Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of

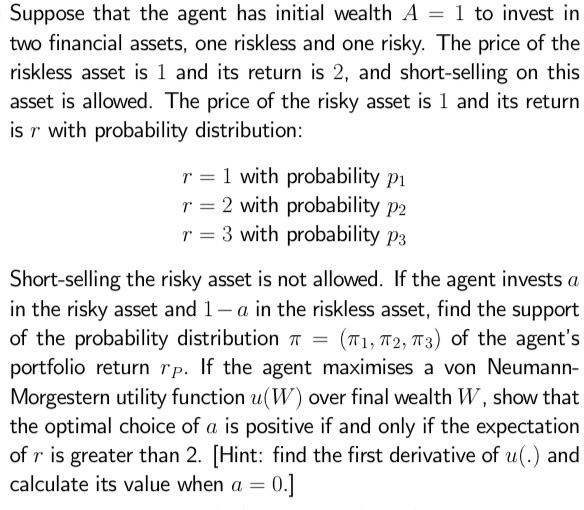

Suppose that the agent has initial wealth A = 1 to invest in two financial assets, one riskless and one risky. The price of the riskless asset is 1 and its return is 2, and short-selling on this asset is allowed. The price of the risky asset is 1 and its return is r with probability distribution: r = 1 with probability pi r = 2 with probability p2 r = 3 with probability p3 Short-selling the risky asset is not allowed. If the agent invests a in the risky asset and 1-a in the riskless asset, find the support of the probability distribution = (T1, T2, T3) of the agent's portfolio return rp. If the agent maximises a von Neumann- Morgestern utility function u(W) over final wealth W, show that the optimal choice of a is positive if and only if the expectation of r is greater than 2. [Hint: find the first derivative of u(.) and calculate its value when a = 0.]

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To find the support of the probability distribution T1 T2 T3 of the agents portfolio return rp we need to consider the different possible outcomes bas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started