Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Russell Co. is a U.S.-based MNC that is dedding whether to finance its operations (with a one-year loan) in U.S. dollars or Canadian

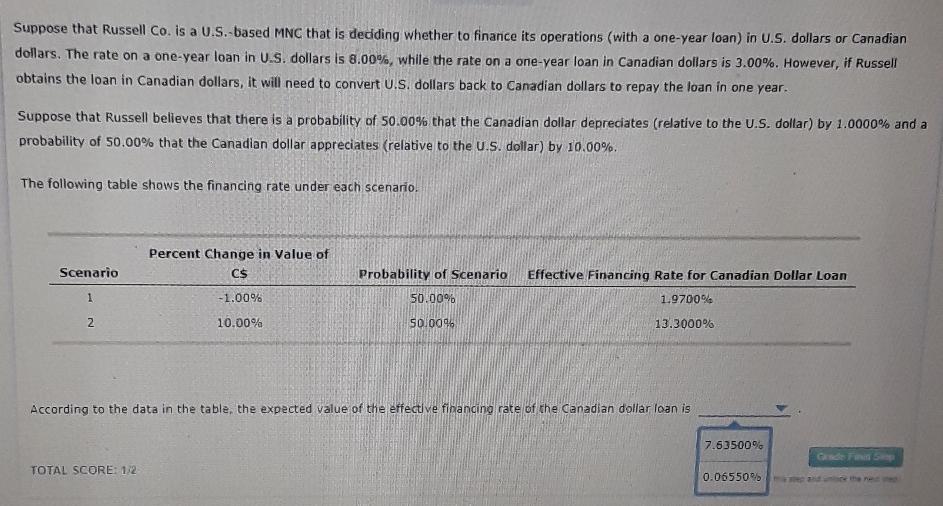

Suppose that Russell Co. is a U.S.-based MNC that is dedding whether to finance its operations (with a one-year loan) in U.S. dollars or Canadian dollars. The rate on a one-year loan in U.S. dollars is 8.00%, while the rate on a one-year loan in Canadian dollars is 3.00%. However, if Russell obtains the loan in Canadian dollars, it will need to convert U.S. dollars back to Canadian dollars to repay the loan in one year. Suppose that Russell believes that there is a probability of 50.00% that the Canadian dollar depreciates (relative to the U.S. dollar) by 1.0000% and a probability of 50.00% that the Canadian dollar appreciates (relative to the U.S. dollar) by 10.00%. The following table shows the financing rate under each scenario. Percent Change in Value of C$ Scenario Effective Financing Rate for Canadian Dollar Loan Probability of Scenario 50.00% 1 1.00% 1.9700% 2 10.00% 50.0096 13.3000% According to the data in the table, the expected value of the effective financing rate of the Canadian dollar loan is 7.63500% TOTAL SCORE: 1/2 0.0655096

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started