Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that the stock of Ganargua Hydro presently trades for $35 a share. You believe that between now and October the stock will rise

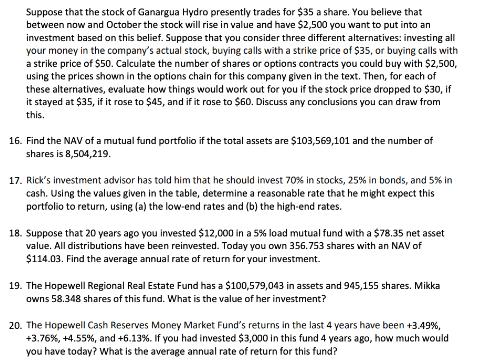

Suppose that the stock of Ganargua Hydro presently trades for $35 a share. You believe that between now and October the stock will rise in value and have $2,500 you want to put into an investment based on this belief. Suppose that you consider three different alternatives: investing all your money in the company's actual stock, buying calls with a strike price of $35, or buying calls with a strike price of $50. Calculate the number of shares or options contracts you could buy with $2,500, using the prices shown in the options chain for this company given in the text. Then, for each of these alternatives, evaluate how things would work out for you if the stock price dropped to $30, if it stayed at $35, if it rose to $45, and if it rose to $60. Discuss any conclusions you can draw from this. 16. Find the NAV of a mutual fund portfolio if the total assets are $103,569,101 and the number of shares is 8,504,219. 17. Rick's investment advisor has told him that he should invest 70% in stocks, 25% in bonds, and 5% in cash. Using the values given in the table, determine a reasonable rate that he might expect this portfolio to return, using (a) the low-end rates and (b) the high-end rates. 18. Suppose that 20 years ago you invested $12,000 in a 5% load mutual fund with a $78.35 net asset value. All distributions have been reinvested. Today you own 356.753 shares with an NAV of $114.03. Find the average annual rate of return for your investment. 19. The Hopewell Regional Real Estate Fund has a $100,579,043 in assets and 945,155 shares. Mikka owns 58.348 shares of this fund. What is the value of her investment? 20. The Hopewell Cash Reserves Money Market Fund's returns in the last 4 years have been +3.49%, +3.76%, +4.55%, and +6.13%. If you had invested $3,000 in this fund 4 years ago, how much would you have today? What is the average annual rate of return for this fund?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the number of shares you could buy with 2500 you need to divide the amount by the current stock price of 35 This gives you 7143 shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started