Answered step by step

Verified Expert Solution

Question

1 Approved Answer

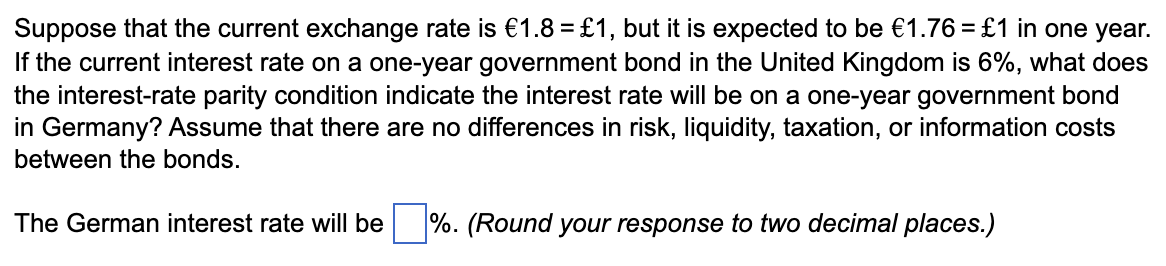

Suppose that the current exchange rate is 1.8=1, but it is expected to be 1.76=1 in one year. If the current interest rate on a

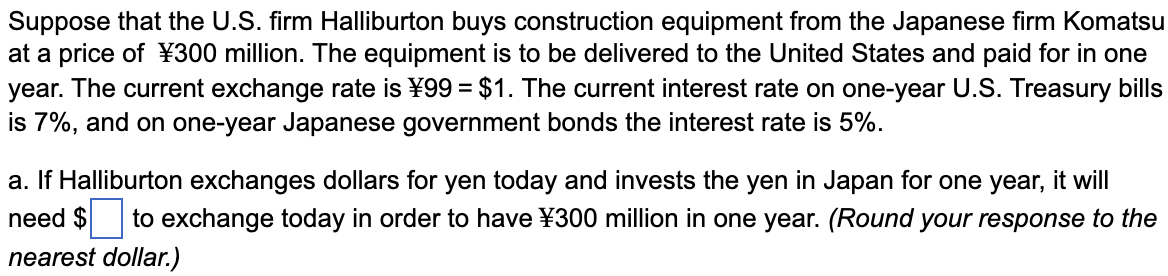

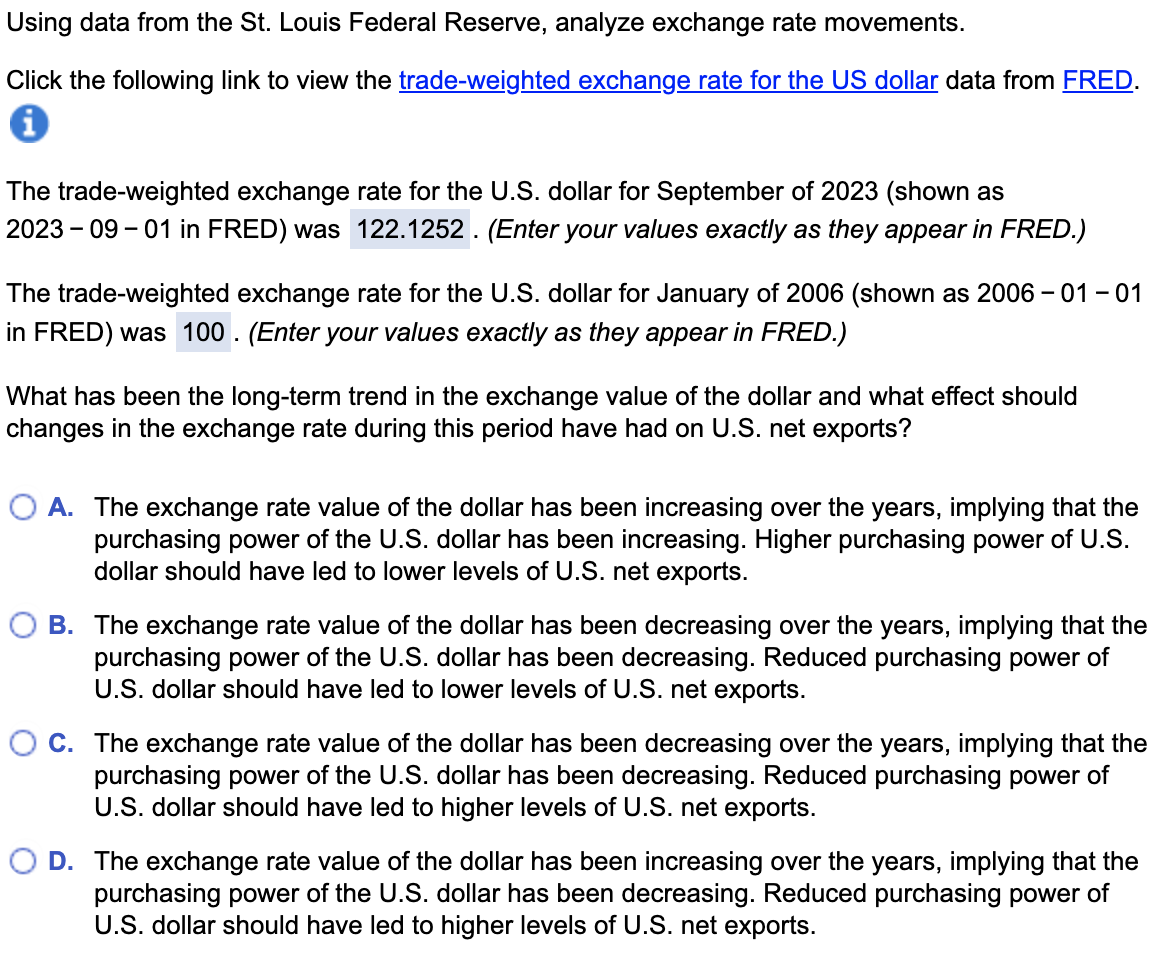

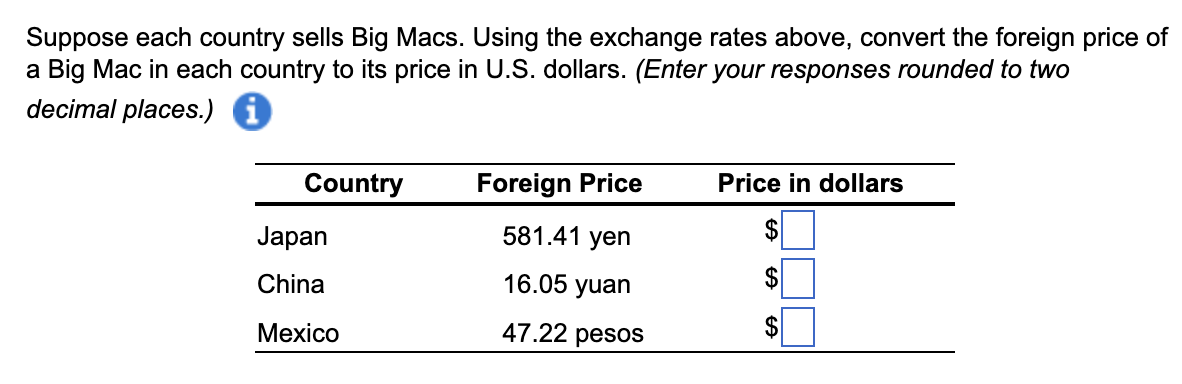

Suppose that the current exchange rate is 1.8=1, but it is expected to be 1.76=1 in one year. If the current interest rate on a one-year government bond in the United Kingdom is 6%, what does the interest-rate parity condition indicate the interest rate will be on a one-year government bond in Germany? Assume that there are no differences in risk, liquidity, taxation, or information costs between the bonds. The German interest rate will be \%. (Round your response to two decimal places.) Suppose that the U.S. firm Halliburton buys construction equipment from the Japanese firm Komatsu at a price of 300 million. The equipment is to be delivered to the United States and paid for in one year. The current exchange rate is 99=$1. The current interest rate on one-year U.S. Treasury bills is 7%, and on one-year Japanese government bonds the interest rate is 5%. a. If Halliburton exchanges dollars for yen today and invests the yen in Japan for one year, it will need \$ to exchange today in order to have 300 million in one year. (Round your response to the nearest dollar.) Using data from the St. Louis Federal Reserve, analyze exchange rate movements. Click the following link to view the trade-weighted exchange rate for the US dollar data from The trade-weighted exchange rate for the U.S. dollar for September of 2023 (shown as 2023- 09 - 01 in FRED) was 122.1252 . (Enter your values exactly as they appear in FRED.) The trade-weighted exchange rate for the U.S. dollar for January of 2006 (shown as 2006-01-01 in FRED) was (Enter your values exactly as they appear in FRED.) What has been the long-term trend in the exchange value of the dollar and what effect should changes in the exchange rate during this period have had on U.S. net exports? A. The exchange rate value of the dollar has been increasing over the years, implying that the purchasing power of the U.S. dollar has been increasing. Higher purchasing power of U.S. dollar should have led to lower levels of U.S. net exports. B. The exchange rate value of the dollar has been decreasing over the years, implying that the purchasing power of the U.S. dollar has been decreasing. Reduced purchasing power of U.S. dollar should have led to lower levels of U.S. net exports. C. The exchange rate value of the dollar has been decreasing over the years, implying that the purchasing power of the U.S. dollar has been decreasing. Reduced purchasing power of U.S. dollar should have led to higher levels of U.S. net exports. D. The exchange rate value of the dollar has been increasing over the years, implying that the purchasing power of the U.S. dollar has been decreasing. Reduced purchasing power of U.S. dollar should have led to higher levels of U.S. net exports. Suppose each country sells Big Macs. Using the exchange rates above, convert the foreign price of a Big Mac in each country to its price in U.S. dollars. (Enter your responses rounded to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started