Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot

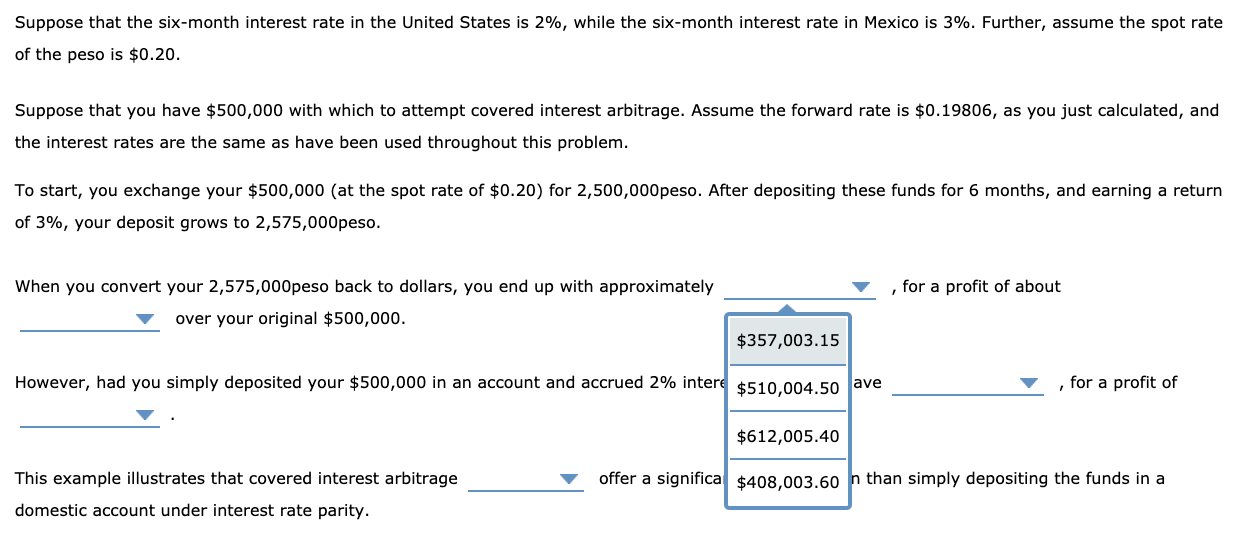

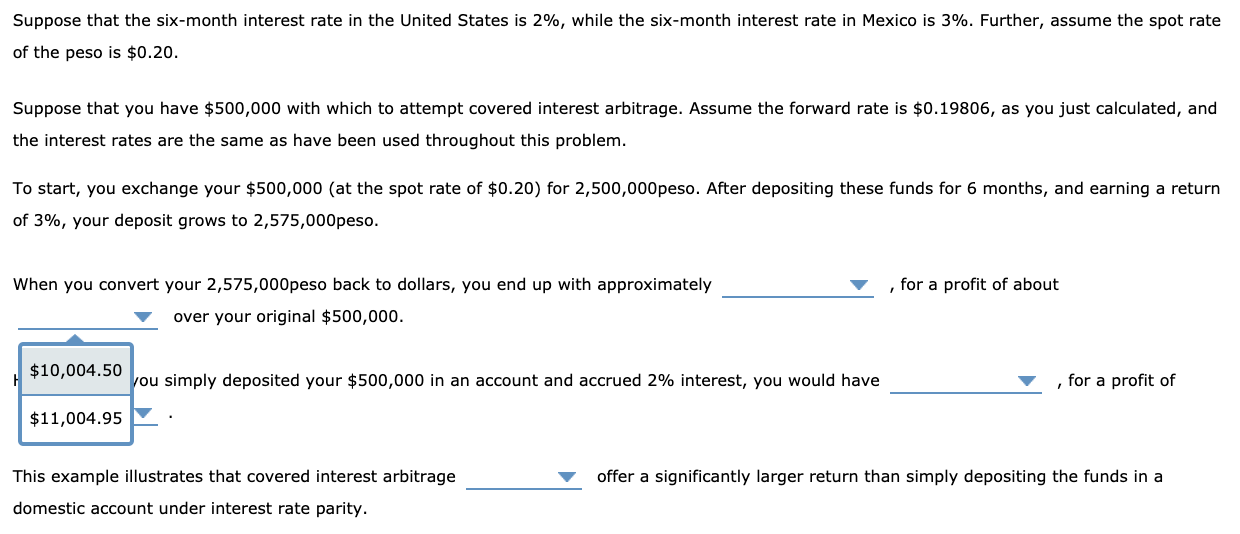

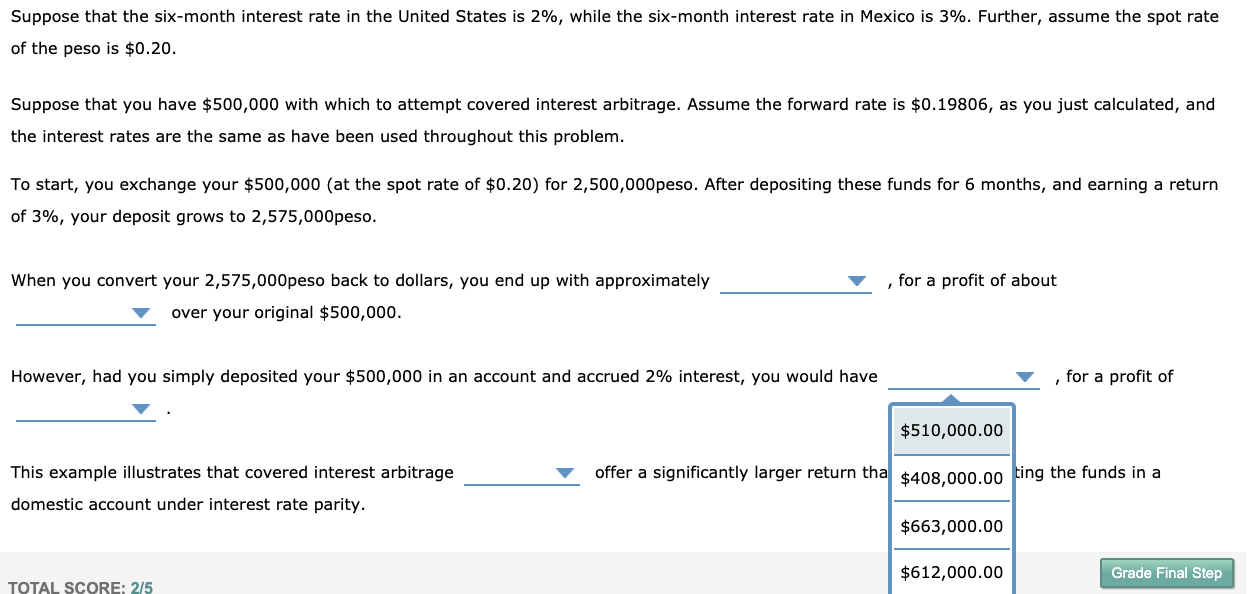

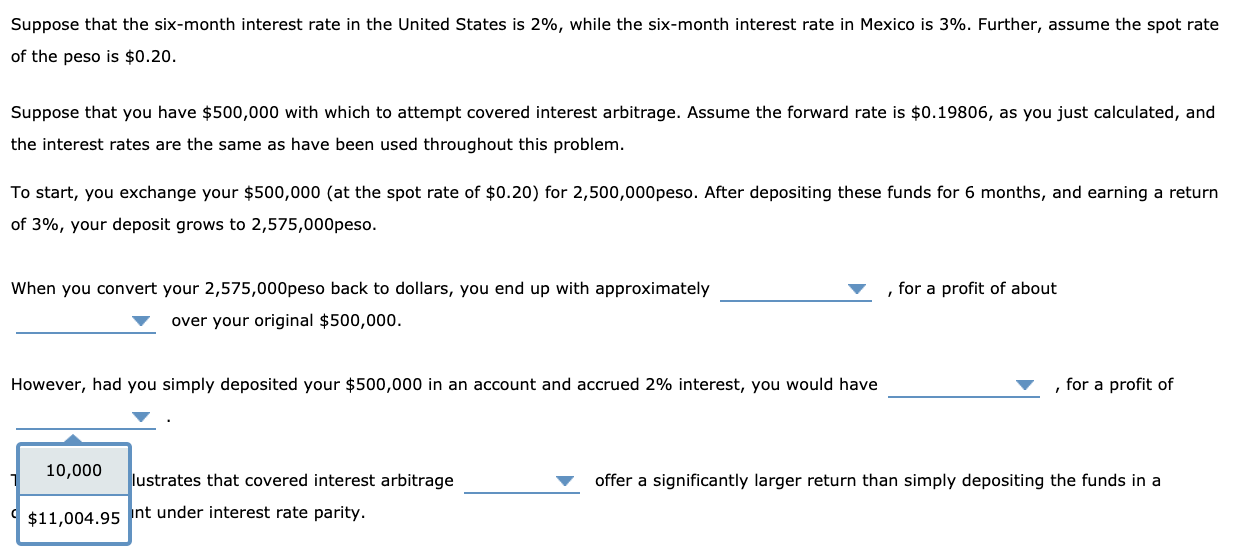

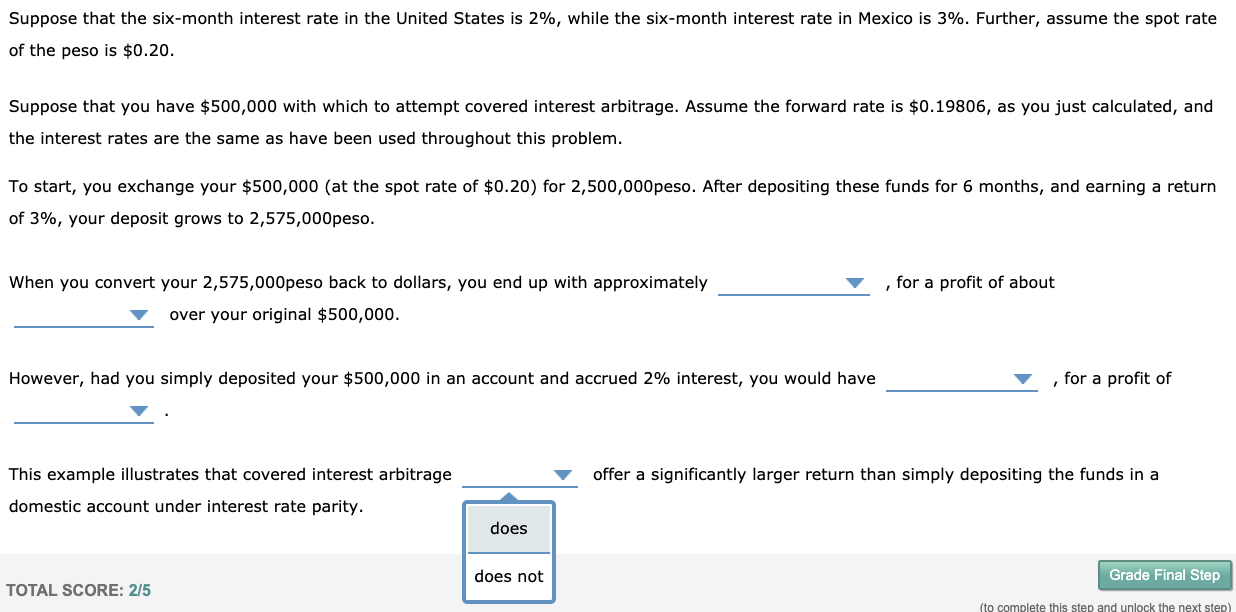

Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot rate of the peso is $0.20. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.19806, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of $0.20 ) for 2,500,000peso. After depositing these funds for 6 months, and earning a return of 3%, your deposit grows to 2,575,000 peso. When you convert your 2,575,000peso back to dollars, you end up with approximately , for a profit of about over your original $500,000. u simply deposited your $500,000 in an account and accrued 2% interest, you would have , for a profit of This example illustrates that covered interest arbitrage domestic account under interest rate parity. offer a significantly larger return than simply depositing the funds in a offer a significantly larger return than simply depositing the funds in a Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot rate of the peso is $0.20. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.19806, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of $0.20 ) for 2,500,000peso. After depositing these funds for 6 months, and earning a return of 3%, your deposit grows to 2,575,000peso. When you convert your 2,575,000peso back to dollars, you end up with approximately , for a profit of about over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 2% inter This example illustrates that covered interest arbitrage domestic account under interest rate parity. Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot rate of the peso is $0.20. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.19806, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of $0.20 ) for 2,500,000peso. After depositing these funds for 6 months, and earning a return of 3%, your deposit grows to 2,575,000 peso. When you convert your 2,575,000peso back to dollars, you end up with approximately , for a profit of about over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 2% interest, you would have , for a profit of ustrates that covered interest arbitrage nt under interest rate parity. offer a significantly larger return than simply depositing the funds in a offer a significantly larger return than simply depositing the funds in a Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot rate of the peso is $0.20. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.19806, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of $0.20 ) for 2,500,000 peso. After depositing these funds for 6 months, and earning a return of 3%, your deposit grows to 2,575,000 peso. When you convert your 2,575,000peso back to dollars, you end up with approximately, , for a profit of about over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 2% interest, you would have , for a profit of This example illustrates that covered interest arbitrage domestic account under interest rate parity. offer a significantly larger return tha ing the funds in a Suppose that the six-month interest rate in the United States is 2%, while the six-month interest rate in Mexico is 3%. Further, assume the spot rate of the peso is $0.20. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $0.19806, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of $0.20 ) for 2,500,000 peso. After depositing these funds for 6 months, and earning a return of 3%, your deposit grows to 2,575,000 peso. When you convert your 2,575,000peso back to dollars, you end up with approximately , for a profit of about over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 2% interest, you would have , for a profit of This example illustrates that covered interest arbitrage domestic account under interest rate parity. offer a significantly larger return than simply depositing the funds in a TOTAL SCORE: 2/5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started