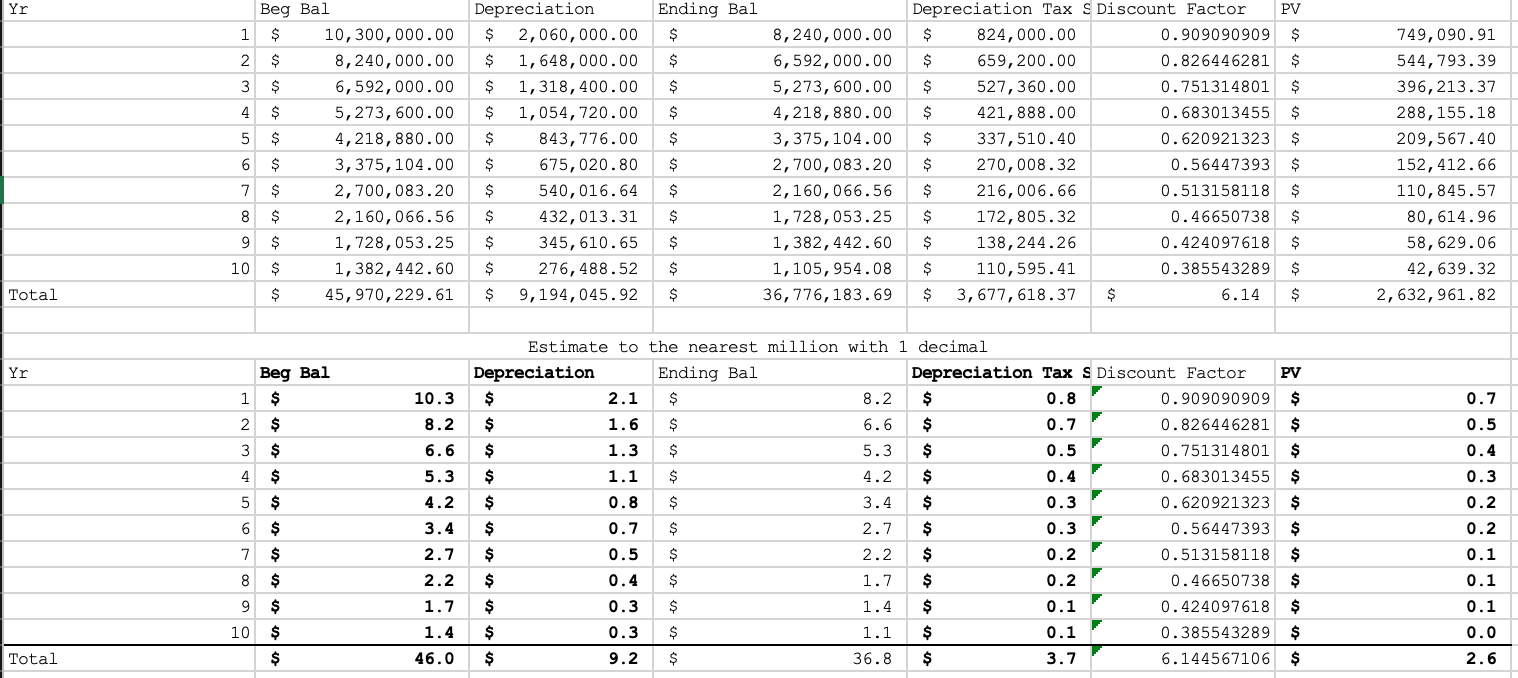

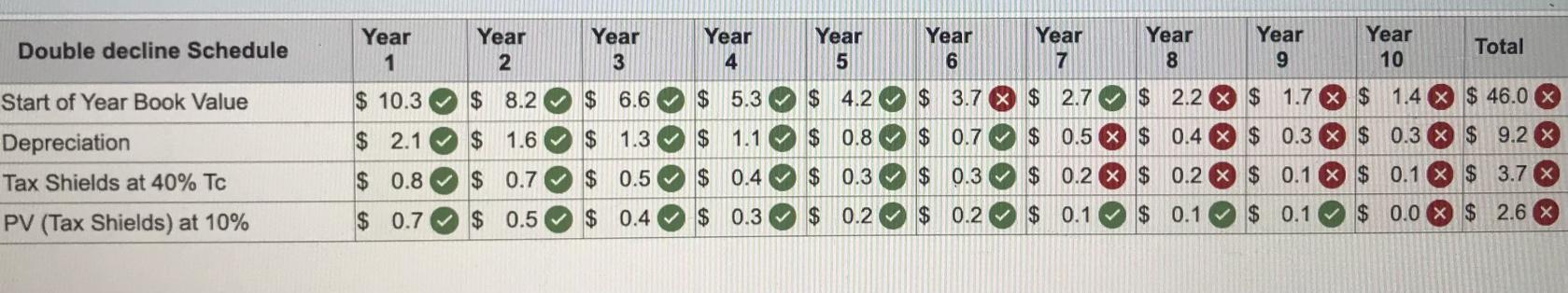

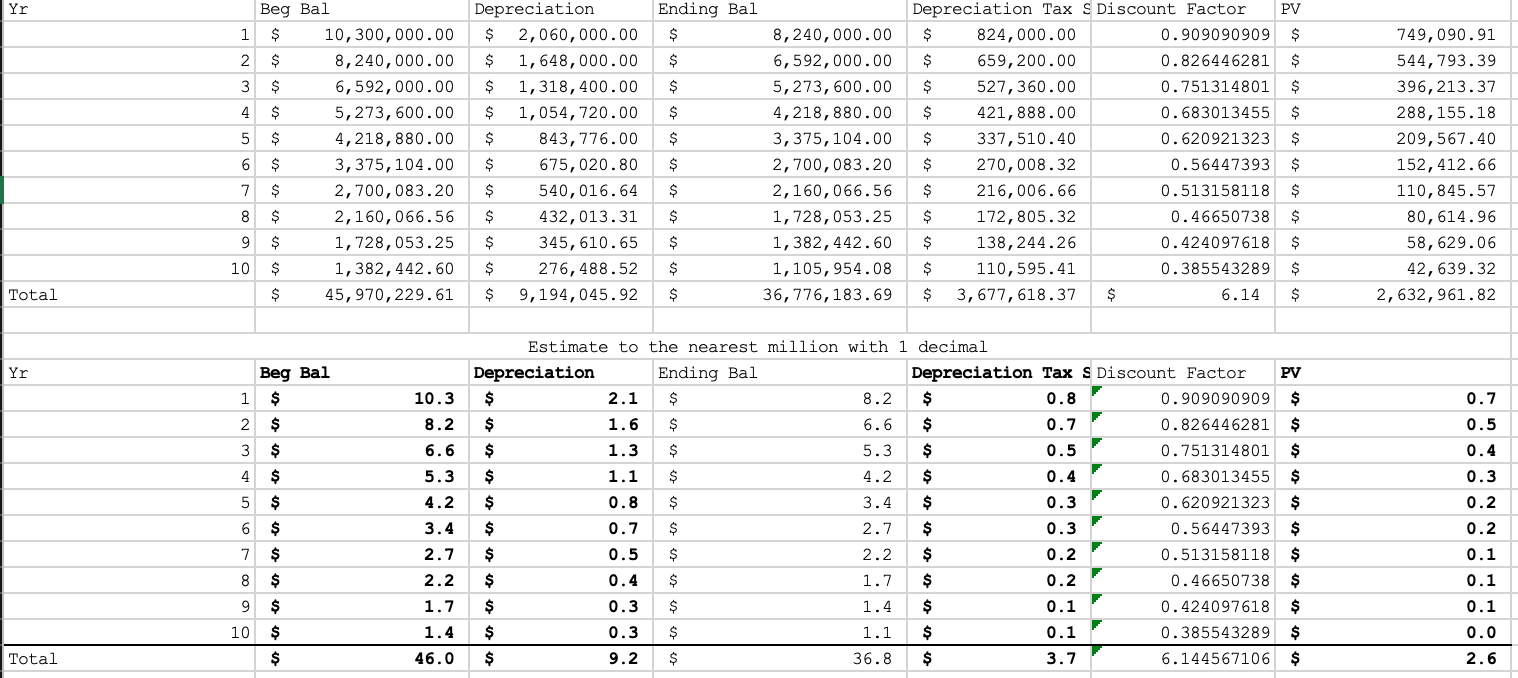

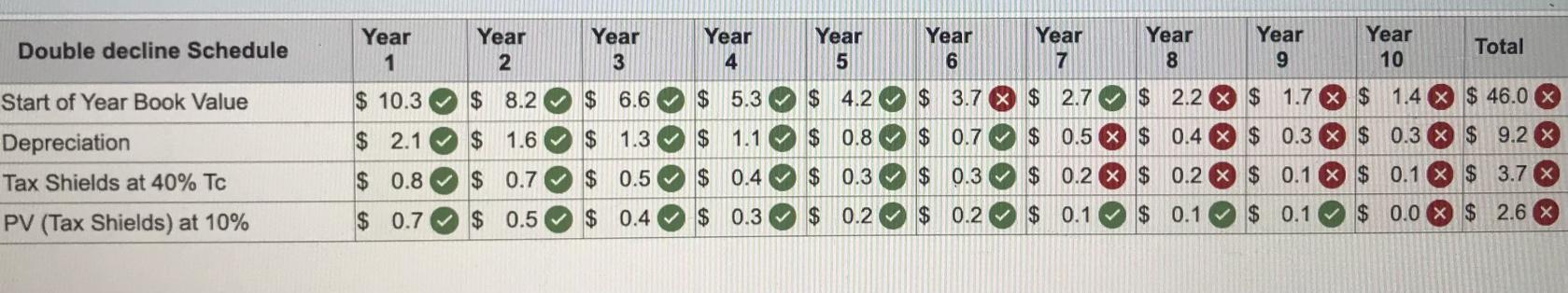

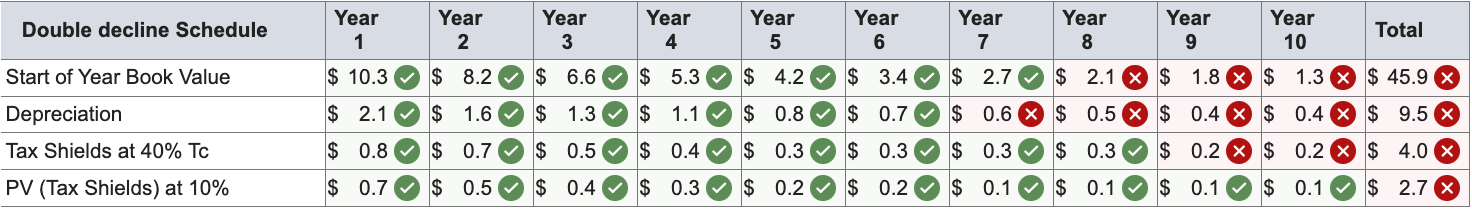

Suppose that Sudbury Mechanical Drifters is proposing to invest $10.3 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 10%. b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point to straight-line. Now, what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) What I did on excel:  Answer for Attempt # 1:

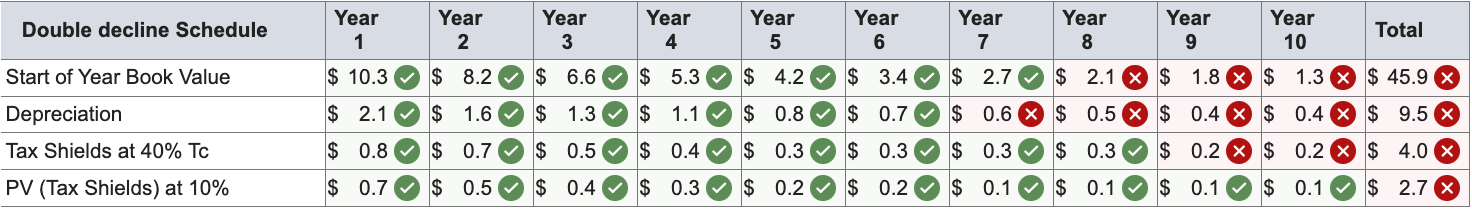

Answer for Attempt # 1:  Answer for Attempt #2:

Answer for Attempt #2:  I don't know what I'm doing wrong. Please help.

I don't know what I'm doing wrong. Please help.

Yr Total Yr Total 1 $ $ $ $ $ $ $ $ $ $ $ 2 3 4 5 6 7 8 9 10 Beg Bal Ending Bal $ 2,060,000.00 $ $ 1,648,000.00 $ $ 1,318,400.00 $ $ 1,054, 720.00 $ $ 843,776.00 $ 3,375, 104.00 $ 675,020.80 $ 2,700,083.20 $ 540,016.64 $ 2,160,066.56 $ 432,013.31 $ 1,728,053.25 $ 345,610.65 $ 1,382,442.60 $ 276,488.52 $ 45,970,229.61 $ 9,194,045.92 $ 1 $ 2 $ 3 $ 4 $ 5 $ 6 $ 7 $ 8 $ 9 $ Beg Bal 10 $ $ 10,300,000.00 8,240,000.00 6,592,000.00 5,273,600.00 4,218,880.00 Depreciation Depreciation 10.3 $ 8.2 $ 6.6 $ 5.3 $ 4.2 $ 3.4 $ 2.7 $ 2.2 $ 1.7 $ 1.4 $ 46.0 $ Depreciation Tax S Discount Factor PV 0.909090909 $ 0.826446281 $ 0.751314801 $ 0.683013455 $ 0.620921323 $ 0.56447393 $ 0.513158118 $ 0.46650738 $ 0.424097618 $ 0.385543289 $ 6.14 $ 2.1 $ 1.6 $ 1.3 $ 1.1 $ 0.8 $ 0.7 $ 0.5 $ 0.4 $ 0.3 $ 0.3 $ 9.2 $ 8,240,000.00 $ 6,592,000.00 $ 5,273,600.00 $ 4,218,880.00 $ 3,375, 104.00 $ 2,700,083.20 $ 2,160,066.56 $ 1,728,053.25 $ 1,382,442.60 $ 1,105,954.08 $ 36,776,183.69 $ Estimate to the nearest million with 1 decimal Ending Bal 824,000.00 659,200.00 527,360.00 421,888.00 337,510.40 270,008.32 216,006.66 172,805.32 138,244.26 110,595.41 3,677,618.37 8.2 $ 6.6 $ 5.3 $ 4.2 $ PV 0.826446281 $ Depreciation Tax S Discount Factor 0.8 0.909090909 $ 0.7 0.5 0.4 0.3 0.751314801 $ 0.683013455 $ 0.620921323 $ 0.3 0.56447393 $ 0.513158118 $ 0.2 0.2 0.46650738 $ 0.424097618 $ 0.1 0.1 3.7 0.385543289 $ 6.144567106 $ 3.4 $ 2.7 $ 2.2 $ 1.7 $ 1.4 $ 1.1 $ 36.8 $ $ 749,090.91 544,793.39 396,213.37 288,155.18 209,567.40 152,412.66 110,845.57 80, 614.96 58,629.06 42,639.32 2,632,961.82 0.7 0.5 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.0 2.6 Double decline Schedule Start of Year Book Value Depreciation Tax Shields at 40% Tc PV (Tax Shields) at 10% Year 1 $10.3 $2.1 $0.8 $0.7 Year 2 $8.2 $1.6 $0.7 $0.5 Year 3 $ 6.6 $ 1.3 >>> $ 0.5 0.5 $0.4 Year 4 $5.3 $ 1.1 $ $0.4 $ 0.3 Year 5 $ 4.2 $ 0.8 $ 0.3 $ 0.2 Year 6 $ 3.7 $ 0.7 $0.3 0.3 $0.2 0.2 Year Year Year Year 7 8 9 10 $2.7 $ 2.2 x $ 1.7 x $ 1.4 x $ 46.0 x $ 0.5 x $ 0.4 x $ 0.2 x $0.2 x $0.1 $0.3 x $0.3 X $9.2 x $0.1 x $0.1 x $ 3.7 x $ 2.6 x $ 0.1 $0.0 X $ 0.1 X > Total Double decline Schedule Start of Year Book Value Depreciation Tax Shields at 40% Tc PV (Tax Shields) at 10% Year 1 $ 10.3 $2.1 $ 0.8 $ 0.7 Year 2 $ 8.2 $ 1.6 $ 0.7 $ 0.5 Year 3 $6.6 $ 1.3 $ 0.5 $ 0.4 Year 4 $5.3 $ 1.1 $0.4 $0.3 Year 5 $4.2 $ 0.8 $ 0.3 $0.2 Year 6 $3.4 $0.7 $0.3 $ 0.2 Year 8 Year 7 $2.7 $ 2.1 $0.6 $ 0.5 $0.3 $0.3 $0.1 $ 0.1 Year 9 Year 10 $ 1.8 $ 1.3 X $ 0.4 X $ $0.2 $0.1 0.4 xX $ 0.2 $ 0.1 Total $ 45.9 $ 9.5 X $4.0 X $ 2.7 x

Answer for Attempt # 1:

Answer for Attempt # 1:  Answer for Attempt #2:

Answer for Attempt #2:  I don't know what I'm doing wrong. Please help.

I don't know what I'm doing wrong. Please help.