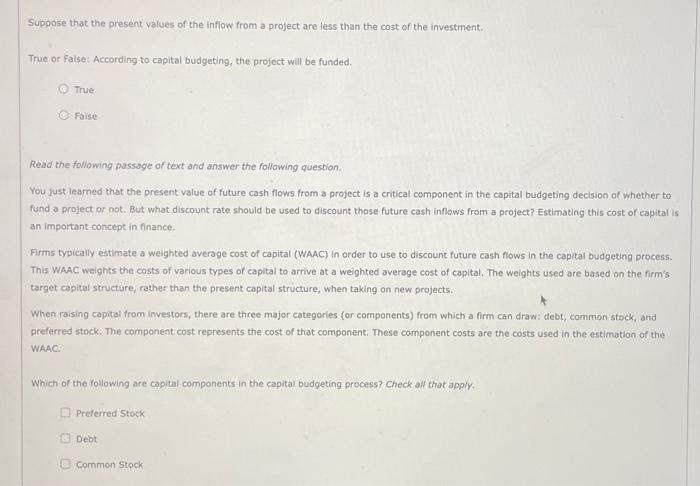

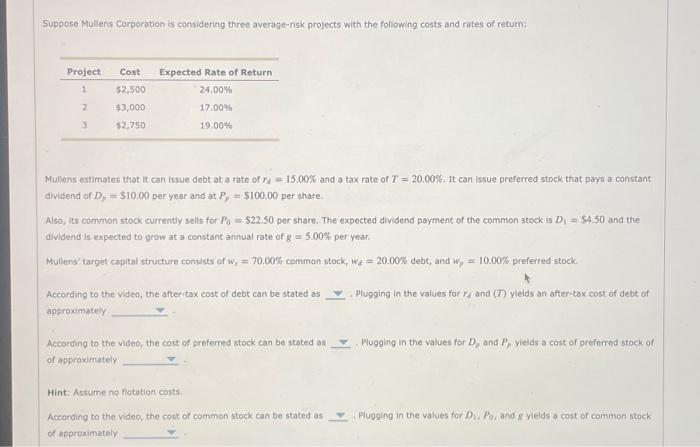

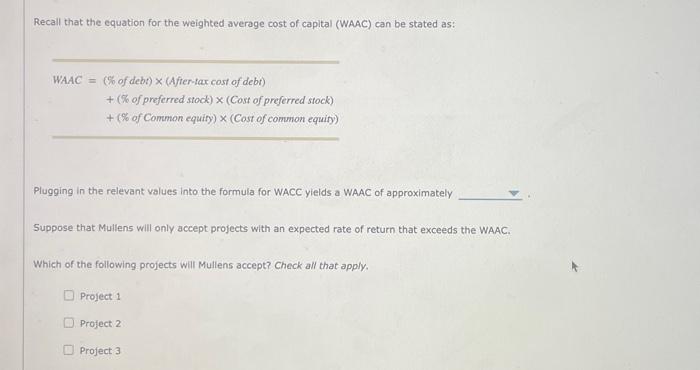

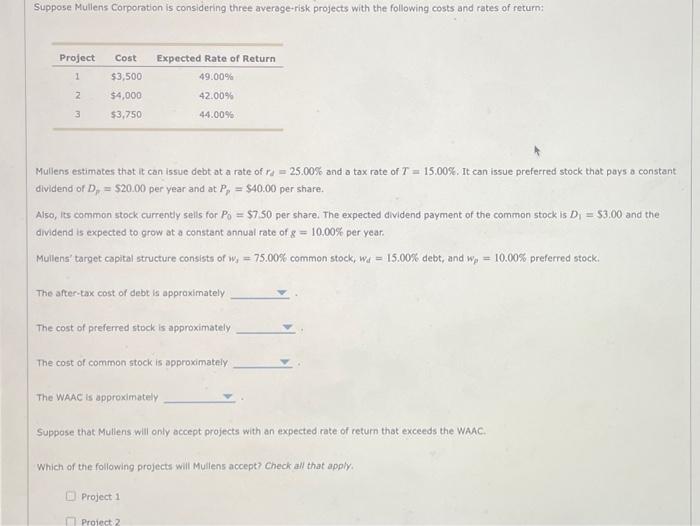

Suppose that the present values of the infiow from a project are less than the cost of the investment. True or Faise: According to capital budgeting, the project will be funded. True Faise Read the following passage of text and answer the following question. You fust learned that the present value of future cash flows from a project is a critical component in the capital budgeting decision of whether to fund a project or not. But what discount rate should be used to discount those future cash inflows from a project? Estimating this cost of capital is an important concept in finance. Firms typically estimate a weighted average cost of capital (WAAC) in order to use to discount future cash flows in the capital budgeting process. This WAAC weights the costs of various types of capital to arrive at a weighted average cost of capital. The weights used are based on the firm's. target capital structure, rather than the present capital structure, when taking on new projects. When raising copital from investors, there are three major categorles (or components) from which a firm can draw: debt, common stock, and preferred stock. The component cost represents the cost of that component. These component costs are the costs used in the estimation of the WAAC. Which of the following are capital components in the capital budgeting process? Check all that apply. Preferred 5 tock Debt Common Stock Suppose Muliens Corporation is considering three average-risk projects with the following costs and rates of return: Muliens estimates that it can issue debt at a rate of ri=15.0005 and a tax rate of T=20.00% it it can issue preferred stock that pays a constank dividend of Dp=$10.00 per year and at Pp=$100.00 per share. Also; its common stock currently sells for P0=$22.50 per share. The expected dividend payment of the common stock is D1=54.50 and the dividend is expected to grow at a constant annual rate of g=5.00% per year: Mullens' target copital stnucture conuists of wy=70.00% comman stock, wd=20.00% debt, and w=10.00%preferred stock. According to the video, the after tax cost of debt can be stated as . Piugging in the values for r and and (i) yiels an arter-tax cost of debt of approximately According to the video, the cost of greferred stock can be stated as Plogging in the values for Dp and Pp yields a cost of preferred stock of of approximately Hint Assume no flotation costs. According to the video, the cost of common stock can be stated as . Plugging in the values for D i. Pe. and 8 yields a cost of common stock of approximately Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC=(%ofdebt)((After-taxcostofdebt)+(%ofpreferredstock)(Costofpreferredstock)+(%ofCommonequity)(Costofcommonequity) Plugging in the relevant values into the formula for WACC yields a WAAC of approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following profects will Mullens accept? Check all that apply. Prolect 1 Project 2 Profect 3 Suppose Mullens Corporntion is considering three average-risk projects with the following costs arid rates of return: Mullens estimates that it can issue debt at a rate of ri=25.00% and a tax rate of T=15.00%. It can issue preferred stock that pays a constant dlvidend of Dj=$20.00 per year and at PP=$40.00 per share. A150, its common stock currently sells for P0=$7.50 per share. The expected dividend payment of the common stock is D1=$3.00 and the dividend is expected to grow at a constant annual rate of g=10.00% per year. Mullens' target capital structure consists of wj=75.00% common stock, wd=15.00% debt; and wp=10.00% preferred stock. The after-tax cost of debt is approximately The cost of preferred stock is approximately The cost of common stock is approximately The WAAC is approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Muliens accept? Check an that apply: Project 1