Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the Bank of Korea has purchased bonds of 2000 from the Kakao Bank. Now suppose that under the required reserve ratio of 2%,

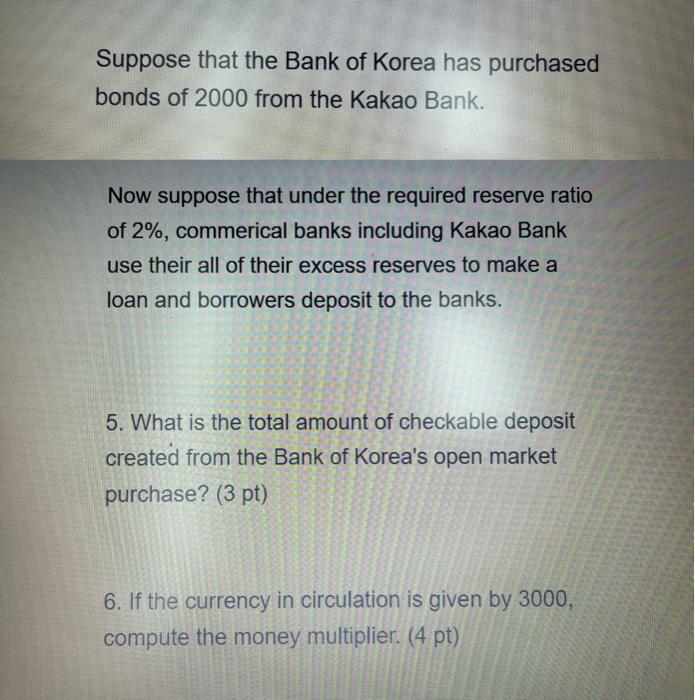

Suppose that the Bank of Korea has purchased bonds of 2000 from the Kakao Bank.

Now suppose that under the required reserve ratio of 2%, commerical banks including Kakao Bank use their all of their excess reserves to make a loan and borrowers deposit to the banks.

5. What is the total amount of checkable deposit created from the Bank of Korea's open market purchase? (3 pt)

6. If the currency in circulation is given by 3000 compute the money multiplier.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started