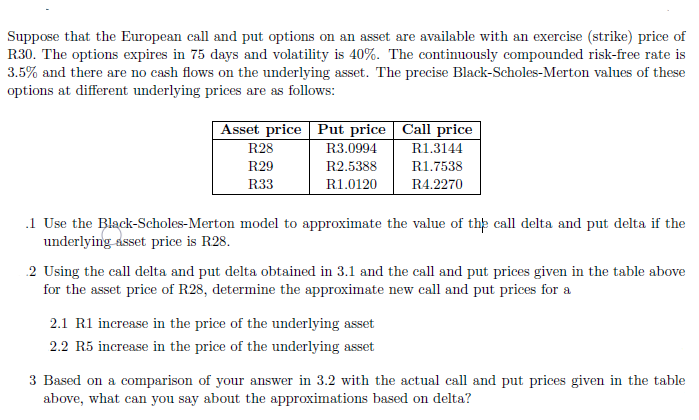

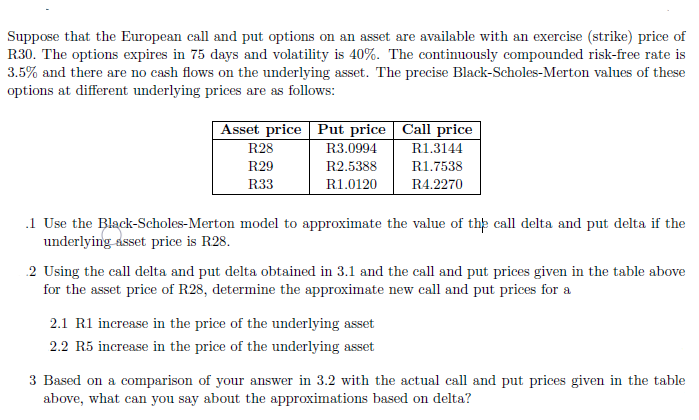

Suppose that the European call and put options on an asset are available with an exercise (strike) price of R.30. The options expires in 75 days and volatility is 40%. The continuously compounded risk-free rate is 3.5% and there are no cash flows on the underlying asset. The precise Black-Scholes-Merton values of these options at different underlying prices are as follows: Asset price Put price Call price R3.0994 R1.3144 R2.5388 R1.7538 R.1.0120 R4.2270 R28 R29 R33 .1 Use the Black-Scholes-Merton model to approximate the value of the call delta and put delta if the underlying asset price is R28. 2 Using the call delta and put delta obtained in 3.1 and the call and put prices given in the table above for the asset price of R28, determine the approximate new call and put prices for a 2.1 R1 increase in the price of the underlying asset 2.2 R5 increase in the price of the underlying asset 3 Based on a comparison of your answer in 3.2 with the actual call and put prices given in the table above, what can you say about the approximations based on delta? Suppose that the European call and put options on an asset are available with an exercise (strike) price of R.30. The options expires in 75 days and volatility is 40%. The continuously compounded risk-free rate is 3.5% and there are no cash flows on the underlying asset. The precise Black-Scholes-Merton values of these options at different underlying prices are as follows: Asset price Put price Call price R3.0994 R1.3144 R2.5388 R1.7538 R.1.0120 R4.2270 R28 R29 R33 .1 Use the Black-Scholes-Merton model to approximate the value of the call delta and put delta if the underlying asset price is R28. 2 Using the call delta and put delta obtained in 3.1 and the call and put prices given in the table above for the asset price of R28, determine the approximate new call and put prices for a 2.1 R1 increase in the price of the underlying asset 2.2 R5 increase in the price of the underlying asset 3 Based on a comparison of your answer in 3.2 with the actual call and put prices given in the table above, what can you say about the approximations based on delta