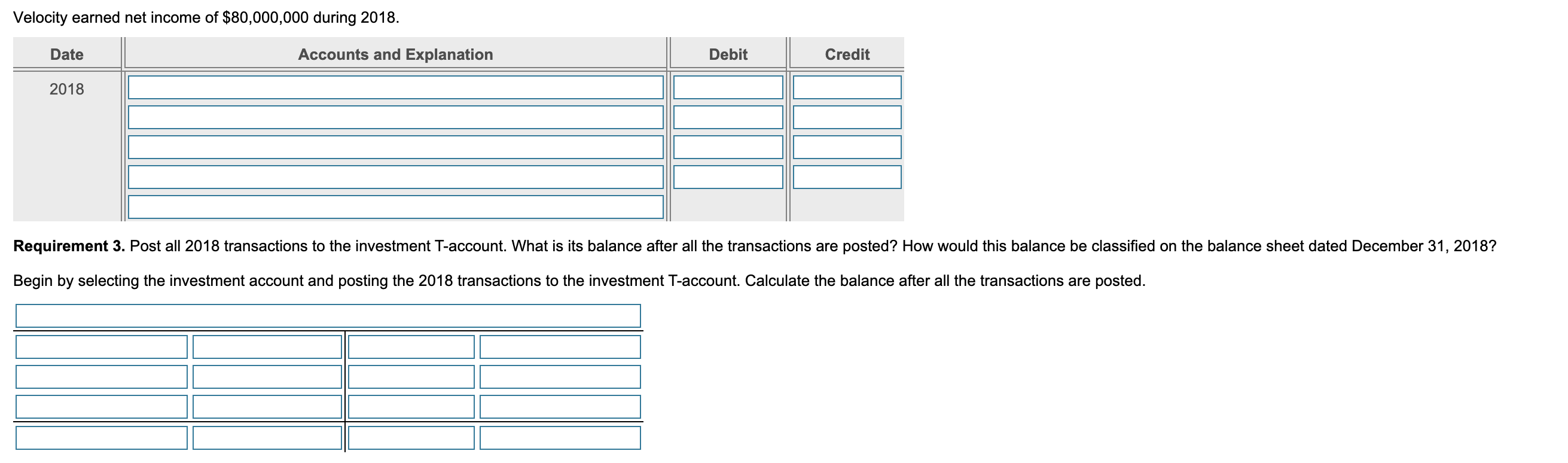

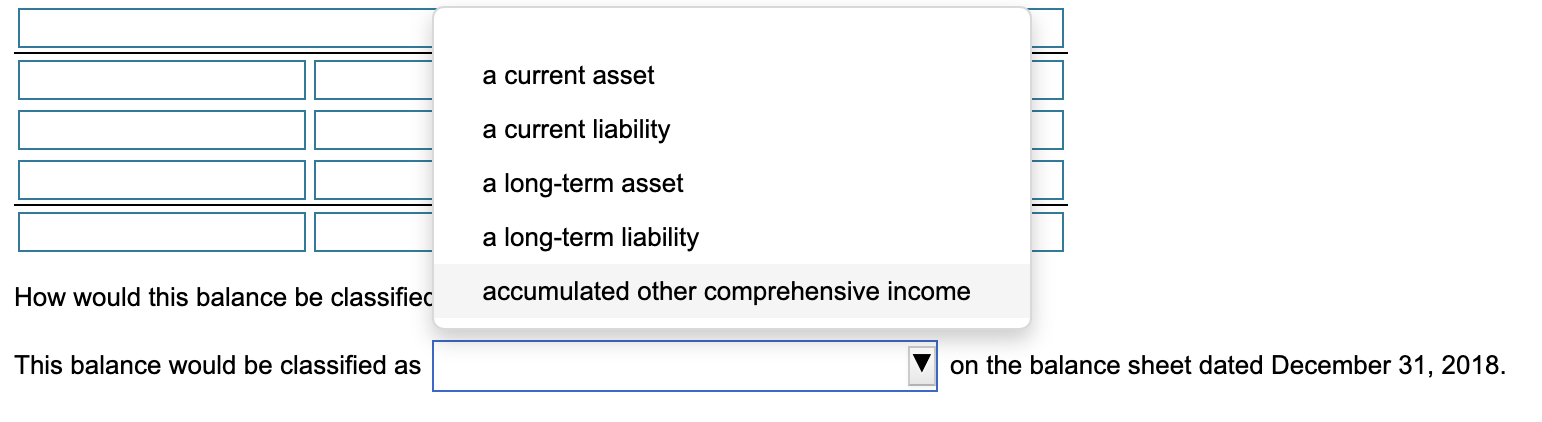

Suppose that on January 6, 2018 Northern Motors paid $220.000.000 for its 25% investment in Velocity Motors, Northern has significant influence over Velocity after the purchase Assume Velocity sarned not income of S60,000,000 and paid cash dividends of S20,000,000 to all outstanding stockholders during 2018. (Assume all outstanding stack is voting stock.) Rand the truiraments Requirement 1. What method should Northern Motors use to account for the investment in Velocity Mators? Give your reasoning. Northern Motors should use the method to account for its Investment in Velocity Motors because the investment Requirement 2. Joumalize all required 2018 transactions related to Northern Motors's Velocity investment. Include an explanation for each entry. (Record debite firet, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No enty required" on the first line of the Account and Explanation column and leave the remaining cells blank.) Northern Molors paid S220.000.000 far ils 25% investment in Velocity Maturs. Data Accounts and Explanation Debit Credit 2018 Jan. 6 Velocity paid cash dividends of $30,000,000 to all outstanding shareholders during 2018 Date Accounts and Explanation 2018 Debit Credit Northern Motors should use the method to account for its investment in Velocity Motors because the investment Requirement 2. Journalize all re required" on the first line of the A elated to Northern Motors's Velocity investment. Include an explanation for each entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no olumn and leave the remaining cells blank.) available-for-sale Northern Motors paid $220,000,0 consolidation in Velocity Motors. Date equity planation Debit Credit held-to-maturity 2018 Northern Motors should use the method to account for its investment in Velocity Motors because the investment Requirement 2. Journalize all required 2018 transactions related to Northern Motors's Velocity investment. Include an explanation fo required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) quired, select creates a parent-subsidiary relationship between Northern Motors and Velocity Motors. Northern Motors paid $220,000,000 for its 25% investment in Velocity Motors. in Velocity is a debt security that Northern Motors plans to hold to maturity. Date Accounts and Explanation Debit Credit represents a 25% ownership of Velocity Motors and Northern Motors has significant influence over Velocity Motors. Velocity earned net income of $80,000,000 during 2018. Date Accounts and Explanation Debit Credit 2018 Requirement 3. Post all 2018 transactions to the investment T-account. What is its balance after all the transactions are posted? How would this balance be classified on the balance sheet dated December 31, 2018? Begin by selecting the investment account and posting the 2018 transactions to the investment T-account. Calculate the balance after all the transactions are posted. a current asset a current liability a long-term asset a long-term liability How would this balance be classified accumulated other comprehensive income This balance would be classified as on the balance sheet dated December 31, 2018