Answered step by step

Verified Expert Solution

Question

1 Approved Answer

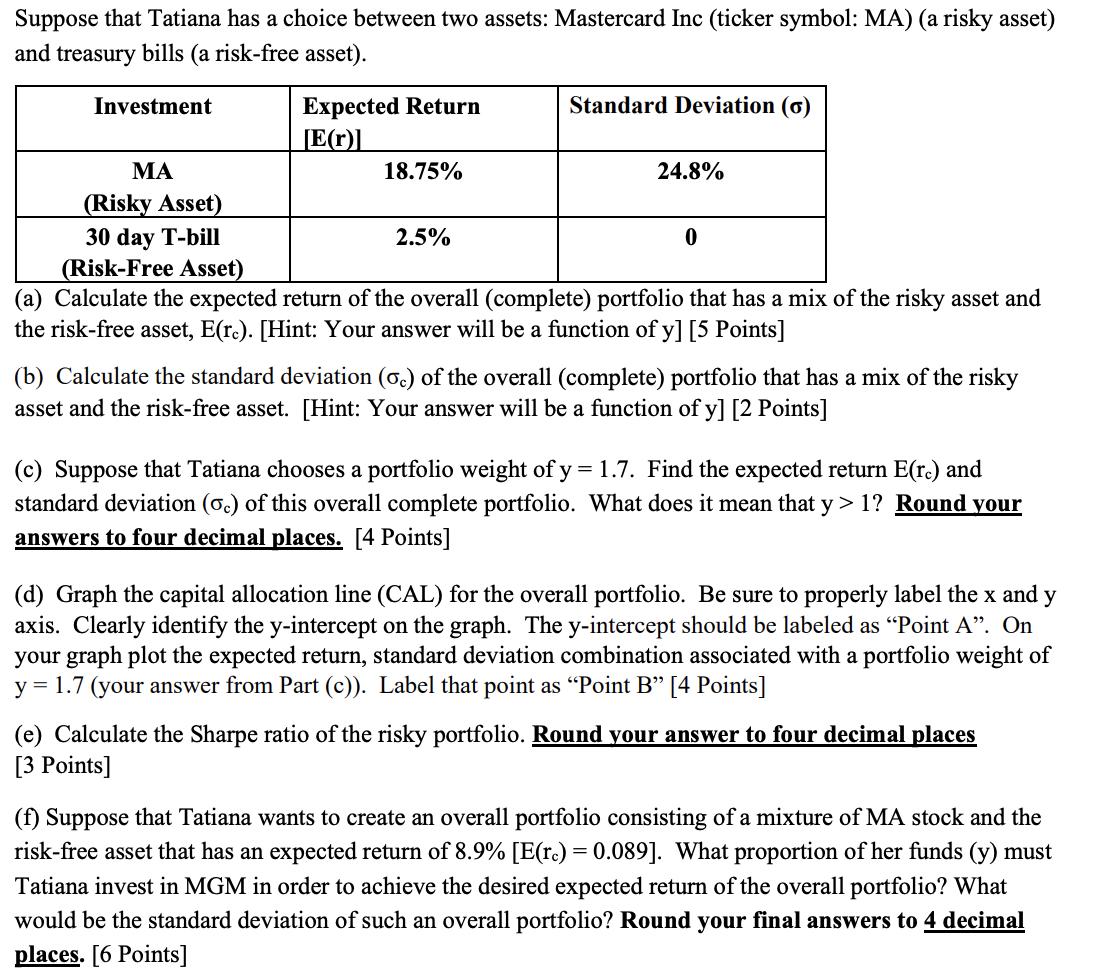

Suppose that Tatiana has a choice between two assets: Mastercard Inc (ticker symbol: MA) (a risky asset) and treasury bills (a risk-free asset). Investment

Suppose that Tatiana has a choice between two assets: Mastercard Inc (ticker symbol: MA) (a risky asset) and treasury bills (a risk-free asset). Investment Standard Deviation () Expected Return [E(r)] MA 18.75% (Risky Asset) 30 day T-bill 2.5% (Risk-Free Asset) 24.8% 0 (a) Calculate the expected return of the overall (complete) portfolio that has a mix of the risky asset and the risk-free asset, E(rc). [Hint: Your answer will be a function of y] [5 Points] (b) Calculate the standard deviation (c) of the overall (complete) portfolio that has a mix of the risky asset and the risk-free asset. [Hint: Your answer will be a function of y] [2 Points] (c) Suppose that Tatiana chooses a portfolio weight of y = 1.7. Find the expected return E(rc) and standard deviation (c) of this overall complete portfolio. What does it mean that y> 1? Round your answers to four decimal places. [4 Points] (d) Graph the capital allocation line (CAL) for the overall portfolio. Be sure to properly label the x and y axis. Clearly identify the y-intercept on the graph. The y-intercept should be labeled as "Point A. On your graph plot the expected return, standard deviation combination associated with a portfolio weight of y = 1.7 (your answer from Part (c)). Label that point as "Point B" [4 Points] (e) Calculate the Sharpe ratio of the risky portfolio. Round your answer to four decimal places [3 Points] (f) Suppose that Tatiana wants to create an overall portfolio consisting of a mixture of MA stock and the risk-free asset that has an expected return of 8.9% [E(rc) = 0.089]. What proportion of her funds (y) must Tatiana invest in MGM in order to achieve the desired expected return of the overall portfolio? What would be the standard deviation of such an overall portfolio? Round your final answers to 4 decimal places. [6 Points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started