Question

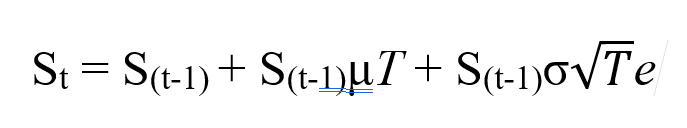

Suppose that the price of a stock follows the equation from Black-Scholes-Merton: S t = S (t-1) + S (t-1) T + S (t-1) sqrtTe

Suppose that the price of a stock follows the equation from Black-Scholes-Merton:

St = S(t-1) + S(t-1)T + S(t-1)sqrtTe

Where St is the current price, S(t-1) is the previous price one period back, is the expected return on the stock determined by CAPM, T is the time between the current price and the previous price as a fraction of a year, is the volatility of the price, and e is a random error term.

What are delta, gamma, theta, vega, and rho for this stock? (if you feel you cannot come up with a specific number for any of these five measures, then just describe what they are likely to be in words i.e. positiveegative, large/small, etc.)

[These measures would be defined very generally here as sensitivity to the risk factor. For example, delta is sensitivity to changes in the price of the stock, theta is sensitivity to the passing of time, etc.]

Please show reasoning with explanations.

= S(t-1)+ Sct-buT + S(t-10VTe = S(t-1)+ Sct-buT + S(t-10VTeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started