Question

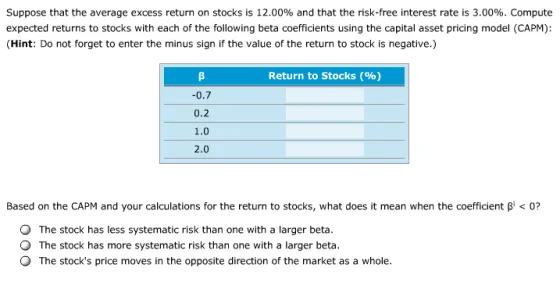

Suppose that the average excess return on stocks is 12.00% and that the risk-free interest rate is 3.00%. Compute expected returns to stocks with

Suppose that the average excess return on stocks is 12.00% and that the risk-free interest rate is 3.00%. Compute expected returns to stocks with each of the following beta coefficients using the capital asset pricing model (CAPM): (Hint: Do not forget to enter the minus sign if the value of the return to stock is negative.) Return to Stocks (%) B -0.7 0.2 1.0 2.0 Based on the CAPM and your calculations for the return to stocks, what does it mean when the coefficient B

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The expected return to stocks usi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App