Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$1.90 million (Fijian dollars, F$ ) worth of imports from Fiji

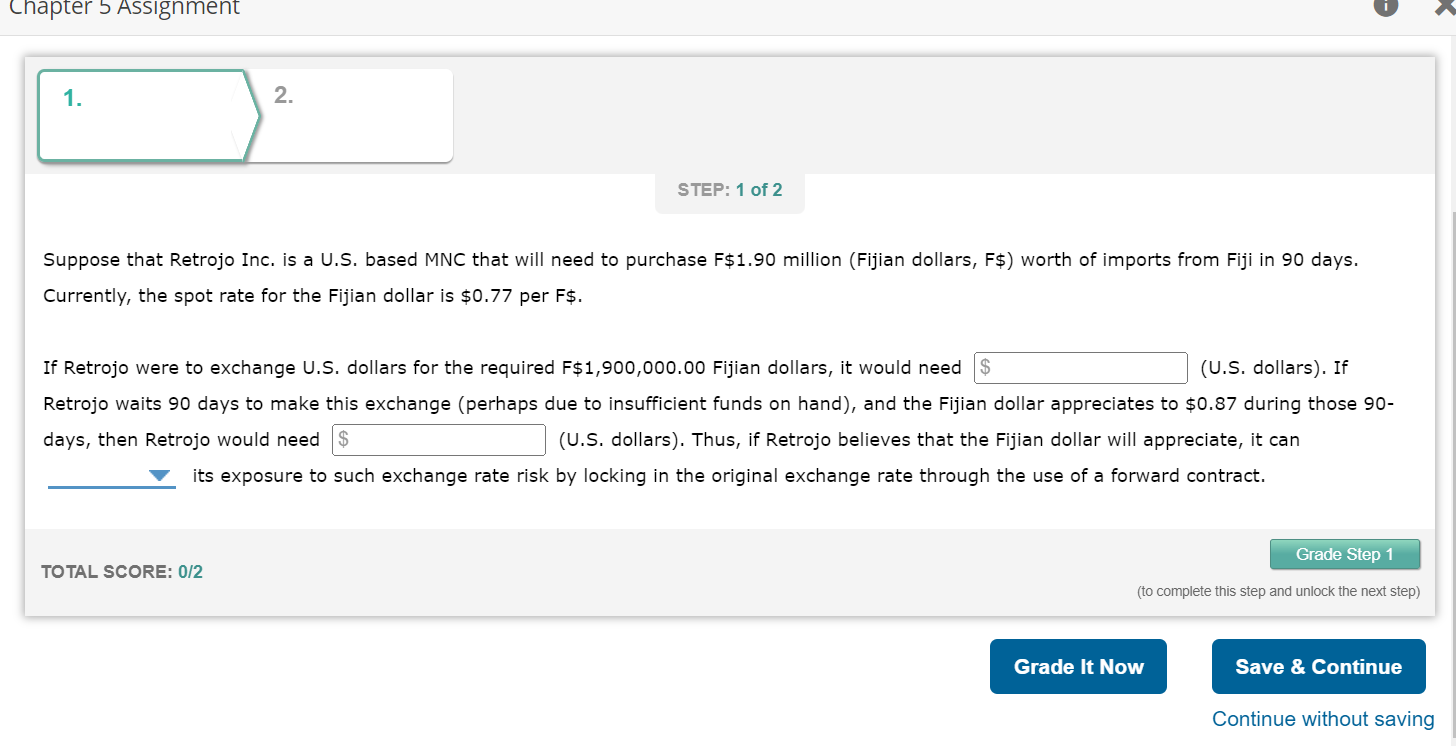

Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$1.90 million (Fijian dollars, F$ ) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.77 per F$. If Retrojo were to exchange U.S. dollars for the required F$1,900,000.00 Fijian dollars, it would need (U.S. dollars). If Retrojo waits 90 days to make this exchange (perhaps due to insufficient funds on hand), and the Fijian dollar appreciates to $0.87 during those 90 days, then Retrojo would need (U.S. dollars). Thus, if Retrojo believes that the Fijian dollar will appreciate, it can its exposure to such exchange rate risk by locking in the original exchange rate through the use of a forward contract. TOTAL SCORE: 0/2 (to complete this step and unlock the next step) Continue without saving

Suppose that Retrojo Inc. is a U.S. based MNC that will need to purchase F$1.90 million (Fijian dollars, F$ ) worth of imports from Fiji in 90 days. Currently, the spot rate for the Fijian dollar is $0.77 per F$. If Retrojo were to exchange U.S. dollars for the required F$1,900,000.00 Fijian dollars, it would need (U.S. dollars). If Retrojo waits 90 days to make this exchange (perhaps due to insufficient funds on hand), and the Fijian dollar appreciates to $0.87 during those 90 days, then Retrojo would need (U.S. dollars). Thus, if Retrojo believes that the Fijian dollar will appreciate, it can its exposure to such exchange rate risk by locking in the original exchange rate through the use of a forward contract. TOTAL SCORE: 0/2 (to complete this step and unlock the next step) Continue without saving Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started