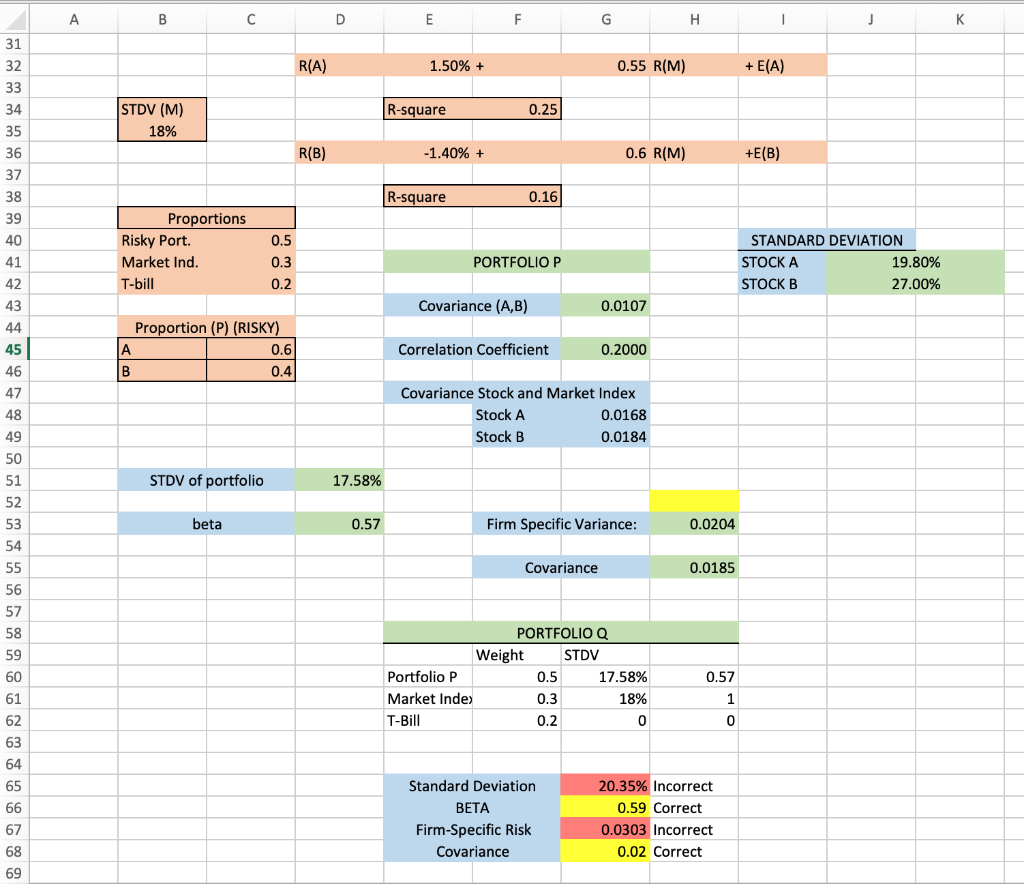

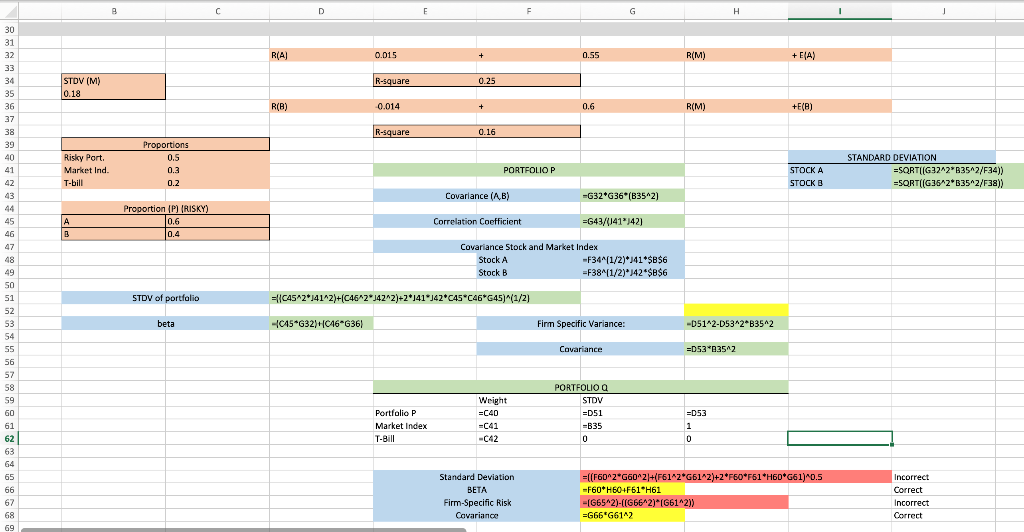

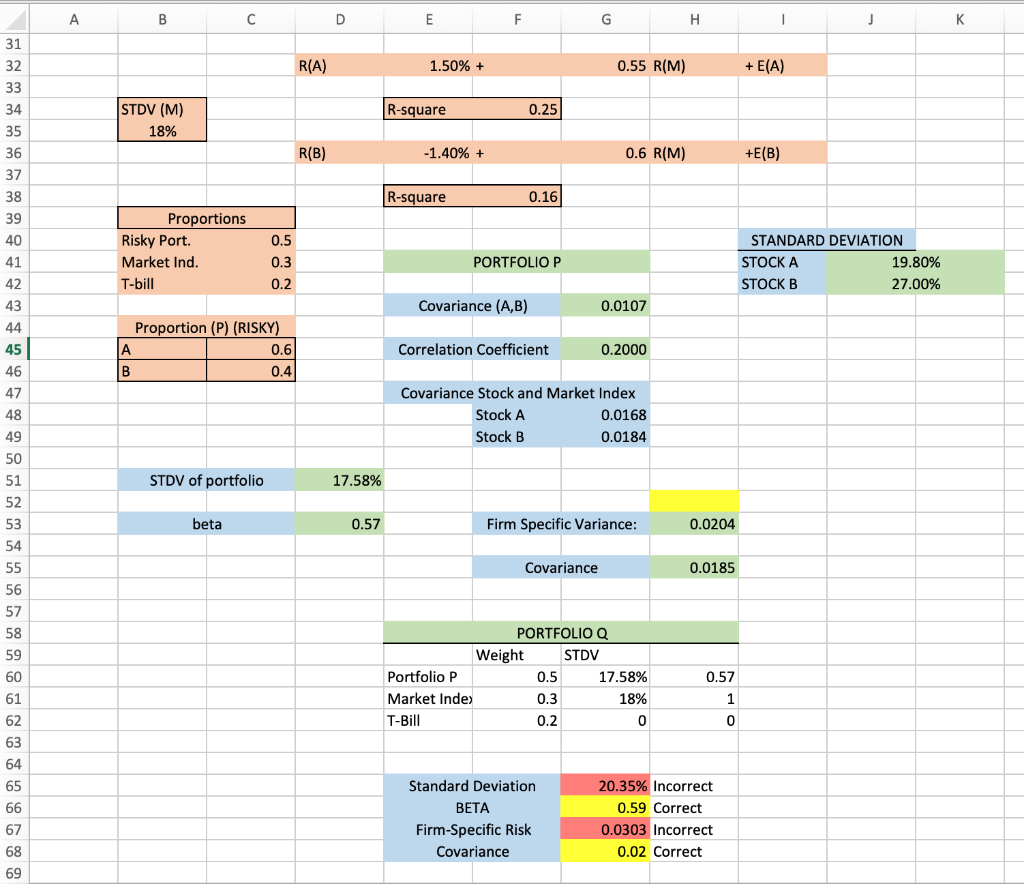

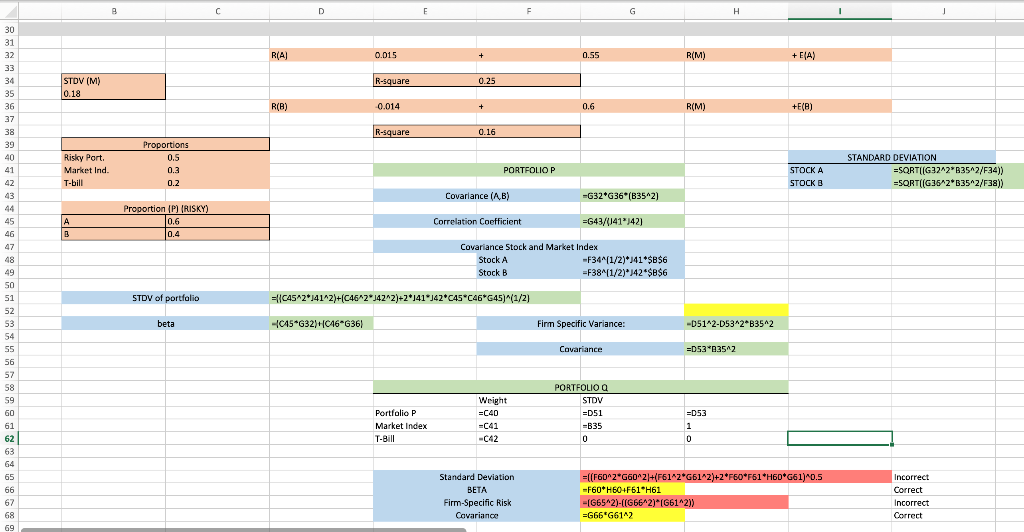

Suppose that the index model for stocks A and B is estimated from excess returns with the following results:

RA = 1.5% + 0.55RM + eA

RB = 1.4% + 0.60RM + eB

M = 18%; R-squareA = 0.25; R-squareB = 0.16

Assume you create a portfolio Q, with investment proportions of 0.50 in a risky portfolio P, 0.30 in the market index, and 0.20 in T-bill. Portfolio P is composed of 60% Stock A and 40% Stock B.

I answered most of them, but the standard deviation and Firm-Specific risk is incorrect. Looking to see if someone can spot the error/mistake.

C D E F G H I J K R(A) 1.50% + 0.55 R(M) +E(A) R-square 0.25 STDV (M) 18% R(B) -1.40% + 0.6 R(M) +E(B) R-square 0.16 0.5 Proportions Risky Port. Market Ind. T-bill 0.3 PORTFOLIO P STANDARD DEVIATION STOCK A 19.80% STOCK B 27.00% 0.2 Covariance (A,B) 0.0107 Proportion (P) (RISKY) | 0.6 Correlation coefficient 0.2000 0.4 Covariance Stock and Market Index Stock A 0.0168 Stock B 0.0184 STDV of portfolio 17.58% beta 0.57 Firm Specific Variance: 0.0204 Covariance 0.0185 PORTFOLIO Weight STDV Portfolio P 0.5 17.58% Market Inde) 0.3 18% T-Bill 0.2 0 0.57 0 Standard Deviation BETA Firm-Specific Risk Covariance 20.35% Incorrect 0.59 Correct 0.0303 Incorrect 0.02 Correct R(A) 0.015 0.55 STOV (M) 0.18 R-square 0.25 R(B) 0.014 0.6 R(M) +E(0) R-square 0.16 Proportions 0.5 Risky Port. Market Ind. T-bill 0.3 0.2 PORTFOLIO P STOCKA STOCKB STANDARD DEVIATION =SQRT{(G3212B35^2/F34)) =SORT (G35A2B35^2/F38)) Covariance (A,B) =G32*636*(B35^2) A Proportion (P) (RISKY) 10,6 0.4 Correlation Coefficient =G43/(141'/42) Covariance Stock and Market Index Stock A -F34(1/2)*141*$B$6 Stock B =F38^(1/2)*142$B$6 STDV of portfolio ={\C4542*141^2)+(C46/20142^2)+2*141 142*C45*C46*G45)^(1/2) beta -C45*G32)+(C46-G36) Firm Specific Variance: -D51^2-D5312B3542 Covariance =D53*83542 PORTFOLIO Q STDV =D51 =B35 =D53 Weight =C40 =C41 -C42 Portfolio P Market Index T-Bill Standard Deviation BETA Firm-Specific Risk Covariance ={(F60*2*G60^2+(F61*2*G612)+2*F60*F51 *H6D*G61)^0.5 -F60*H60+F61*H61 -[G65^2)-((G66^2)*(G61^2)) =G66*G6142 Incorrect Correct Incorrect Correct C D E F G H I J K R(A) 1.50% + 0.55 R(M) +E(A) R-square 0.25 STDV (M) 18% R(B) -1.40% + 0.6 R(M) +E(B) R-square 0.16 0.5 Proportions Risky Port. Market Ind. T-bill 0.3 PORTFOLIO P STANDARD DEVIATION STOCK A 19.80% STOCK B 27.00% 0.2 Covariance (A,B) 0.0107 Proportion (P) (RISKY) | 0.6 Correlation coefficient 0.2000 0.4 Covariance Stock and Market Index Stock A 0.0168 Stock B 0.0184 STDV of portfolio 17.58% beta 0.57 Firm Specific Variance: 0.0204 Covariance 0.0185 PORTFOLIO Weight STDV Portfolio P 0.5 17.58% Market Inde) 0.3 18% T-Bill 0.2 0 0.57 0 Standard Deviation BETA Firm-Specific Risk Covariance 20.35% Incorrect 0.59 Correct 0.0303 Incorrect 0.02 Correct R(A) 0.015 0.55 STOV (M) 0.18 R-square 0.25 R(B) 0.014 0.6 R(M) +E(0) R-square 0.16 Proportions 0.5 Risky Port. Market Ind. T-bill 0.3 0.2 PORTFOLIO P STOCKA STOCKB STANDARD DEVIATION =SQRT{(G3212B35^2/F34)) =SORT (G35A2B35^2/F38)) Covariance (A,B) =G32*636*(B35^2) A Proportion (P) (RISKY) 10,6 0.4 Correlation Coefficient =G43/(141'/42) Covariance Stock and Market Index Stock A -F34(1/2)*141*$B$6 Stock B =F38^(1/2)*142$B$6 STDV of portfolio ={\C4542*141^2)+(C46/20142^2)+2*141 142*C45*C46*G45)^(1/2) beta -C45*G32)+(C46-G36) Firm Specific Variance: -D51^2-D5312B3542 Covariance =D53*83542 PORTFOLIO Q STDV =D51 =B35 =D53 Weight =C40 =C41 -C42 Portfolio P Market Index T-Bill Standard Deviation BETA Firm-Specific Risk Covariance ={(F60*2*G60^2+(F61*2*G612)+2*F60*F51 *H6D*G61)^0.5 -F60*H60+F61*H61 -[G65^2)-((G66^2)*(G61^2)) =G66*G6142 Incorrect Correct Incorrect Correct